Fig. 1—insider trading at the White House and judiciary.

Essentially, every Cabinet-level agency in the Obama White House has one or more senior leaders who are invested in a Facebook investment scheme that was years in the making by collaborators from the National Venture Capital Association.

Click here to view the underlying data obtained from the Office of Government Ethics, OpenSecrets.org and Judicial Watch.

(Nov. 22, 2013)—Investigations into the financial holdings of 240 members of the White House cabinet and federal judiciary reveal a corrupt agenda that is likely the cause of Washington's dysfunction, and one which not even Tom Clancy would have written.

HealthCare.gov is merely collateral damage.

The patterns of investing reveal "haves" and "have not's" within the Obama Administration. Tellingly, the vast majority of the "haves" are attorneys. One wonders if administration "have not's" know how they are being manipulated.

Over 70% of these political appointees are invested in the same set of funds featuring Fidelity, Vanguard, T. Rowe Price and TIAA-CREF.

These funds directly and indirectly invested billions in the pre-IPO sale of Facebook insider stock by Goldman Sachs. T. Rowe Price purchased more than 5% of the ownership. TIAA-CREF fund managers were along for the ride, which attracted the many academics planned for the Obama administration.

This activity pumped Facebook’s valuation dramatically. By comparison, according to Reuters (Aug. 27, 2009) the combined market shares of the two largest funds, Fidelity and Vanguard, was 23.4% in 2009.

The analysis proves that these insiders invested disproportionately into this set of funds―almost three times the funds’ actual market share proportions. What did this group know that others did not?

Billions were also invested by Goldman Sachs’ Russian oligarch partner, Alisher Usmanov. Months earlier, Goldman and Morgan Stanley had received some $30 billion in bailout funds overseen by National Economic Council chairman Lawrence “Larry” Summers.

Summers is Facebook chief operating officer Sheryl K. Sandberg’s long-time business mentor and former boss at the World Bank and U.S. Treasury. Morgan Stanley told Senator Chuck Grassley that they sent over $5 billion overseas. AFI believes these funds were leveraged in foreign banks, including Dubai where the Russians operate, and returned to purchase the Facebook stock.

SEC, Commerce, supreme court are all in

Focusing on 32 of the more interesting senior Washington officials (Fig. 1), 26 are attorneys who are one of the following: judge, chief counsel or the head of an agency. Commerce Secretary Rebecca M. Blank holds 40 funds. Supreme Court Chief Justice John G. Roberts holds 21, Eric H. Holder holds 25 and Leader v. Facebook Federal Circuit chief judge Alan D. Lourie holds 22. AFI has compiled the 240 holdings by agency (CLICK HERE).

Why didn’t the SEC, FBI and Justice Department investigate this unprecedented private market making that makes Bernie Madoff look like a schoolboy? The answer is: Because senior leaders of those agencies were in on the scheme. SEC Chair Mary L. Shapiro holds 49 of these funds.

SEC Shapiro's chief counsel, Thomas J. Kim, a former attorney for Latham & Watkins LLP, issued the unprecedented exemption from the 500-shareholder rule that Goldman used to make the private stock market in Facebook shares. Kim did not disclose his conflict of interest with Facebook, James W. Breyer, Accel Partners or his former employer. By the way, even FBI director Robert S. Meuller holds 13 funds.

Post dotcom blues motivated the support for Breyer's scheme

National Venture Capital Assocation Collusion

Certain NVCA directors traded on secret promises to Fidelity, Vanguard, T. Rowe Price and TIAA-CREF investors to inflate Facebook’s pre-IPO valuation.NCVA directors associated with Facebook:

- James W. Breyer―NCVA director and chairman, 1999-2005; Accel Partners LLP, managing director; Facebook director, chairman, largest investor; IDG-Accel China director, along with his secretive father and Chinese venture capitalist, John P. Breyer; Wal-Mart director until resignation after the Mexican corruption scandal.

- Robert C. Ketterson, NCVA director, 2003-2008; Breyer investing partner in deals; Fidelity fund manager.

- Anne Rockhold, NCVA director and chairman, 2008-2013; Vanguard chief financial officer; Accel Partners chief financial officer.

- Ann H. Lamont, NCVA director, 2001-2005; Oak Investments director; AthenaHealth director and investor; Castlight Health director and investor; Todd Y. Park, U.S. chief technology officer investing partner; David A. Ebersman. Facebook chief financial officer deal partner; David Y. Park, brother of Todd Y. Park, AthenaHealth chief operating officer partner.

- Latham & Watkins LLP, NCVA chief Washington lobbyist; former employer of Thomas J. Kim, SEC Chief Counsel; current employer of Matthew J. Moore, husband of Leader v. Facebook federal judge Kimberly A. Moore; James W. Breyer, Accel Partners LLP attorney.

Fig. 2—National Venture Capital Association Principals who conspired to build perhaps the largest patent property theft and stock manipulation scheme in the history of the United States.

Researchers wondered why such prominent funds as Fidelity, Vanguard and T. Rowe and TIAA-CREF would become entangled in this scheme. What was their end game? The answer is they wanted more tech investing opportunities. Tech investments provided good returns, and they needed to feed their investors who had become accustomed to the high returns from tech.

These funds looked to the National Venture Capital Association (NCVA) for their next big deals.

NCVA Chairman James W. Breyer saw this insatiable appetite and devised a grand scheme.

Breyer had to steal technology and manipulate markets to prime the pump

Breyer hatched a plan to steal a hot new invention by Columbus innovator Leader Technologies, Inc. that he had learned about from his attorney, Fenwick & West LLP (also Leader's attorney).

He would select a pliable Harvard student and fabricate a budding "next Bill Gates" story around this guy. He'd build a new platform around the stolen technology, call it Facebook, and recruit the PayPal Mafia to coach and fund the kid. It was dumb luck that the kid was a pathological liar (not a normal character flaw in 19-year old Harvard students; that comes later with experience).

Breyer knew he needed institutional investors in his Facebook creation before he took it public. So, he got his fellow NCVA directors from Fidelity, Vanguard, T. Rowe and TIAA-CREF to agree to eventually invest in Facebook. In the meantime, he would get his friends to invest in these funds immediately, with the sure knowledge (wink, wink) that these funds would come into a windfall in the coming years (four years later) when Facebook went public. The windfall would float all boats in these funds.

Fund investments keep judges, regulators and media cooperative

Collateral benefits of this insider trading include: (1) the elite group invited to invest would keep their mouths shut, and (2) they would do favors for Breyer. Fix lawsuits. Suppress journalists. Destroy and conceal evidence. Plant false stories. Fabricate evidence. Get expert witnesses to lie. File criminal charges to stop civil cases against Zuckerberg (Ceglia v. Zuckerberg). Waive off the public's privacy complaints. All such conduct is cannon fodder for the corrupt.

Several of these favors have included concealing Zuckerberg's 28 hard drives and Harvard emails from Leader Technologies' attorneys; stipulating to his judge-investors (Lourie, Moore, Wallach, Rader, Horbaly) in Leader v. Facebook that Facebook attorneys be allowed to dictate the outcome; and ordering Patent Office director David J. Kappos to try killing Leader’s patent by administrative dictate.

Stock manipulation is illegal. If the SEC and judiciary are complicit, who will enforce the constitution?

Does this scheme sound too good to be true? It is. This kind of stock manipulation by insiders is illegal. For example, a corporate officer who knows about a pending public offering cannot tell his family and friends about the upcoming sale so they can buy in while the price is low.

However, this is exactly what Breyer and these administration officials have done and continue to do. Sometime before 2008, Breyer encouraged them to invest in his colleague’s funds with the promise certain (wink, wink) that all the skids were greased to create the largest tech IPO in history.

Washington’s dysfunction is caused by this hidden agenda of Facebook interests

Now we know why Washington is dysfunctional.

The hidden agenda of these Facebook interests has destabilized Washington. Nothing is what it seems since the real agenda is never on the table. Obama officials are looking out for their personal Facebook investments at every turn.

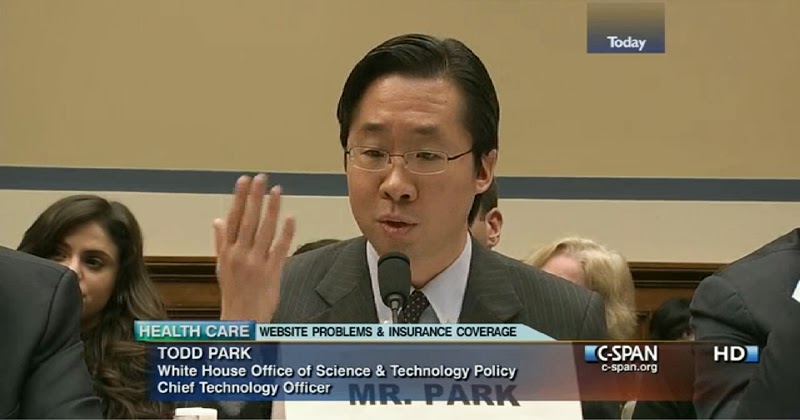

Fig. 3—Todd Y. Park, U.S. Chief Technology Officer. Mr. Park testified on Nov. 13, 2013 before the House Oversight Committee. Park gave vague answers and pretended not to know who made the decision to take the HealthCare.gov website lives on Oct. 1, 2013. Committee Chairman Darrell Issa (CA-49th) presented documents showing that the website had failed basic security tests, so an outside contractor recommended a delay.

Click here to jump to the previous post.

AFI investigators have dug into Park's background and discovered massive conflicts of interest and direct relationships with the Facebook Club. These relationships certainly prevented him from doing his job impartially. Instead of diligently overseeing the development of HealthCare.org, Park seems to have preferred being cheerleader-in-chief for government data giveaway events like "Datapalooza." When asked by Rep. Trey Gowdy (SC-4th) where he'd been prior to Oct. 1, Park misled the Committee into thinking he'd had no prior responsibility for the the website, when in fact, he had been the chief technology officer at HHS since Apr. 4, 2009. Photo: C-SPAN.

This agenda comes into focus when we observe U.S. CTO Todd Y. Park's priorities. Instead of making the HealthCare.org website development and implementation his number one priority, he busied himself with giving away government data in the "Open Health Data Initiative," OpenGov.org and HHS "Datapalooza."

Then, Park lied to the House Oversight Committee about his role in developing HealthCare.gov. (See previous post.)

For President Obama to put Todd Y. Park in charge of the tech surge, when Park created the mess, is either incompetence or intentional. AFI believes this is an intentional act by a President who is favoring his Facebook interests, not America's.

Apparently, Facebook interests are hell bent to get access to all of America's most private health and personal data. And, we have a President dedicated to letting them have it.

* * *

More angles to this scandal:

- How these Facebook interests were used as "influence currency" to help win the 2008 and 2009 presidential elections for Barack Obama.

- Why the HealthCare.org debacle may be a smokescreen for more Facebook hacker data theft. What is stored in Facebook’s data center in Lulea, Sweden?

- How the personal data collected by the Facebook Club is used to manipulate elections.

- How a dozen law firms and bar associations have corrupted American constitutional democracy, namely:

- American Inns of Court

- Blank Rome LLP

- Cooley Godward LLP

- DC Bar Association

- Federal Circuit Bar Association

- Fenwick & West LLP

- Gibson Dunn LLP

- Latham & Watkins LLP

- National Intellectual Property Law Association/Institute

- Perkins Coie LLP

- Weil Gotshal LLP

- White & Case LLP

- How the Justice Department's $13 billion ostensible settlement with J.P. Morgan Chase is more Facebook Club self-dealing.

- Constitutional remedies for justice when both the Executive and Judicial Branches are corrupt.

- Leader Technologies Inventor Protection Act.

e.g. "IBM Eclipse Foundation" or "racketeering"

e.g. "IBM Eclipse Foundation" or "racketeering"

As someone who has been in the VC community for decades, I can only say one thing. Wrong. Whoever wrote this post is really out of touch with the reality of how VC funding works. Mark Zuckerberg controls roughly 30% of Facebook. That is a phenomenally high percentage. If he were a puppet like this blog claims, it is inconceivable that he would have such influence.

ReplyDeleteI also have to note another major misrepresentation that I noticed. This blog claims that the federal circuit and Supreme Court deviated from case law by not evaluating the Pfaff and Group One tests. But there is a very simple reason for this. Look at Leader's appeal brief. They conceded that Leader sold the invention too soon, so these issues were never raised at the appellate level.

Well, Mark Goeings (a.k.a. Facebook attorney). Even novice investors now know Zuckerberg is nothing but a prop. He's an empty suit, you know what I mean, ah, dude? The hubcaps are flying off the story you fabricated with the help of so-called journalists like David Kirkpatrick. Facebook is and has always been a custom-creation of Summers, Sandberg, Breyer and their VC and banking buddies.

DeleteAs to your assertion that Leader conceded that it sold the invention too soon, that is OUTRAGEOUSLY FALSE, as you know. Just the opposite is the reality. Leader said they could not have sold it too soon because it wasn't ready. Your penny arcade antics using fabricated video snippets and an altered interrogatory is your so-called proof of admission... with judge skids greased. Let's see how that works out for you when all is said and done.

Repeat your lies all you like, the dogs are on to you. Woof. Woof.

So our readers can read for themselves that Goeings-Facebook is trying to put out false statements to fool the unsuspecting, here is a link to Leader Technologies' Supreme Court "Petition for Writ of Certiorari."

Deletehttp://www.leader.com/docs/(CLICKABLE-CITES)-Petition-for-Writ-of-Ceriorari-Leader-Technologies-Inc-v-Facebook-Inc-No-12-617-U-S-Supreme-Court-Nov-16-212.pdf

Mark is correct. Read the briefs. Leader never tried to challenge the jury's finding that they offered the software to companies more than a year before the patent application was filed. They took a different approach. They admitted that they offered it for sale too early, but claimed that the product they offered didn't embody the invention. McKibben made that same argument on the stand but the jury didn't believe it. If you read the appellate briefs, you will see that Leader didn't argue that they did indeed offer the software for sale too early. That is why the court didn't analyze the NDAs, etc. those issues were not raised on appeal, and an appellate court can only address the issues that are actually raised in the briefs.

DeleteMark you hit the nail right on the head. Appellate review is very narrow. Leader appealed on the sole issue of whether its product embodied the claimed invention when they offered it for sale. They admitted that it was offered for sale more than a year before the patent application. They just claimed that what they offered wasn't the invention. The jury didn't believe it. That is why the federal circuit didn't address NDAS, etc. irrelevant since the only issue was whether the product offered for sale embodies the invention.

ReplyDeleteMark Zuckerberg still Seek hospital treatment for poison ivy?

DeleteMore lies and spin by Facebook's attorneys. That appears to be all you people know how to do. You are the only ones who defend the Facebook misconduct because your are complicit.

ReplyDeleteMark Zuckerberg never work on Facebook like the film THE SHINING!!!

ReplyDelete<!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch <!- - Jessica Alona is a bitch

Zuckerberg testified under oath that he programmed the first Facebook site in Jan. 2004 by himself, in "one to two weeks," while studying for sophomore finals, chasing girls on Craigs list and at least a dozen burlap bags. Zuckerberg has found all his homes on Craigslist. His first place was a sparse one-bedroom apartment that a friend described as something like a "crack den." [...] "He's the poorest rich person I've ever seen in my life," Tyler Winklevoss said. Mark Zuckerberg never work on Facebook it was just a dating porn site, zuck: I’m not exactly sure how the farm animals are going to fit into this whole thing (you can’t really ever be sure with farm animals…), but I like the idea of comparing and some of these people have pretty horrendous facebook pics.I almost want to put some of these faces next to pictures of farm animals. its interesting to learn that facebook was intended to be a dating site just like facemash you see zuckerberg stole the idea facebook with the help of Larry Summers and paypal mafia Breyer the same people that were in on the 2008 global economic crisis that cost tens of millions of people their life savings, Larry Summers and Breyer nothing comes without consequence you little bitch. the 2008 global economic crisis was a PONZI scheme

Todd K. Park's Datapalooza! ::: Liberating Your Data YOU KNOW OF THE THE THEFT OF Leader Technologies' AND THE THEFT OF THE IDEA FACEBOOK Todd Park SAID he'd had no prior responsibility for the the website BUT YOU DID AND YOU KNOW THAT FACEBOOK WAS STOLEN AND YOU HAVE massive conflicts of interest and direct relationships with the Facebook Club, YOU CANT FIX THE website CAN YOU. YOU KNOW ITS STOLEN ITS A COVER UP???? Todd. STEP UP TODD OR GO TO JAIL

ReplyDelete