OBama's Billionaire Commerce Secretary conceals bogus intellectual property claims by Organizing for Action & HealthCare.gov websites; fails to disclose her Facebook "dark pool" holdings

(Dec. 30, 2013)—The Department of Commerce, led by Hyatt Hotel billionaire heiress, Penny S. Pritsker, is violating her code of ethics by involving the Commerce Department in any matter related to Leader Technologies. She holds up to $23.4 million Facebook interests (likely more in numerous trusts) held through Wall Street insider "dark pools." She led Obama’s 2008 campaign where the Obama For America (OFA, aka Organizing for Action) social website made the difference, and to which Obama posts more than one a day.

OFA & HealthCare.gov websites

Both of the Obama administration's main websites, Organizing for Action (formerly Obama for America) and HealthCare.gov, claim the social software systems running those sites are "open source." These sites deeply embed Facebook links. However, Facebook is guilty on 11 of 11 claims of infringing the patent of Columbus innovator, Leader Technologies, Inc. The fact is, the Obama administration's fantasy is to believe the software is open source, when it is not. The true inventors have gone uncompensated, meaning OFA and HealthCare.gov are operating on confiscated property.

Commerce Department officials have not responded to our inquiries. Individuals close to the In re. Facebook class action lawsuit over the NASDAQ system meltdown in the Facebook IPO confirm that unregulated "dark pools" could create uncertainty and cause the system to be unresponsive under high volume. A Leader Technologies official said "nothing surprises us any more about this widespread corruption."

Commerce's Facebook Dark Pools

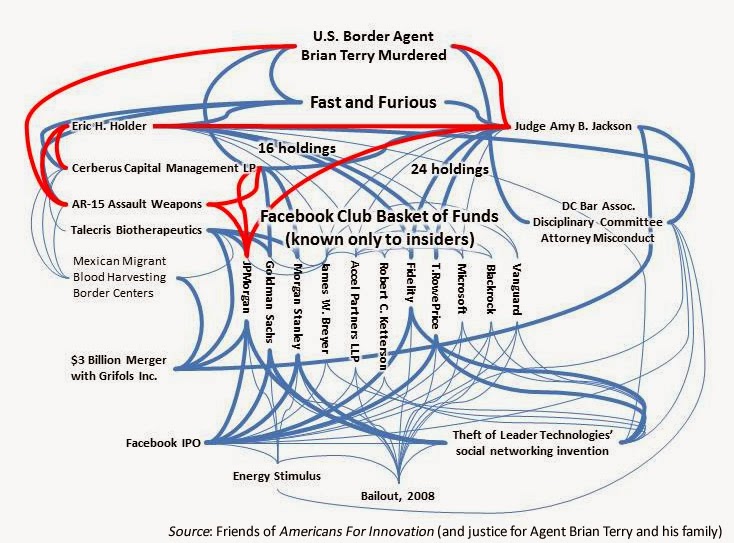

Dark pools were recently discovered as the likely source of the Obama administration's inordinate influence over politicians, bureaucrats, donors, judges, Silicon Valley, Wall Street and the media. Dark pools have also been discovered as the likely source of the NASDAQ "glitch" during the Facebook IPO. NASDAQ could not manage trading volumes from sources for which NASDAQ systems could not adequately provide and account for during extremely heavy volume.

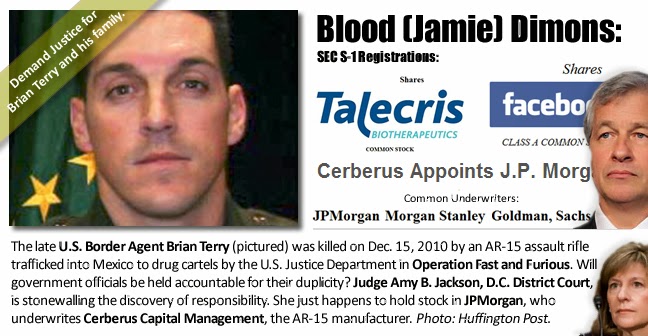

Pritzker's personal bankers were manipulating the Facebook IPO stock

Facebook IPO stock was being sold in both the front room (NASDAQ) and back room ("dark pools") simultaneously. Pritzker's fund managers Goldman Sachs, Morgan Stanley and JPMorgan were manipulating these sales since they controlled them both. Morgan Stanley allowed Facebook insiders to sell over $13 billion in holdings on the third day of trading. Such sales are wholly improper. Remember Jim Cramer's "epic rant" over Peter Thiel's Facebook insider stock dump? See "Cramer: Thiel’s Sale of Facebook Stock ‘Tawdry’" by Jim Cramer, CNBC, Aug. 21, 2012.

Facebook "dark pools" web of conflicts

Insiders traditionally must wait three to six months before selling their stock, and sell in small quantities. In stark contrast to the accepted norm, Facebook's Chairman, James W. Breyer, Accel Partners, sold over $6.5 billion of his shares on Day 3. Breyer appears to have been funding his father, John P. Breyer's, Chinese fund, IDG-Accel-China with these proceeds (John P. Breyer and George Soros are Hungarian émigré contemporaries).

Such conduct is an obscene abuse of the public trust and rendered the offering a mammoth scam. Another dark pools holder is Ann H. Lamont who is a board member of Obama's HealthCare.gov and White House chief technology officer, Todd Y. Park. Her company, Meritech Management, sold $263 million on Day 3. Goldman Sachs sold almost $1 billion. Russian oligarch Yuri Milner sold a whopping $3.79 billion (Goldman Sachs' Moscow partner). Peter Thiel dumped $633 million. Microsoft dumped $243 million. The web of conflicts is stifling. [They all sold on May 22, 2012, while the market was reeling from the NASDAQ glitch.)

Pritzker’s Patent Office is already mired in related conflicts of interest regarding the unprecedented 3rd patent re-exam of Leader's patent ordered by the Patent Office Director David J. Kappos, a former employee of Facebook stakeholder IBM. Patent judge, David C. Siu, a former employee of Facebook stakeholder Microsoft, is also directly involved.

Leader Technologies proved that Facebook is guilty of infringing their social networking patent on 11 of 11 counts. However, despite this, the federal courts ruled against Leader anyway, citing an obscure law called on-sale bar for which Facebook had no evidence. The appeals court judges, all Facebook "dark pool" interest holders as well, turned a blind eye and favored their financial holdings over of the U.S. Constitution and Leader's private property rights. So much for new definition of "blind justice." The Patent Office even asserted presidential privilege to conceal the White House interference in this matter.

Obama's 47 million OFA "likes" need Pritzker's protection; so does his crippled ObamaCare website

The Leader v. Facebook case was irreparably prejudiced by the Obama administration after President Obama grew his Facebook political website—Obama for America (a.k.a. Organizing for Action)—to 47 million “likes.” Even Patent Office Director David J. Kappos, part of the Commerce Department, used Facebook for his newsletter to over 10,000 employees.

Pritsker and other senior Commerce officials are part of a massive pre-IPO Facebook “dark pools” investing scheme

Neither the "dark pool" prospectus nor the Facebook S-1 made a single mention of investors risks associated with Leader v. Facebook—the only case against Facebook to go to the Supreme Court; and despite the devastating ruling of literal infringement against Facebook on 11 of 11 claims.

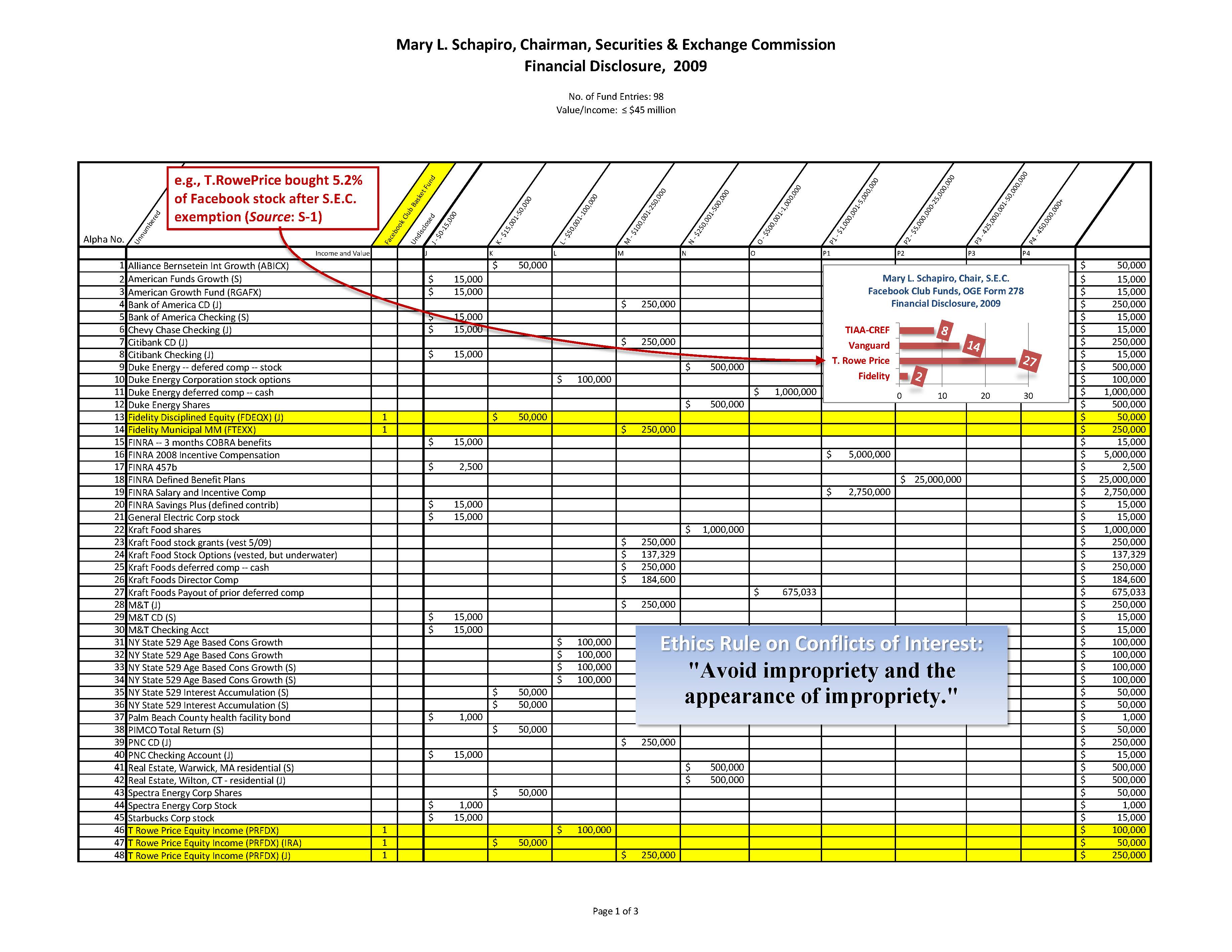

NASDAQ did not report the dark pools held by federal judges, senior S.E.C. and Commerce Dept. officials and Russian oligarchs, among others

The dark pools scheme solicited agreement from selected insider fund managers to purchase private Facebook shares more than four years in advance of the Facebook IPO. These funds then likely tipped off selected fund managers, judges, politicians and bureaucrats to this plan and invited them to invest four years early.

The ethics rules are clear. Public employees are required to avoid even the appearance of impropriety. At minimum, the Department of Commerce conduct reeks of impropriety.

Bottom line, hundreds of Obama administration political appointees and select federal judges were invited into this Facebook investing club. See summary of Obama appointees and judicial holdings.

It is difficult to fathom the extent of negative impact of these hidden agendas on the operations of government.

Commerce Dept. is duty bound to recuse itself from all matters related to Leader Technologies

The Department of Commerce must recuse itself from any and all matters related to Leader Technologies. Penny S. Pritzker has 30 investments in Facebook interests totaling up to $23.4 million. See below.

Pritzker’s predecessor at Commerce, Rebbeca M. Blank, has 40 investments in Facebook interests (TIAA-CREF, Fidelity and Vanguard).

Pritsker’s staff is part of the Facebook Club too

-

Commerce General Counsel, Cameron F. Kerry, has 23 investments in Facebook interests;

-

Commerce Director, Robert M. Groves, 19 investments in Facebook interests;

-

Commerce Patent Office Director, David J. Kappos, has 14 investments in Facebook interests. In addition, David J. Kappos was the former chief counsel at IBM, a major Facebook stakeholder;

-

Patent Office FOIA officer, Kathryn W. Siehndel, who is currently stonewalling FOIA requests, was employed by Facebook’s law firm, White & Case LLP; and

Administrative judge in Leader v. Facebook, Stephen C. Siu, was employed at Microsoft, another major Facebook stakeholder.

Penny S. Pritzker is more than $23.4 million conflicted re. Leader Technologies

The following summary was extracted from Pritzker’s 251-page disclosure. It includes a 67 page amendment after she “forgot to disclose” $80 million in trusts. Unfortunately, the trust disclosures are a sham since none of them disclose the holdings of these trusts.

Act Now! File complaints online to the Commerce Department Inspector General, and with your Congresspersons and Senators

AFI readers are encouraged to file complaints with Inspector General Todd J. Zinser. We suggest you attach the PDF of this post and attach it to your complaint letter. There is no one right way to send in the complaint. Just write it in your own words the best you can.

It remains unclear whether Mr. Zinser is a member of the Facebook Club. So, in the meantime he will be given the benefit of the doubt.

Make the noise grow louder and louder

Be sure to send copies of your complaint to your elected Congressperson and Senators. Also, send a copy to the House Oversight Committee led by Representative Darrell Issa CA-49th), and Representative Jim Jordan (OH-4th)

If you have been sitting on the sidelines on these Leader matters, don’t any longer. These corrupt Washington officials believe no one will hold them accountable.

Let’s prove them wrong.

* * *

e.g. "IBM Eclipse Foundation" or "racketeering"

e.g. "IBM Eclipse Foundation" or "racketeering"