Mueller's investments reveal collusion with Larry Summers' former Harvard professor and exclusive Wall Street hedge funds

(Mar. 25, 2016)—Americans expect and our laws require that our top law enforcement officer--the Director of the Federal Bureau of Investigation (FBI)—be above reproach and vigorously prosecute wrongdoers.

Former FBI director Robert S. Mueller’s was a sponsor of Supreme Court nominee, Merrick B. Garland, during Garland's first Senate confirmation hearing for D.C. circuit judge in 1995—a formative year for the current NSA spy state and IBM’s “The Internet of Things.” Mueller led the FBI under George Bush and Barack Obama for 12 years from Sep. 4, 2001 to Sep. 4, 2013.

Following the money, AFI investigators evaluated Mueller’s 2001 and 2011 financial disclosures, his first and last. Read these noble words from Mueller when he wanted the top law enforcement job in 2001:

“We must tell the truth and let the facts speak for themselves. The truth is what we expect in our investigations of others, and the truth is what we must demand of ourselves when we come under scrutiny." Robert S. Mueller Senate Confirmation, Jul. 30, 2001, page 26.

Sadly, Mueller often did the opposite.

After Virginia law school in 1973, Mueller worked for various U.S. Attorneys before becoming one himself in 1998. These long stretches with the U.S. Justice Department were interspersed with stints in the law firms Hill & Barlow LLP (Boston) and Hale & Dorr LLP (Washington). He focused on financial fraud, terrorism, money laundering and public corruption—a set of skills he appears to have leveraged for himself and his friends.

In our opinion, the knowledge Mueller gained about beating the system has been turned on the American people and unleashed a lawless FBI during Mueller's tenure as FBI director. We will name the ways.

Separation of powers fails when the FBI colludes

America has been here before. Our first FBI Director, G. Edgar Hoover, used dirt on political targets to maintain his power for 42 years. Hoover proclaimed famously: “Justice is incidental to law and order.” It appears that Robert Mueller agrees.

Separation of powers as a principle breaks down when those powers collude, especially our chief law enforcement officers at the FBI.

Dramatic changes in America have occurred on Mueller’s watch. He was either incompetent or complicit.

QUESTION: Did Mueller miss all this fraud incompetently, or was he in on it?

- Mutual fund judicial bribery thru ethical redefinition as not a financial interest (2001)

- 9-11 attack (2001)

- Terrorism war (2001)

- Patriot Act abuses masked as protection (2001)

- Theft of social networking invention by IBM and NSA confiscation (2001)

- Citizen privacy abused by NSA for security (2003)

- Hedge fund Ponzi schemes (2003)

- 2008 banking crisis (2007)

- Barack Obama election (2007)

- Energy stimulus (2009)

- Obamacare welfare (2009)

- IRS political enemies targeting (2010)

- BLM land redistribution (2009)

- American Invents Act patent destruction (2011)

- Fast and Furious gun running (2009)

- Common Core and M.O.O.C.* education federalization (2009)

- Open border voter recruiting masked as liberalization (2009)

- Judeo-Christian morality attacked as archaic intolerance (2009)

* M.O.O.C. (Massive Open Online Course) (University level)

CONCLUSION: Mueller was a participant who was cared for by the Cartel ringleaders.

Mueller’s money — obfuscation and great wealth

Between 2001 and 2011, Mueller’s holdings exploded four-fold, from 41 to 178 entries. This begs the obvious question how a public servant can get so rich on the job. In our experience, officials often bury dubious transactions in long lists of small transactions. It discourages the unsuspecting public from taking the time to figure out what they are doing. Mueller’s 2011 disclosure exhibits that pattern.

In the ten years between 2001 and 2011, Mueller’s net worth grew from $1.8 million (hard number) in 2001 to approximately $7 million in 2011 (soft number). The 2001 number is a hard number since Mueller submitted a complete financial statement to the Senate for his 2001 confirmation hearing. However, for 2011 he submitted only investing ranges.

$1.8 million (2001)

Please recall that the stock market collapsed during this period (2001-2011) and the assets of most investors DECLINED significantly. However, Mueller's assets increased up to $7.0 million.

$7.0 million (2011)

Researchers believe Mueller's 2011 numbers are probably much higher due to dubious hedge fund entries and, unless he lives under a bridge, missing real estate disclosures.

Mueller’s offshore Top 1%-er hedge funds

Average Americans cannot participate in hedge funds because the minimum investments, typically between $100,000 and $10,000,000, are unachievable. Therefore, hedge funds are the exclusive playground of the 1%-ers, normally.

However, the 1%-ers let Mueller play.

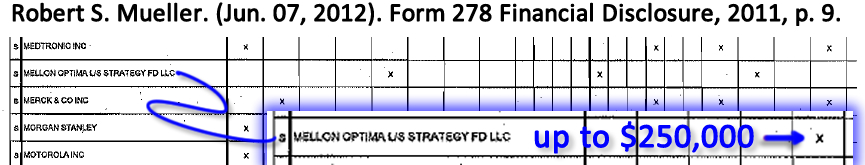

Buried in Mueller’s explosion of holdings between 2001 and 2011 are two hedge funds that no other person in government holds, to our knowledge:

- Mellon Optima L/S Strategy Fd LLC

- Defenders Multi-Strategy Hedge Fund LLC

AFI investigators focused on the Mellon Optima fund for the moment. It is damning enough.

bread crumbs lead back to Cartel's Harvard godfather —Larry Summers

In short, the Mellon Optima fund appears to be another misguided scheme of Lawrence H. Summers. New readers should know that Summers is a central figure in the Cartel. AFI has written extensively on Summers, so we will not repeat it here.

See Hijack of the Cyberworld Timeline starting at 1990; See also Briefing for Representative Jim Jordan (OH) – House Oversight Committee - American and Russian Opportunists Undermining U.S. Sovereignty and Corrupting U.S. Financial and Judicial Systems, Oct. 19, 2012.

BNY and Harvard took care of Mueller in the Caymans

Mueller’s two hedge funds are intertwined.

The first glaring ethical problem is the lack of disclosure of the activity inside these funds.

These funds are "closed" limited liability companies whose carefully selected members actively participate in the management of their funds and benefit directly from the financial returns. They receive quarterly allocations of profits and losses to their capital accounts for which they must pay taxes.

Mueller's Mellon Optima 2004, page 6 investment memorandum describes the exclusivity of the fund unabashedly:

"An investment in the Fund enables Investors to invest with Investment Managers whose services generally are not available to the investing public, whose investment funds may be closed from time to time to new investors or who otherwise may place stringent restrictions on the number and type of person whose money they will manage." (Emphasis added).

Said less kindly: the great unwashed American public need not apply.

Another remarkable feature of Mellon Optima is this shocking statement:

"Investors in the Fund have no individual right to receive information about the Investment Funds or the Investment Managers, will not be investors in the Investment Funds and will have no rights with respect to or standing or recourse against the Investment Funds, Investment Managers or an any of their affiliates."

Huh? They're saying give us your tens of millions of dollars but don't ask what's in the box you are buying. Wow.

Why would Robert S. Mueller, America's chief law enforcement officer, invest up to $250,000 in Mellon Optima? What does he know about these fund managers that he is not disclosing the public? The whole point of financial disclosure laws is to be transparent. FBI Director Mueller hides this information.

Bookmark: #hale-dorr-friedmanHale & DoRr LLP

Another conflict of interest is that Mueller's former law firm, Hale & Dorr LLP, is corporate counsel to Mellon Optima. This is yet more evidence of funny business.

Another Harvard backdoor

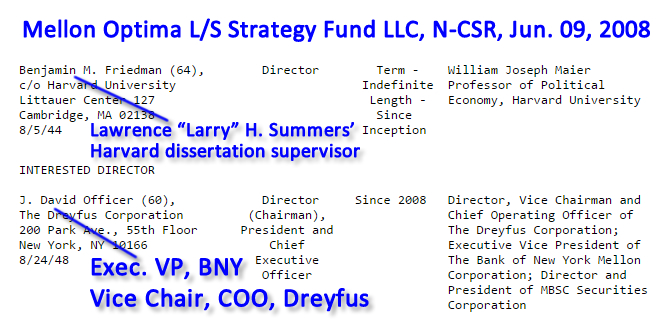

From its 2004 inception, one of Mellon Optima's directors has been Benjamin M. Friedman, a Harvard political economy professor. Friedman led Lawrence H. Summers' PhD dissertation committee.

For one year starting in 2008, Mellon Optima's Chairman, President and CEO was J. (John) David Officer. J. David Officer was also executive vice president of Bank of New York (BNY) and vice chairman and chief operating officer of Dreyfus Funds. Tellingly, Mueller holds 15 BNY Mellon funds and 11 Dreyfus Funds.

BNY Mellon 2008 Scandal

During the 2008 banking crisis, J. David Officer and BNY engaged in a scheme to defraud custodial customers in undisclosed, fraudulent and misleading foreign exchanges. They were indicted in 2011. U.S. v. BNY Mellon, Case No. 11-cv-6969 (SDNY 2011). This could help explain why J. David Officer was only Chairman, President and CEO at Mellon Optima for one year.

AFI covered HSBC Whistleblower Hervé Falciani who blew the lid off of these offshore tax havens where money launderers, arm's dealers, spies and fraudsters sip coffee together. Falciani exposed all of the banks in Mueller's portfolio.

More on Mellon Optima's formation

Mellon Optima was formed on Dec. 17, 2004—one week after IBM stunned the world by selling its profitable PC Group to the Chinese (Lenovo). Hindsight shows that the purpose of this transaction was to embed spy algorithms into PC hardware and software more easily. See Hijack of the Cyber World Timeline, 2004.

That was also one week after IBM Eclipse Foundation recorded in their minutes that they were “unable to locate” the originator of the social networking source code they were distributing (actually it is Columbus, Ohio innovator Leader Technologies) and would therefore have to “re-implement” it. Timeline, Dec. 08, 2004.

Also a week earlier, Bill Clinton was paid $125,000 for a Goldman Sachs speech in New York.

Goldman Sachs had provided the financing to the Chinese to buy the IBM PC Group.

JPMorgan handled the IBM side of this dubious spy state transaction.

Cravath Swaine LLP handled the transaction for IBM.

Cravath Swaine LLP is where former IBMer and Patent Office director, David J. Kappos, landed after leaving the Patent Office. Before leaving, Kappos ordered an unprecedented third "reexam" of Leader Technologies social networking patent and invalidated it with a secret kangaroo court of IBM and Microsoft insider patent judges, led by Judge Stephen C. Siu.

Exclusive hedge fund holdings for 1-%ers… and FBI Director Mueller

$32.3 Billion

Mellon Optima is invested in 22 hedge funds worth $32.3 billion.

$73.9 Billion

Defenders Multi-Strategy is invested in 33 hedge funds worth $73.9 billion.

36% in the Caymans

Thirty-six percent (36%) of these fund holdings are offshore, mostly in the Cayman Islands.

These funds are exclusive clubs for the 1%-ers where even a one quarter of one percent increase in the value of these two funds distributes $265.5 million to the holders.

The rich get richer

Mueller's hedge funds are brokered by Citibank, JPMorgan, Morgan Stanley and Goldman Sachs, among others.

Mueller held/holds stock directly in JPMorgan, Morgan Stanley, State Street, Bank of America, BNY and Wells Fargo.

The other big banks drive Mueller’s other funds, including Barclays, Credit Suisse, UBS, RBS, RBC, Goldman Sachs, HSBC, Merrill, BNP and BNY.

Not a single FBI prosecution

Curiously, not a single executive from these banks was ever prosecuted or even investigated by Mueller's FBI. Now we know why. Our chief law enforcement officer was a willing beneficiary of the global scams.

Holding funds is not illegal. Failing to disclose conflicts of interest is.

Obviously, if Mueller had taken enforcement action against these banks, he would hurt his portfolio.

Mueller’s FBI was silent about illegal NSA wiretapping.

Mueller’s FBI was silent in 2008 when banks in which he was invested gorged themselves on $475 billion of TARP taxpayer bailout funds. [Editor: Then Secretary of the Treasury Paulson, former Chairman and CEO of Goldman Sachs, had pushed through $700 billion, but that number was cut back by The Dodd-Frank Act to $475 billion.]

Mueller's FBI was silent when BNY Mellon took advantage of the international turmoil and manipulated currency markets in 2008 to benefit Mueller's Mellon Optima investment.

Mueller’s FBI was silent when his banks again gorged themselves on Obama energy stimulus freebies.

Mueller’s FBI was silent while Barack Obama fed Obamacare consulting and software development contracts to Michelle Obama's Princeton classmate, Toni Townes-Whitley, senior vice president, CGI Federal.

Theft of Leader Technologies’ social networking invention by IBM

Mueller’s FBI was silent in 2001-2002 when Mueller’s mentor, James P. Chandler, fed his client Leader Technologies' social networking invention to IBM and IBM's Eclipse Foundation.

Bookmark: #mueller-clinton-obama-deep-state-conflicts-of-interestThirty-two (32) of Mueller’s technology holdings valued up to $3.7 million read like a Who Who of the IBM Eclipse Foundation members. They include

| Name | Mueller $$$ Holding (up to) | IBM Eclipse Foundation Member | Facebook relationship | DEMOCRAT: Clinton speech fee / donor |

REPUBLICAN: Mitt Romney holding / donor |

Obama CEO Tech Council | NSA spy state vendor |

| Amazon | Yes | Yes | Yes | data | |||

| AMEX | Yes | Yes | advertiser | Yes | |||

| Apache | Yes | Yes | vendor | embedded | |||

| Apple | Yes | Yes | Yes | data | |||

| AT&T | Yes | Yes | advertiser | Yes | data | ||

| Autodesk | Yes | Yes | Yes | embedded | |||

| Bank of America | Yes | Yes | underwriter, advertiser | Yes | Yes | ||

| BMC Software | Yes | Yes | embedded | ||||

| BNY | Yes | Yes | underwriter, advertiser | ||||

| Capital One | Yes | Yes | advertiser | ||||

| CBS | Yes | Yes | advertiser | Yes | |||

| Cisco | Yes | Yes | Yes | Yes | Yes | data, embedded | |

| Comcast | Yes | Yes | Yes | data, embedded | |||

| Covidien | Yes | Yes | embedded | ||||

| EMC | Yes | Yes | Yes | Yes | embedded | ||

| GE | Yes | Yes | advertiser | Yes | embedded | ||

| Yes | Yes | Yes | Yes | data | |||

| Honeywell | Yes | Yes | embedded | ||||

| IBM | Yes | Yes | advertiser | Yes | Yes | Yes | embedded |

| Informatica | Yes | Yes | Yes | embedded | |||

| Intuit | Yes | Yes | advertiser | Yes | data | ||

| JPMorgan Chase | Yes | Yes | underwriter, advertiser | Yes | Yes | ||

| Microsoft | Yes | Yes | advertiser, vendor | Yes | Yes | Yes | embedded |

| Morgan Stanley | Yes | Yes | underwriter, advertiser | ||||

| Motorola | Yes | Yes | advertiser | Yes | embedded | ||

| NetApp | Yes | Yes | vendor | Yes | embedded | ||

| News Corp | Yes | Yes | advertiser | data | |||

| Oracle | Yes | Yes | Yes | Yes | embedded | ||

| Qualcomm | Yes | Yes | Yes | Yes | Yes | embedded | |

| State Street | Yes | Yes | advertiser | Yes | Yes | ||

| Time Warner | Yes | Yes | Yes | embedded | |||

| Vanguard | Yes | Yes | advertiser | Yes | |||

| VMware | Yes | Yes | vendor | embedded | |||

| Wal-Mart | Yes | Yes | advertiser | Yes | data | ||

| Wells Fargo | Yes | Yes | underwriter, advertiser | Yes | Yes | ||

| Table 1: Align of Cartel interests among Cartel members, Robert S. Mueller with IBM, IBM Eclipse Foundation, Facebook, established Democrats and Republicans, Obama's White House, the NSA Spy State | |||||||

What can the average American (We the People) do about this lawlessness

Release the angels of heaven against these scoundrels and their hounds of hell.

| Support Leader Technologies' patent property rights, and the rights of other inventors cheated by the Cartel. | Stop allowing the Cartel to abuse our privacy. | Boycott Cartel companies. |

| Resist. | Demand justice. | Demand real transparency and accountability. |

| Impeach corrupt judges. Failing that, shame them into disgraced resignation (like Randall R. Rader - the chief judge in the Leader v. Facebook appeal) or following the law. See How judges grow rich on the backs of American inventors. | Remove the people who are abusing the powers delegated to them. | Be vigilant. |

| Be courageous. | Be bold. | Don't take "no" for an answer. |

| Expose the Cartel's legal, accounting and banking providers. | Support the victims of this abuse of power. | Please add to this list in the comments section below ... |

* * *

Notices: This post may contain opinion. As with all opinion, it should not be relied upon without independent verification. Think for yourself. Photos used are for educational purposes only and were obtained from public sources. No claims whatsoever are made to any photo.

Comment

Click "N comments:" on the line just below this instruction to comment on this post. Alternatively, send an email with your comment to amer4innov@gmail.com and we'll post it for you. We welcome and encourage anonymous comments, especially from whisteblowers.

e.g. "IBM Eclipse Foundation" or "racketeering"

e.g. "IBM Eclipse Foundation" or "racketeering"