Chief Justice Roberts pleads poverty as an excuse for his corrupt courts & "dark pool" Facebook IPO investments

.

New Jan. 3, 2014—Judicial Corruption Panels below

(Jan. 2, 2013)—On Dec. 31, 2013, U.S. Supreme Court Chief Justice John G. Roberts (Baby Bush appointment Sep. 29, 2005—four years into The Patriot Act) issued a 15-page end of year report on the federal judiciary and 217-page Guide to Judiciary Policy, a.k.a. license to steal or "the art of judicial chicanery."

Buried on page 9, Justice Roberts blames hypothetical injustices by his courts (“unvindicated rights”) on lack of funding. Nowhere does he admit that his courts are rife with cronyism and don't deserve the funds they're presently receiving.

Instead, he praises his federal judges for their "selfless commitment to public services" and affirms the notion of an "independent Judicial Branch." These platitudes ring hollow in the light of his conduct and that of his courts. When corporate CEOs perform incompetently or corruptly, they are fired and, in the case of corruption, prosecuted.

However, using the court’s own ethical standards, the conduct of Chief Justice Roberts’ judges in Leader v. Facebook proves that Roberts' courts are wantonly corrupt.

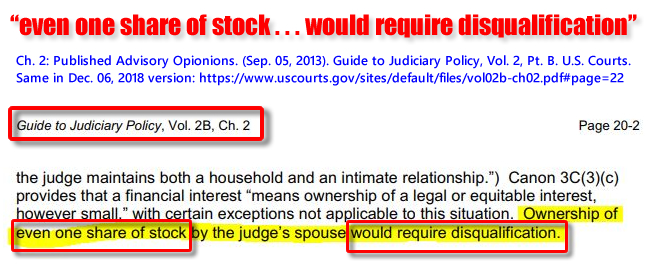

"Even one share" requires disqualification

According to the court's own Judiciary Policy, ownership of “even one share of stock” requires disqualification (p. 20-2), not to mention the directive to "avoid even the appearance of impropriety." This concept trumps the flimsy excuses currently voiced about being allowed to invest in mutual funds. The point is, if you know or should have known, that the mutual fund held, or intended to hold Facebook stock, you must disqualify yourself.

By 2008, all the Leader v. Facebook judges held the Facebook "dark pools" stock. They were evidently chomping at the bit for Facebook to go public. The Federal Circuit, whose presiding judge Alan D. Lourie held 22 Facebook "dark pools," even timed his rulings to accommodate Facebook IPO media needs—claiming the timing was purely coincidental. The actions of Roberts' courts showed that they were not going to let Leader Technologies' constitutional private property rights spoil their dreams of an IPO windfall.

The Leader v. Facebook case went before the Delaware District Court Judge Leonard P. Stark, then the Federal Circuit Court of Appeals, and then the U.S. Supreme Court.

Judges in Leader v. Facebook held at least 213 Facebook “dark pool” investments

Facebook "Dark Pool" Investments

View Supreme Court PDF Portfolio (12.1 MB)

View Supreme Court ZIP Portfolio (13.5 MB)

See All Executive Department Summaries

Judicial financial disclosures show that every judge in Leader v. Facebook had financial holdings in Facebook “dark pools” organized by Goldman Sachs, Morgan Stanley, JPMorgan, Fidelity, Blackrock, Vanguard, T. Rowe Price, TIAA-CREF, Microsoft and IBM.

Charade of impartiality

Despite these conflicts, not a single judge recused himself from Leader v. Facebook. Instead, they played a charade of impartiality. The evident motive was to protect their personal “dark pool” holdings prior to the Facebook IPO.

Facebook "Dark Pool" Investments

View Federal Circuit ZIP Portfolio (16.2 MB)

View Federal Circuit PDF Portfolio (16.6 MB)

See All Executive Department Summaries

Contradicting Justice Roberts’ assertion of an “independent Judicial Branch,” we instead see a court system that has subordinated itself to Wall Street, Silicon Valley, as well as their own personal greed.

We further see a court system that has turned a blind eye to the similar “dark pool” holdings of their Executive Branch brethren. We see the heads of the SEC, Commerce, Treasury, Health and Human Services, Education, Commodities, Justice, etc. all swimming in the same Facebook dark pools. See two previous posts.

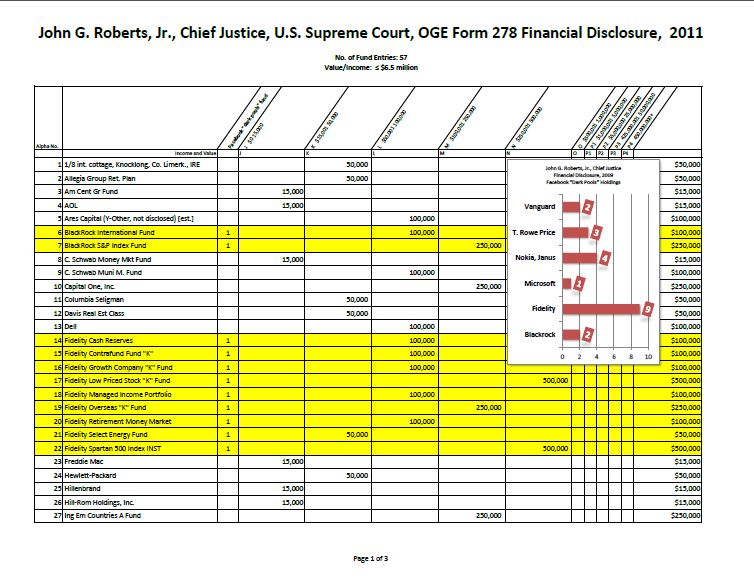

Justice Roberts is swimming in Facebook “dark pool” investments

Justice Roberts holds up to $6.5 million in 21 “dark pool” Facebook investments that he concealed when declining to hear Leader Technologies’ Petition for Writ of Certiorari. (This doesn't even account for the fact that he failed to tell Leader Technologies that Facebook's attorney, Thomas G. Hungar, Gibson Dunn LLP, is his protégé.) Likewise, Associate Justices Alito has 18, Breyer has 8, Ginsburg has 12, Elena Keegan has 18, Scalia has 30, Sotomayor has 4 and Thomas has 3. See Fig. 2; see also Corruption Panels below.

Fig. 6—Chief Justice John G. Roberts holds at least 21 Facebook "dark pool" investments. This makes him conflicted on any matters related to Leader v. Facebook. Click here to download a PDF directly.

The Leader v. Facebook Federal Circuit judges had similar holdings. Judges Lourie has 22, Moore has 20, Wallach has 12, and so on. The Leader v. Facebook District Court judge Leonard P. Stark has 9. See Fig. 3; see also Corruption Panels below.

Justice Roberts now has the audacity to ask for additional funds, while his judges personally pocket hundreds of millions of dollars, maybe even billions, in Facebook stock sales founded on a lie they helped perpetrate—the confiscation of the social networking patent property of Columbus innovator Leader Technologies.

The People have the power of the purse. If we fund corrupt institutions, then we deserve the results.

American government's separation of powers is currently cruel hoax

The People must say no to Justice Roberts’ funding request, at least until he proves an “independent Judiciary” is more than another lie, like "If you like your doctor, you can keep your doctor, period." Among his restitutions, he must return Leader Technologies’ stolen property. We must not let these great deceivers off the hook. The victims of their greed and deception must be made whole.

Say no to Justice Roberts until his federal courts come clean on Leader v. Facebook and other evident injustices.

If he doesn't, the only other remedy is impeachment, or he resigns in disgrace.

Justice Roberts' current conduct is wholly unacceptable to freedom loving people.

* * *

Federal Judiciary invested in Facebook "dark pools"—brokered by Goldman Sachs, Morgan Stanley and JPMorgan? *re. Leader v. Facebook + Fast & Furious + Rembrandt v. Facebook

Leonard P. Stark, Leader v. Facebook trial judge, July 19-27, 2010. Barack Obama nominee. Replaced 25-year veteran judge Joseph J. Farnan one month before trial. Confirmed one week after the trial. Ignored Pfaff Electronics and Group One v. Hallmark Cards precedents for testing on-sale bar evidence. His sole rationale for supporting Facebook was an unrelated 1860's criminal case that had never been used in a patent trial in history. His nomination was advised to Obama by Facebook lawyer Donald K. Stern, Cooley Godward LLP.

It should also be noted that just months before trial, Facebook's Leader v. Facebook trial attorney, Michael Rhodes, Cooley Godward LLP, was appointed Chief Legal Counsel for Tesla Motors—the recipient of almost $465 million in energy stimulus funds. Cooley Godward LLP and McBee Strategic LLC (led by Nancy Pelosi's former adviser Mike Sheehy) were key advisers on the stimulus funds given to 22 organizations, largely associated with Obama donors. 20 of those funded companies have now failed. Cooley Godward's man in the White House, Donald K. Stern, also advised Obama on the Stark nomination.

Amy B. Jackson aka Amy Sauber Berman.She has been stonewalling discovery of information from Attorney General Eric H. Holder about the murder of U.S. Border Agent Brian Terry by the Justice Department's Operation Fast and Furious.

Judge Berman is obviously a member of the Facebook Protection Racket Club.

Thomas S. Ellis III, J.D. Harvard. NO PHOTO AVAILALBE. He has failed to disclose his "Facebook "dark pool" conflicts of interest in Rembrandt v. Facebook; interests that were benefitted by the May 18, 2012 IPO, and which continues to accrue to him. His feigned objectivity is more dishonesty from a morally bankrupt federal judiciary.

Judge Ellis is obviously a member of the Facebook Protection Racket Club.

e.g. "IBM Eclipse Foundation" or "racketeering"

e.g. "IBM Eclipse Foundation" or "racketeering"

We have a commenter posting spam. If this person has facts and wishes to discuss them, that's fine. Otherwise, repeated posts based only on speculation and obviously feigned sincerity will be removed. We have observed that Facebook-friendly posts have yet to present a single hard fact that references something other than fabricated attorney evidence and attempts at baiting. It seems that Facebook's only defenders are attorneys. At last count Facebook employs 8-10 firms.including Gibson Dunn, Fenwick & West, Latham & Watkins, Cooley Godward, White & Case, Orrick Herrington, Weil Gotshal, Perkins Coie and Blank Rome. Facebook is a wholly attorney-fabricated company and appears it needs this much protection to maintain the big lie.

ReplyDeleteWhat do the following have in common?

ReplyDeleteA Havard teenager and pathological liar;

A Havard President and egomaniac economist;

A Havard chick who takes orders from the egomaniac;

A Russian oligarch who takes orders from the egomaniac;

A gaggle of crooked venture capitalists who give orders to the egomaniac;

A gaggle of Havard Law alumni whose mothers raised little monsters;

A gaggle of crooked Supreme Court justices, 80% Havard;

A gaggle of crooked Federal Circuit judges;

A crooked Delaware District Court judge;

A gaggle of Wall Street Havard grads who give orders to the US President;

A gaggle of Executive Branch political appointees, 60% crooked lawyers;

A gaggle of crooked Silicon Valley wonks;

A gaggle of crooked law firms who skipped ethics class; and

A verified Havard liar as President of the United States?

FACEBOOK

The best company Havard grads could steal.

(I misspelled "Harvard" intentionally. They lost their R-esolve to do Right along the way. And don't forget: "If you like your doctor, you can keep your doctor, period." Bwahahahaha.)

There is a fundamental flaw in the logic now being espoused in this blog. Your realize that the Facebook holdings in virtually all of these so called dark pools are minuscule? 1 percent. A quarter of a percent. And you also realize that if Facebook performs well it harms the stock price of other companies in the same mutual funds. These funds are comprised of hundreds and often thousands of different companies.

ReplyDeleteIt is absolutely preposterous to think that the entire us government, judiciary, and media have been bought off--via unstable mutual funds where the value of the fund is contingent on hundreds of other companies--simply to support Facebook.

We must be getting somewhere. Dale Michaels, attorney for Facebook, now says the holdings, like T.Rowe Price's who owned 5.2% of Facebook, is "minuscule." Oh wait, perhaps you didn't bother reading the Facebook S-1 disclosure, did you? Some of us did and know you are lying. No, Mr. Michaels whatever your name is, it is your logic that is tragically preposterous and more attempts at misdirection. Like we have told you repeatedly now. The dogs have your scent.

DeleteDale Michaels attempts to rewrite the Judiciary Policy. The policy says that "even one share" requires disqualification of these judges. The rule does not allow the holder to determine whether or not a holding is relevant. The rule says ANY holding requires recusal. Michaels admits that these funds hold Facebook stocks, and therefore, these judges are guilty of breaking their own rules. In trying to defend these Facebook holdings, Michaels condemns those he attempts to excuse. Such is the case with duplicity.

DeleteGlad to see you are paying attention, Mr. Michaels. Suggest you find another profession other than law. Your morals are broken. One fund is enough, and too bad for you, its all public evidence.

DeleteDale, mutual funds aside, since Facebook WAS found guilty on 11 of 11 counts of literal patent infringement of Leader Technologies' property (and, since we are talking about software platforms, we must also assume we are referring to software code); given the fact that Zuckerberg his self declared Facebook an "Open-Source Platform", I implore you to answer the following:

DeleteTo whom does this "Open-Source Platform" actually belong to?

I think you know the answer to that question already, but I defer.

We've already thoroughly posted on this subject re. Obama's two chief technology officers. In fact, it was chasing down the public sources on this false claim that led to the "dark pools" exposé.

DeleteLawsuit charges that Facebook scanned private messages

ReplyDeleteComputerworld

IDG News Service - Facebook has been accused of intercepting private messages of its users to provide data to marketers, according to a class-action ...

See all stories on this topic »

Facebook facing lawsuit over privacy issue

Fox Business

Facebook facing lawsuit over privacy issue. Advertisement. Details. Description. Lanier Law Firm's Mark Lanier on Facebook's privacy issue and ...

See all stories on this topic »

Lawsuit Claims Facebook Is Reading Your Private Messages

The Wire

Facebook could be reading your private messages to help advertisers figure ... The company was hit this week with a class action lawsuit alleging it is ...

See all stories on this topic »

Facebook faces class action lawsuit for scanning messages

Fox News

Welcome,. You're logged in as. Profile; Logout. You're watching... Facebook faces class action lawsuit for scanning messages. Advertisement. Details.

See all stories on this topic »

Facebook Accused Of Reading Private Messages, Selling Data

Huffington Post

Two Facebook users, Michael Hurley and Matthew Campbell, filed a class action lawsuit against Facebook on Dec. 30, 2013, alleging that the social ...

OBAMA says with Great Authority that Snowden did damage but the damage was that OBAMA lost the back door keys he got from the NSA to spy and steal ideas from your cell phone and to give market surveillance of ideas to Larry Summers James W. Breyer the PayPal boys and THE FACEBOOK CLUB , Snowden says we need balance in spying but its a WALL STREET GOVERNMENT SNOWDEN OBAMA stole info from your cell phone and one of the ideas that he stole was read out word for word to every one YES THAT'S WORD FOR WORD EVERY ONE, this was on JUNE TO THE END 2012 The President of the United States is break the law. Obama has organised such an information drive that Your phone exposes unnecessary information to adversaries and provides an easy conduit for information leakage, information that ended up on Obama desk and Sharing this information with THE FACEBOOK CLUB -- lets hope that Apple has improved its software security : Facebook declined to make executives available for interviews before the IPO offering, The power that Larry Summers wields over the stolen company FACEBOOK makes meaningless the notion of investor democracy. THE FACEBOOK CLUB was organized and controlled by lawrence larry summers soon to be Obama's chief economic advisor THIS WAS THE PAY OFF that lawrence larry summers got from Obama OBAMA AND SUMMERS new that facebook was stolen and new of the THEFT OF Leader Technologies'

ReplyDeleteWayne Chang filed a lawsuit against the Winklevoss brothers. Chang said that the Winklevoss brothers merged their company, called ConnectU, with Chang’s web development company to make a new company: The Winklevoss Chang Group (WCG). Chang complained that the Winklevosses “expressly agreed that the litigation between ConnectU and Facebook was an asset of ConnectU and an asset of WCG,” according to BusinessInsider. Chang never got any money when the Winklevosses received $65 million as part of the settlement THE FACEBOOK CLUB. Chang claims that this IM conversation took place between him and Cameron in November 2004: but the idea facebook was not the winklevoss idea nor was it mark zuckerberg idea SO WHO IDEA WAS IT BOYS. ------ LOL

ReplyDeleteMark Zuckerberg signed a contract with PAUL CEGLIA in April 2003. Later in 2004, a copy of the contract was posted on to the internet buy a Harvard Crimson reporter . ZUCKERBERG hired attorney LISA SIMPSON of ORRICK LLP, who threatened the Crimson reporter, then came to his house with four lawyers who threatened to call the police and called him a thief. ORRICK and GIBSON DUNN are committing perjury, in my opinion, and conspiring with Zuckerberg to protect his stolen empire. They know the truth about ZUCKERBERG. Both LISA SIMPSON, ORRICK and GIBSON DUNN say the ink on the Celgia contract is two years old, but they know full well that the contract is genuine.

THE DAVID KIRKPATRICK BS STORY

LIBOR The strategy wasn’t a secret. Each morning at a meeting of UBS’s interest-rate-derivatives desk in Tokyo, Mr. Hayes would change his status on his Facebook page to reflect his daily desires for Libor to move up or down, David Kirkpatick did an investigation in England about libor manipulation and set up libor manipulation info on facebook under the disguise of doing an investigation. The ponzi scheme had everything it needed. THE FACEBOOK CLUB that was stolen and the THEFT OF Leader Technologies' and Larry Summers who was running facebook

Here's a refresher on judicial ethics from the Justice Department's own Judiciary Policy: http://www.uscourts.gov/uscourts/RulesAndPolicies/conduct/Vol02B-Ch02.pdf

ReplyDelete(((1.))) The policy mentions "impropriety" 99 times, citing The Code of Conduct for U.S. Judges, Canon 2:

"[a] judges should avoid impropriety and the appearance of impropriety in all activities."

(((2.))) "Canon 3C(1) is clear that a judge should disqualify in ***any*** proceeding in which his or her impartiality might reasonably be questioned." (p. 27-2).

(((3.))) Recusal is required where there is "participation in development of the bar association position on the matter." (p. 52-2). The Federal Circuit Bar Association filed a motion in Leader v. Facebook against a Friend of the Court motion. Besides FCBA membership by all the judges, their Clerk of Court and Executive, Jan Horbaly, was Ex Officio at the FCBA. These positions ***demanded*** recusal by the whole court. Instead, they were silent and acted like they were unbiased. Gag.

http://www.scribd.com/doc/106156081/Response-to-Request-of-Federal-Circuit-Bar-Association-s-Request-for-Reissue-Re-Leader-v-Facebook-Case-No-2011-1366-Fed-Cir-by-Lakshmi-Arunach

(((4.))) OPINION 97 -- THIS RULE IS SIX PAGES (longest in the rules) Hmmmmmmmmmmm (Shakespeare: "The lady doth protest too much, methinks") -- Re. Magistrate Judge Leonard P. Stark's surprise appointment to the Leader v. Facebook case one month before trial, while simultaneously being considered by Obama for appointment. Facebook's attorney Donald K. Stark, Cooley Godward LLP, was on the Obama panel advising Stark's appointment.

"If the magistrate judge knows that a lawyer... has a financial or other personal interest that could be substantially affecte by the outcome of a case, then the magistrate judge should recuse." STARK DID NOT RECUSE. (p. 97-5)

(5.) MUTUAL FUNDS - read this policy and weep. One could drive a truck through it. All the sneaky lawyer wiggle language aside, it is subject to the overarching rule of Canon 3C(1)(c) which "requires a judge to disqualify himself or herself when the judge knows that he or she 'has a financial interest... in a party to the proceeding." Re. the Facebook "dark pools."

This rule is like punching into the Pillsbury Dough Boy. While it provides a "safe harbor" rule for mutual funds, it sets apart enough exceptions to condemn all of the 213 Leader v. Facebook court holdings anyway. From the "safe harbor" rule (p. 106-2), it exempts (a) former law firm 401(k) retirement plans managed by the law firm, (b) IRA's, (c) brokerage accounts held in the judge's name (or children/spouse/stock-parkers), (d) judge managed mutual fund holdings.

"[R]ecusal may be required under Canon 3C(1)(c) because the judge has an 'interest that could be affected substantially by the outcome of the proceeding." (p. 106-2).

***MAGICALLY***, not a single judge or judicial employee (incl. the Patent Office officers with substantial Facebook holdings and relationships) in Leader v. Facebook raised the specter of conflict of interest despite their 213 "dark pool" investments. Their silence is deafening!

My source: http://www.uscourts.gov/uscourts/RulesAndPolicies/conduct/Vol02B-Ch02.pdf

I almost forgot to include (((EVEN ONE SHARE)))

Delete"Canon 3C(3)(c) provides that a financial interest means ownership of a legal or equitable interest, ***however small***...” ***Ownership of even one share of stock*** by the judge’s spouse would require disqualification." (p.20-2).

http://www.uscourts.gov/uscourts/RulesAndPolicies/conduct/Vol02B-Ch02.pdf

A reader has tallied the VIEWS of some Leader v. Facebook judicial and government corruption ocuments from multiple websites.

ReplyDeleteTOTAL VIEWS TO DATE: 333,680

VIEWS: 17,249

Response to Request of Federal Circuit Bar Association's Request for Reissue Re. Leader v. Facebook, Case No. 2011-1366 (Fed. Cir.) by Lakshmi Arunachalam, Ph.D., Sep. 17, 2012

http://www.scribd.com/doc/106156081/Response-to-Request-of-Federal-Circuit-Bar-Association-s-Request-for-Reissue-Re-Leader-v-Facebook-Case-No-2011-1366-Fed-Cir-by-Lakshmi-Arunach

VIEWS: 15,573

Renewed Motion for Leave To File Amicus Curiae Lakshmi Arunachalam, Ph.D. Brief, Jul. 27, 2010 - Leader v. Facebook - CLERK'S COPY WITH EXHIBITS

http://www.scribd.com/doc/101191619/Renewed-Motion-for-Leave-To-File-Amicus-Curiae-Lakshmi-Arunachalam-Ph-D-Brief-Jul-27-2010-Leader-v-Facebook-CLERK-S-COPY-WITH-EXHIBITS

14,275 Views

http://www.scribd.com/doc/107866373/Briefing-for-Representative-Jim-Jordan-OH-House-Judiciary-Committee-re-Leader-v-Facebook-Sep-28-2012

http://www.scribd.com/doc/107866373/Briefing-for-Representative-Jim-Jordan-OH-House-Judiciary-Committee-re-Leader-v-Facebook-Sep-28-2012

14,242 Views

http://www.scribd.com/doc/106156081/Response-to-Request-of-Federal-Circuit-Bar-Association-s-Request-for-Reissue-Re-Leader-v-Facebook-Case-No-2011-1366-Fed-Cir-by-Lakshmi-Arunach

VIEWS: 10,935 (total, multiple sites)

Briefing for Representative Jim Jordan (OH) - HOUSE OVERSIGHT COMMITTEE - American and Russian Opportunists Undermining U.S. Sovereignty and Corrupting U.S. Financial and Judicial Systems, Oct. 19, 2012

http://www.scribd.com/doc/110575673/Briefing-for-Representative-Jim-Jordan-OH-HOUSE-OVERSIGHT-COMMITTEE-American-and-Russian-Opportunists-Undermining-U-S-Sovereignty-and-Corruptin

VIEWS: 9,260

Working Summary, 'Revitalize and Expand Moral and Ethical Principles Embodied in the Business Judgment Rule;' Prepared for Representative Jim Jordan (OH), HOUSE OVERSIGHT COMMITTEE, Oct. 25, 2012

http://www.scribd.com/doc/111167350/Working-Summary-Revitalize-and-Expand-Moral-and-Ethical-Principles-Embodied-in-the-Business-Judgment-Rule-Prepared-for-Representative-Jim-Jordan

VIEWS: 7,749

Patent Office Cover-up in Leader v. Facebook, Feb. 7, 2013

http://www.scribd.com/doc/124428891/patent-office-cover-up-in-leader-v-facebook-feb-7-2013

VIEWS: 6,711

Lakshmi Arunachalam Phd Open Letter to Democratic Candidates, 30 July 2012

http://www.scribd.com/doc/101527448/Lakshmi-Arunachalam-Phd-Open-Letter-to-Democratic-Candidates-30-July-2012

VIEWS: 6,782

http://www.scribd.com/doc/104894533/Motion-to-Compel-Each-Member-Of-The-Federal-Circuit-To-Disclose-Conflicts-Of-Interest-in-Leader-v-Facebook-by-Amicus-Curiae-Lakshmi-Arunachalam-PhD

VIEWS: 7,689

The Real Facebook | A Portrait of Corruption, Mar. 28, 2013

http://www.scribd.com/doc/132840942/The-Real-Facebook-A-Portrait-of-Corruption-Mar-28-2013

VIEWS: 6,921 (total, multiple sites)

"Faces of the Facebook Corruption - We see. We 'like.' We steal." Americans for Innovation, Jul. 6, 2013

http://www.scribd.com/doc/152136827/Faces-of-the-Facebook-Corruption-We-see-We-like-We-steal-Americans-for-Innovation-Jul-6-2013

VIEWS: 6,913

Petition for Writ of Certiorari, Leader Technologies, Inc. v. Facebook, Inc., No. 12-617 (U.S. Supreme Court Nov. 16, 212) (clickable citations)

http://www.scribd.com/doc/113545399/Petition-for-Writ-of-Certiorari-Leader-Technologies-Inc-v-Facebook-Inc-No-12-617-U-S-Supreme-Court-Nov-16-212-clickable-citations

Jill, your analysis and understanding of the judiciary rules and how these funds work are off the mark.

ReplyDeleteFirst, judges are mandated to keep abreast of their holdings in order to avoid just such conflicts. It is not hard to do. All funds must publish the stocks they hold for the clients. One call to the broker gets the list. Judges are MANDATED by the Judicial Conference to keep a conflicts log, keep it up to date, and report on conflicts before they take cases. That's their job. Your logic would excuse a doctor prescribing a new drug he holds stock in in his IRA. Democracy cannot function with these sorts of people as our judges.

Second, Rain's comment above highlights holdings that cannot claim the "safe harbor" privilege and must be disclosed, however small. I won't repeat those citations here. The rule is even clearer: it says "even one share" ... even one share held by a spouse.

Justice demands unbiased judging. The rules are what they are and they are right. ANY investment in a litigant, even one share, is too many. If a judge is holding such a stock in a fund, he or she must divest or recuse. That's the rule. These sneaky games the Facebook Club attempted to get away with are clever but illegal. The impropriety alone is off the charts. Using your logic they might as well add a new clause for "Stealth Investing... How to hide your investments from public scrutiny." Heck, it could be a new course at Harvard and Stanford Law Schools. Sad to say, it probably is.

As to the Facebook holdings in these funds themselves, look them up for yourself. We did our homework and have.

Remember, you as an American citizen (we assume you are) need unbiased judges just as much as us. We suggest you stop loving all things unscrupulous and stand up for your constitutional rights. You may need those rights someday yourself. If you keep giving your rights away to crooks, they won't be. Ask families of relatives who were murdered in Nazi death camps.

The handwriting is on the wall.

Jill, your "simple math" doesn't add up.

Perhaps Jill is using Al Gore's "fuzzy math"...after all, he did invent the calculator.

DeleteWe wrote on the Nazi death camps and property confiscation in September 2013:

Deletehttp://americans4innovation.blogspot.com/2013/09/obama-administration-confiscates.html

The values expressed by Jill are those that condemn history to repeat its tragic mistakes.