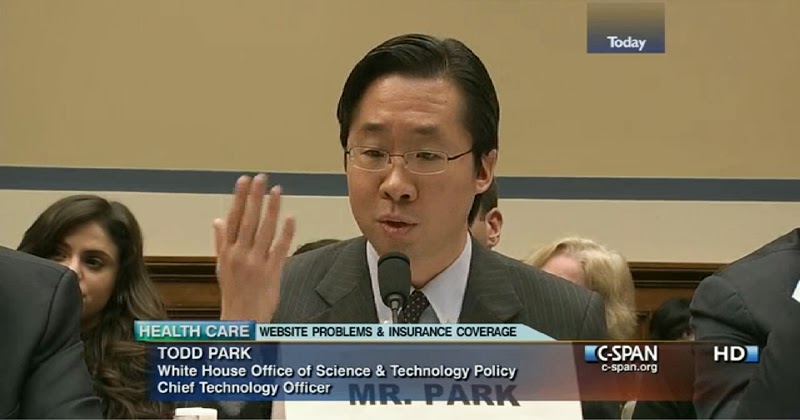

Park misled the House Oversight Committee about his knowledge and role in HealthCare.org

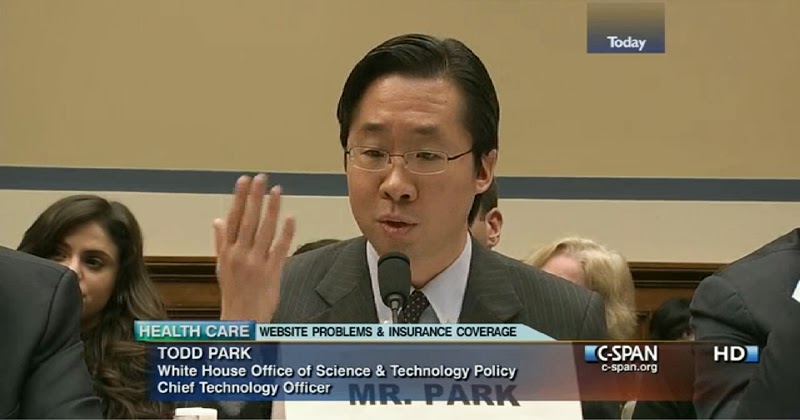

Fig. 1—Todd Y. Park, U.S. Chief Technology Officer (CTO). Mr. Park testified on Nov. 13, 2013 before the House Oversight Committee. Park gave vague answers and pretended not to know who made the decision to take the HealthCare.gov website lives on Oct. 1, 2013. Committee Chairman Darrell Issa (CA-49th) presented documents showing that the website had failed basic security tests, so an outside contractor recommended a delay.

AFI investigators have dug into Park's background and discovered massive conflicts of interest and direct relationships with the Facebook Club. These relationships certainly prevented him from doing his job impartially. Instead of diligently overseeing the development of HealthCare.org, Park seems to have preferred being cheerleader-in-chief for government data giveaway events like "Datapalooza." When asked by Rep. Trey Gowdy (SC-4th) where he'd been prior to Oct. 1, Park misled the Committee into thinking he'd had no prior responsibility for the the website, when in fact, he had been the chief technology officer at HHS since Apr. 4, 2009. Photo: C-SPAN.

Video: C-Span.

(Nov. 15, 2013)―To hear Todd Park tell it, he didn’t know who decided to take HealthCare.gov live after it failed critical security and volume tests. But, Park is only the chief technology officer of the United States.

As a matter of fact, Henry Chao didn’t know either, and he’s only the deputy director and deputy chief information officer of the Centers for Medicare and Medicaid (CMS).

On Nov. 14, President Obama said he didn't even know there was a problem. He's only the President, and this is only his signature legislation.

Incompetence? We don't think so.

* * *

On Nov. 13, two of America’s top healthcare technologists, Todd Y. Park and Henry Chao, testified before the House Oversight Committee about the allegedly botched HealthCare.org roll out.

Update Nov. 24, 2017: Botched Obamacare Rollout was likely a False Flag to siphon America's healthcare data to the rogue C.I.A. "dark Profiles" on each American

We now think that the botched Obamacare rollout was a

false flag to provide an excuse for large Clinton Foundation donors IBM, Booz Allen Hamilton and Andersen Consulting to be hired with taxpayer funds to come in and

copy all of America's healthcare information into offshore "dark profile" databases run by the rogue C.I.A. under the fog of these "mistakes."

Fig. 2—Just look at this shady character. Watch his impudent expressions. Would you trust him with your daughter, much less America's healthcare? Henry Chao, Deputy Director and Deputy Chief Information Officer of the Centers for Medicare and Medicaid (CMS). Mr. Chao testified on Nov. 13, 2013 before the House Oversight Committee. Chao claims he did not know that the HealthCare.,gov website had failed a basic security test before allowing it to go live. Chao, like Todd Park, claimed not to know who made the decision to go live. Rep. Jim Jordan (OH-4th) stated that he believed the decision was political, not technical, and that it came from White House advisers Nancy-Ann M. DeParle and Jeanne Lambrew.

DeParle and Lambrew are believed to be the same White House operatives who ordered the IRS to target the Tea Party, but have so far refused to testify. Also surprising was the revelation that neither Chao nor Park insisted that the launch be stopped, since no end-to-end system testing had been done. Even rookie project managers know better. These omissions are beyond incompetence and point to willfulness.

Video: C-Span.

Park and Chao danced around even the most basic questions. How long will it take to fix? How much will it cost? Who’s in charge? Do you need help?

Instead, they dished up non-committal technobabble like “software development is an iterative process” and “security testing is never done,” and perhaps the best one was “Microsoft is still fixing Windows XP.”

Rep. Gowdy: “Where in the heck were you for the first 184 weeks?” Click here for Rep. Gowdy C-SPAN segment

Park is the new leader of President Obama’s “tech surge.” His first administration appointment was back in 2009 when he was appointed as chief technology officer at the Health and Human Services (HHS) Department on Aug. 4, 2009.[01] Three days later, Aneesh Chopra was appointed as the first U.S. CTO on Aug. 7, 2009. This means that Park oversaw the complete design and development of HealthCare.gov before being appointed chief technology officer at the White House on Mar. 9, 2012.[02]

Representative Trey Gowdy (South Carolina-4th) asked Park why he was only just now being consulted to perform the tech equivalent of triage. Rep. Gowdy asked, “Where in the heck were you for the first 184 weeks [after the passage of the Affordable Care Act.]” He continued, “Why didn’t they bring you in to build it?”[03]

Todd Y. Park misled Congress

Todd Park responded, “That wasn't part of my role.” This answer is misdirection on numerous fronts, but we’ll focus on two.

Fig. 4—Todd Y. Park, U.S. CTO, HHS CTO, founder athenahealth and Castlight Health, later became White House chief technology officer and was "loaned" by President Obama to the Hillary 2016 election committee in San Francisco to assist her Hillary for America website. Such loaning of Executive Branch personnel is a clear violation of the Hatch Act that forbids government employees from being paid to engage in partisan politics while employed by the American People.

First, Todd Y. Park is the CTO of the United States. It is his job to oversee America’s technology infrastructure, and most assuredly his boss’ signature healthcare legislation.

Second, before coming to the White House, Todd Y. Park was CTO of the Health & Human Services Department since Aug. 4, 2009.[01] Therefore, Park was in charge of the planning and development of all HHS technology, including HealthCare.org.

Development of HealthCare.gov was, indeed, Todd Y. Park’s direct responsibility at HHS (John P. Holdren, White House Press Release, Mar. 9, 2012: "He led the successful execution of an array of breakthrough initiatives, including the creation of HealthCare.gov").[04] Further, even when he came to the White House on Mar. 9, 2012,common sense says that oversight of the implementation of the President’s signature legislation would consume him, night and day, until it was right for the American people.

Fig. 5—White House Mar. 9, 2012 announcement of Todd Y. Park's appointment as U.S. chief technology officer by President Obama. Among Park's successes touted is HealthCare.gov.

[02] Source: The White House, accessed Nov. 18, 2013.

Instead, it appears that Park busied himself giving away chunks of government “big data” through initiatives like "Health Data Liberation," OpenData.gov, The Health Data Initiative and HHS “Datapalooza.” That’s the real name. It is not a typo or joke. Is this sophomoric name a Freudian choice that betrays Park's true views about healthcare privacy and security?[05]

Park’s evident priority was giving away government data under whatever Orwellian guise worked. Coincidentally, this data feeds his venture capital business partners with new business opportunities. In videos of these events, Park appears more like a cheerleader than a sober minded person concerned about securing America’s healthcare.

Todd Y. Park's incestuous associations

Given Park’s untruthful and misleading House Oversight Committee testimony, AFI investigators began digging into Park’s background. In summary, a nest of interlocking conflicts of interest emerged. In short, Park has been feathering his business interests ever since he and his colleagues started working for the Obama White House.

|

|

|

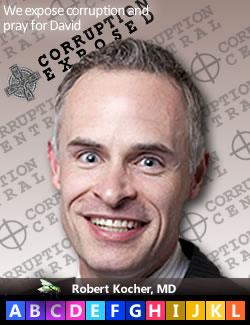

Robert Kocher, MD

Athenahealth, Dir.

Castlight Health, Dir.

White House, Special Assistant for Healthcare Reform

Photo: Univ. of Washington |

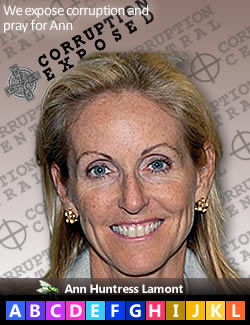

Ann H. Lamont

Oak Investments

Athenahealth, Dir.

Castlight Health, Dir.

National Venture Capital Assoc., Dir. (2001-2005)

Photo: Stanford Univ. |

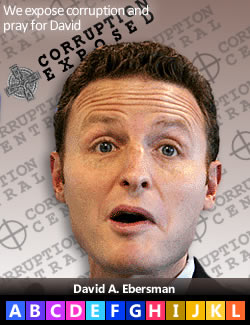

David A. Ebersman

Facebook, CFO

Castlight Health, Dir.

Photo:J. Sullivan/Getty Images |

Table 1. Obama tech chief Todd Y. Park's business partners at Athenahealth, Castlight Health, Booz Allen, the National Venture Capital Association, Cleveland Clinic and Boston Scientific cast long conflicts of interest shadows over all of Todd Y. Park's actions as U.S. CTO. None of these conflicts were disclosed to the American people. |

Park has started two healthcare companies named Athenahealth (ATHN) and Castlight Health, Inc. SEC and other public records show that three people play prominently in Park’s companies, namely Robert Kocher, MD, Ann Huntress Lamont, and David A. Ebersman (Facebook CFO).

Park’s Castlight company has received $160 million of venture funding from Morgan Stanley, T. Rowe Price, Oak Investment Partners, Venrock, Wellcome Trust, US Venture Partners, Maverick Capital, and oddly, Cleveland Clinic.

AFI readers will recognize members of the Facebook Club in this list, namely Ebersman, Morgan Stanley, T. Rowe Price and the Cleveland Clinic. Leader Technologies was conducting a confidential clinical trial of their new invention at the Cleveland Clinic with Boston Scientific in late 2003, just a few months before Facebook went live on Feb. 4, 2004. According to new testimony, Zuckerberg and Co. secretly received a copy of Leader Technologies' actual source code via Leader's attorneys, who were tipped off by Boston Scientific and the Cleveland Clinic that it was ready. This Cleveland Clinic involvement is a telling outlier, and yet another in a long list of Leader v. Facebook "coincidences."

Todd Y. Park worked for Booz Allen Hamilton as a healthcare consultant prior to 1997. Booz Allen was hired by Canada-based CGI Federal to help build HealthCare.gov. CGI Federal received $678 million in no-bid contract funds, which are described in government documents as having been acquired by “full and open competition.” Michelle Obama’s Princeton classmate, Toni McCall Townes-Whitley, is senior vice president of CGI Federal.

Since Park was the CTO of HHS when the decision to hire his former employer, Booz Allen, was made, this is an evident and undisclosed conflict of interest according to the Standards of Ethics governing the Executive Branch. This doesn’t even address the impropriety of hiring a company whose Executive VP is a former classmate of the President’s wife.

Fig. 6—Robert Kocher at a meeting with

President Obama. Facing the camera from left to right are

Peter Orszag,

Nancy-Ann Deparle,

Kocher,

Jason Fuhrman,

Phil Schilero and

President Obama.

Zeke Emanuel and

Gene Spearling are seen from the back.

Photo: Univ. of Washington.

Park’s business partner, Robert Kocher, MD, joined the Obama White House in 2008 as Special Assistant for Health Care Reform. Strangely, neither Park’s and Kocher’s financial disclosures are available from the Office of Government Ethics, where even Hillary Clinton’s is available.

Nevertheless, AFI was able to obtain a copy of Robert Kocher’s 2009 disclosure from the Wall Street Journal where we find the same major investing in certain Facebook-friendly funds that include Fidelity, T. Rowe Price, Vanguard, Janus, Morgan Stanley, JP Morgan, Goldman Sachs and Blackrock.

These are the same funds that are invested in by the Leader v. Facebook judges John G. Roberts, Elena Kegan, Leonard P. Stark, Alan D. Lourie, Evan J. Wallach, Randall R. Rader, Jan Horbaly (Federal Circuit Executive), Stephen C. Siu, David J. Kappos, Kimberly A. Moore, and a clutch of law firms closely associated both with Facebook and the Obama administration (Cooley, Gibson, Fenwick, Orrick, Weil, Latham, Blank, White, FCBA, DC Bar). Further, AFI investigators are now discovering this same investing pattern from numerous members of the Obama White House cabinet.

Robert Kocher, MD and Todd Y. Park helped establish the Obamacare agenda from the beginning. For example, Kocher helped moderate the White House Forum on Health Reform on Mar. 5, 2009 along with Zeke Emanuel, Peter Orszag, Nancy-Ann DeParle and Larry Summers (See Fig. 3). Todd Park also figures prominently in these gatherings. President Obama gave the opening remarks. Click here for C-SPAN video of this conference. Neither Park nor Kocher have ever disclosed these evident conflicts of interest.

Todd Y. Parks’ relationship to Ann H. Lamont. Lamont was a fellow director in Athenahealth on Mar. 2, 2009. Lamont is also a director in Park’s Castlight Health, along with Kocher, and also along with Facebook’s CFO Ebersman. According to OpenSecrets.org, in addition to Parks’ personal influence, his Athenahealth company paid $1.235 million to lobby HHS between 2009-2013. Park’s and Kocher’s company, Athenahealth, as well as director Ebersman’s company, Facebook, stood to benefit from Park's and Kocher's influence. This is the definition of conflicts of interest, and is against the law.

Lamont is also managing partner of the venture capital firm Oak Investments. Oak helped provide $160 million for Todd Y. Park to build Castlight. Castlight’s website says:

“Castlight Health delivers the solution to enable employers and health plans to lower the cost of health care and provide individuals unbiased pricing and quality information to make smart health care purchase decisions.”

Call us crazy, but doesn’t Castlight’s mission sound like the HealthCare.gov sales pitch?

Robert Kocher ran interference so Park could be HealthCare.gov savior

Todd Y. Park does not disclose his conflicts of interest with Robert Kocher, Ann H. Lamont, Facebook, Athenahealth or Castlight. Neither does Park disclose his conflicts of interest with Oak Investments, Morgan Stanley, T. Rowe Price, Fidelity, Vanguard, Janus, Morgan Stanley, JP Morgan, Goldman Sachs nor Blackrock—all companies poised to benefit swimmingly from Obamacare.

Robert Kocher, MD, does not disclose his conflicts of interest with the same players.

HealthCare.gov followed no well-accepted I/T industry development standards and processes (See AFI Commenter's Summary). Its failure is filled with incompetence and telegraphs misdirection. But there is a logical explanation. It has been contrived, just like the 2008 bailout crisis, the Leader v Facebook whitewash, the Facebook IPO NASDAQ glitch, the collosal green energy stimulus failures, and now this. The regularity is now a pattern that telegraphs intent.

Nancy-Ann M. DeParle runs interference for Boston Scientific and Cleveland Clinic in Leader v. Facebook

Nancy-Ann M DeParle is another Harvard attorney and a long time Obama White House insider in charge of health reform. She was formerly a senior adviser for J.P. Morgan and Administrator of the Health Care Financing Administration (HCFA) (now the Centers for Medicare and Medicaid Services—CMS—where Henry Chao is the Deputy CIO now). Her pedigree is deeply embedded in the Facebook Club. She was a Boston Scientific director when she came to the White House. Boston Scientific is implicated, along with Cleveland Clinic, a Todd Y. Park investor, in the theft of Leader Technologies’ social networking invention.

Tellingly, DeParle’s financial disclosure exhibits the same obsessive investing patterns as all the other Facebook Club members. Analysis of the 28 Mark Zuckerberg hard drives and Harvard emails that were unlawfully withheld from Leader Technologies in Leader v. Facebook would prove this. However, as long as this matter is overseen by a complicit Justice Department, including Chief Justice Roberts, justice will not be served by them.

Fig. 7—Obama's 1st chief technology officer Aneesh Chopra (L) (Todd Y. Park's predecessor) courted Facebook's chief operating officer.

Pres. Obama "likes" all things Facebook. Nov. 22, 2008—three days after Leader Technologies sued Facebook for patent infringement is pictured here giving a fond embrace to Facebook chief operating officer Sheryl K. Sandberg at the White House. This event was the investiture of Larry H. Summers as Director of the National Economic Counsel, thus taking charge of managing the 2008 "banking stimulus," also called another great rape of We The People.

Photo: Ghanbari AP.

(R) at his White House event titled "Silicon Valley Business Leaders Attend Meeting Of President's Council On Jobs" On Aug. 2, 2011.

Pres. Obama has confiscated the invention of Columbus innvoator

Leader Technologies for the benefit of his cronies at Facebook,

Obama for America, Chopra/Park's "Datapaoolza" HHS giveaway, a big FB IPO payday for his friends who got him elected, electioneering manipulation, as well as HealthCare.gov.

Photo: Zimbio.The Facebook Club is running the HealthCare.gov show

Turning back to Ann Lamont, she was a director of the National Venture Capital Association between 2001-2005, an NCVA official confirmed yesterday. Facebook’s former chairman and largest shareholder, James W. Breyer, Accel Partners LLP, also served as an NCVA director between 1999 and 2004. Fidelity Fund’s Robert C. Ketterson also served as a fellow NCVA director under Breyer’s chairmanship during the theft of Leader Technologies’ invention by Facebook in late 2003-2004.

Lamont’s close relationship to James W. Breyer and Robert C. Ketterson ties her to Facebook and Fidelity Funds―all members of the Facebook Club, and thus to the compromised Leader v. Facebook federal judges, Patent Office examiners and judges, as well as numerous members of the White House cabinet who have benefited from their insider tips to invest in certain funds before the Facebook IPO.

Fig. 8—Ned and Ann Lamont celebrate his 2006 Democratic primary victory over Senator Joe Lieberman. Senator Lieberman turned independent and won the election. Lamont's father is a Harvard economist, and his grandfather was CEO of J.P. Morgan & Co. Lamont is a 4th generation Harvard graduate. Is this photo eerily reminiscent of the closing scene in the movie

The Manchurian CandidatePhoto: Fred Beckham -- Associated Press.

More Facebook Club members emerge from Lamont’s husband, Edward M. (“Ned”) Lamont, Jr. Ned, Jr. is a fourth generation Harvard grad. Ned Sr. is a Harvard economist and colleague of Larry Summers. Ned's grandfather was Thomas W. Lamont who was a member of the Council on Foreign Relations and CEO of J.P. Morgan & Co. during the Great Depression when stock manipulation ran wild.

The Lamonts and Lawrence "Larry" Summers, as economists and bankers, certainly know how to manipulate markets, governments and economies for personal gain and powermongering. This violates the most fundamental code of ethics among economists: do no harm.

Lamont’s financial disclosure from his failed attempt in 2006 to unseat Senator Joe Lieberman reveals a close relationship to Goldman Sachs, a prime mover behind this global corruption.

Fig. 9—Russian Prime Minister Dmitry Medvedev and

Hacker / thief Mark Zuckerberg, Gorki, Russia, Oct. 1, 2012. The Facebook Club is selling America's sovereignty to the highest bidder while they hide behind willing juvenile delinquents.

Photo: AP/Alex. Zemlianichenko.

Fig. 9.1—OBAMA to MEDVEDEV: "After my election I have more flexibility." South Korean Summit, Mar. 26, 2012.

Russian oligarchs and second largest Facebook stockholders

Alisher Usmanov and

Yuri Milner collaborate with the Kremlin. They have already fleeced the U.S. stock market out of billions. Their Moscow partners include

Goldman Sachs and

Morgan Stanley. Harvard economics professor and former Obama bailout chief

Lawrence "Larry" Summers has been

Milner's and Facebook COO

Sheryl Sandberg's mentor and boss since he was the chief economist for the

World Bank in 1992.

Todd Y. Park's Datapalooza! ::: Your "HEalth Data Liberation"[05]

Did you know your healthcare data needed to be "liberated" by Todd Y. Park? Didn't think so.

Fig. 8.2—Facebook Server Farm in Luleau, Sweden. Arguing that the location saves energy costs (its colder) and backs up other servers, these servers are also capable of storing

much if not all of America's healthcare information, outside the jurisdication of U.S. law.

Photo: Susanne Lindholm.

Zuckerberg was likely in Moscow coordinating programming efforts with Milner's math and physics cronies at

Moscow State University. The computer science lab there is a breeding ground for viruses and trojan horses that exploit computers globally. MSU's long term goal is to secretly control global financial transactions and to siphon funds for themselves and the government, while disrupting competitors' transactions.

Many economists blame Summers for doing harm and using his influence at the World Bank to force the disasterous Russian voucher system that gave birth to the massively corrupt Russian oligarchs. He appears to be cashing in on those corrupt relationships. Pictured here, Summers sent a boy to front for him—a boy that he

fabricated with the help of the

PayPal Mafia and massive

Harvard Crimson coverage in 2003-2004 while he was President of

Harvard, we believe.

James W. Breyer’s father, John P. Breyer, runs enormous venture capital funds in China and India, where son James is increasingly spending his time and energy, while he simultaneously publicly disses U.S. venture investing.

Larry Summers collaborates with Russian oligarchs Alisher Usmanov and Yuri Milner, as well as Facebook COO, Sheryl Sandberg. Summers has been Milner’s and Sandberg’s mentor since his World Bank days as chief economist starting in 1992. At Harvard, then Professor Summers tutored student Sandberg starting in about 1990.

Goldman Sachs and Morgan Stanley (beneficiaries of $22 billion in U.S. taxpayer bailout funds) were partnered with these Russians, and probably sent them billions of these funds to leverage so that they could funnel it back through banking havens like Dubai (Mail.ru had an office there—a large Facebook investor) as private purchases of pre-IPO Facebook shares.

These actions inflated Facebook's valuation to $100 billion—stock also held by all the Leader v. Facebook judges, including Chief Justice John G. Roberts, who was the swing vote on Obamacare.

A reasonable person can only conclude from this incestuous web of interconnections that Obamacare is nothing short of a power grab on a global scale—a power grab funded by multiple scams against the U.S. taxpayer (bailout, stimulus, Leader v. Facebook judicial corruption, FB IPO, "Health Data Liberation," HHS "Datapalooza," OpenData.gov, HealthCare.gov) in which the American President is a mere chess piece.

* * *

Footnotes:

[03] House Oversight Hearing on HealthCare.gov failures, Nov. 13, 2013. Park, T., Chao, H. (Nov. 13, 2013). HealthCare.gov Web Site Implementation, U.S. House Committee Oversight and Government Reform, Testimony of Todd Y. Park, U.S. CTO, and Henry Chao, Deputy Director and Deputy Chief Information Officer of the Centers for Medicare and Medicaid (CMS). C-SPAN. https://www.c-span.org/video/?316214-1/healthcaregov-web-site-implementation-panel-1.

[04] White House Confirms HealthCare.gov was Todd Y. Park's responsibility.White House. (Mar. 09, 2012). Todd Park Named New U.S. Chief Technology Officer [Press release]. Barack Obama. White House Press Office. https://www.fbcoverup.com/docs/library/2012-03-09-Todd-Park-Named-New-US-Chief-Technology-Officer-by-John-P-Holdren-Barack-Obama-White-House-Mar-09-2012.pdf

("For nearly three years, Todd has served as CTO of the U.S. Department of Health and Human Services, where he was a hugely energetic force for positive change. He led the successful execution of an array of breakthrough initiatives, including the creation of HealthCare.gov, the first website to provide consumers with a comprehensive inventory of public and private health insurance plans available across the Nation by zip code in a single, easy-to-use tool.")(emphasis added).

e.g. "IBM Eclipse Foundation" or "racketeering"

e.g. "IBM Eclipse Foundation" or "racketeering"