Mark Loughridge, IBM CFO, arranged $10 billion JPMorgan slush fund, Goldman Sachs Ponzi-like financing for Chinese while cronies financed Facebook for NSA snooping without Congressional oversight

Note to new readers (May 22): We include this news flash about Judge Sue L. Robinson in this coverage of the Leader v. Facebook judicial corruption and NSA spying scandals because JPMorgan is Facebook's and IBM's underwriter funding much of this corruption. JPMorgan also benefits from the technology stolen by IBM, Facebook and Eclipse. Bottom line: They say their technology is Open Source, but that is a Big Lie. They stand tall on the backs of real inventors in America and Europe.

Fig. 1– Judge Sue Lewis Robinson. Presided one+ year over JPMorgan case before admitting conflicts of interest with JPMorgan.

Judge Sue L. Robinson in

Arunachalam v. JPMorgan (see

previous post) recused herself from the case on May 15, 2014 following Dr. Arunachalam's motion to disqualify for conflicts of interest. This is great news for justice, it will likely unwind all judgments in the case for judge bias, and force a rehearing of the whole case. Shockingly, Robinson sent the case back to Judge Richard J. Andrews, whose now

admitted relationships to and

admitted holdings in JPMorgan are legion. The Delaware District Court appears to be imploding from self-inflicted wounds. The crooked

Leader v. Facebook Judge Leonard P. Stark is now the chief judge in this district. Stark holds substantial Facebook and JPMorgan stock.

JPMorgan is one of Facebook's and IBM's lead underwriters.

Today, on May 18, 2015, Dr. Arunachalam filed a

Motion to Void the Judgments Ab Initio (from the beginning). She lays bare the "corruption and maliciousness" of the judges and their JPMorgan handlers. The Delaware Court is knee deep in a

quick sand of corruption created by their collusion with JPMorgan, IBM and the Facebook Cartel.

May 20, 2015 Update: The two faces of Judge Susan L. Robinson: On Sep. 13, 2013, Judge Robinson told the Senate Judiciary Committee that "

whether you're dealing with chemical patents or software patents, clearly the mechanics of a patent case are complex and burdensome..." Yet on

Apr. 08, 2014, just seven months later, Judge Robinson replaced the presiding Judge Richard G. Andrews in

Pi-Net (Arunachalam) v. JPMorgan, cv-282-RGA-SLR. Just a week later on Apr. 15, 2014, Robinson held the all-important Markman Hearing. In that hearing, she failed to disqualify a fraudulent JPMorgan technical expert, then ruled against Dr. Arunachalam's "complex" patent on May 14, 2014, a month later. Essentially, the American taxpayer is paying these judges to play patty cakes with monopolistic, deep-pocket litigants like IBM and JPMorgan who dump piles of procedural "motion practice" on these courts, then these judges whine about being overworked when they get caught colluding.

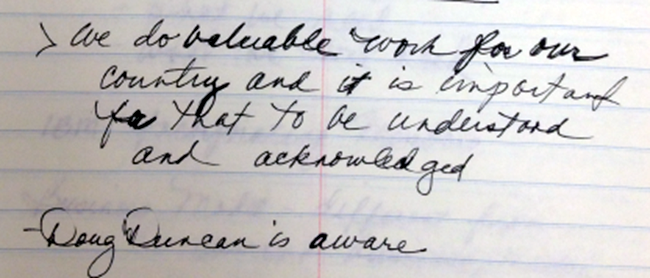

Fig.2—Mark Loughridge, IBM's Chief Financial Officer, recently retired, now a director at The Vanguard Group, was the longest running CFO in IBM history. He also presided over the greatest sellout of American sovereignty in history.

Photo: The VAR Guy;

Signature: IBM annual report.

ORIGINAL POST

(May 14, 2015)—The world went to hell in 2004, or so it seems. If America allows the Benedict Arnolds at IBM, Eclipse Foundation (IBM incognito), JPMorgan, NSA, Goldman Sachs and Facebook, identified below, to succeed, then we believe China will control the future of the Internet, tech and finance. It is not too late to stop them, but time is running out.

On Dec. 8, 2004, IBM’s chief financial officer, Mark Loughridge, shocked the IBM world with his holiday-time announcement of the sale of IBM’s storied PC Group to the Chinese company, Lenovo.

IBM’s breach of fiduciary duty ushered in a sellout of America

The devil was in the details that Loughridge failed to disclose. It appears that IBM’s directors and officers breached their fiduciary duties by not warning shareholders and the public about the hidden agendas large enough to drive a Mack truck through.

IBM failed to disclose that:

- Stolen technology: IBM stole Columbus, Ohio innovator Leader Technologies’ social networking invention via The Eclipse Foundation that started on Nov. 29, 2001.

- Counsel conflicts: IBM relied on the advice of intellectual property law adviser, Professor James P. Chandler, who was also Leader’s patent counsel. Chandler was also the author of the Economic Espionage Act of 1996, the Federal Trade Secrets Act, member of President Clinton's National Infrastructure Assurance Council and adviser to the Justice Department, FBI, NSA, CIA, White House and Congress.

Uncommonly unified competitors

This uncommonly unified Benedict Arnold activity could not have happened without Columbus, Ohio innovator Leader Technologies’ important social networking invention—which they

all wanted

for free from IBM’s Eclipse Foundation. In unison, the members of Eclipse turned a blind eye to questions of authorship of the invention to which they would receive enormous benefit. They chose instead to swallow

hook, line and sinker.

Bottom line: IBM's Eclipse Foundation sold out America and American inventors in just 12 months.

The national security smoke screen

“

National security!” has become the excuse for this mobster thievery and obfuscation of discovery and FOIA requests. Zuckerberg's 28 Harvard hard drives have been protected by numerous federal judges on this cartel's payroll.

America's Founders feared the two-party system and the interference of banks and corporations. So did Abraham Lincoln (1863):

"The banking powers are more despotic than a monarchy, more insolent than autocracy, more selfish than bureaucracy."

We must now add

supranational law firms to this list of despotic corporations.

- Bogus open source claims: Via The Eclipse Foundation, IBM promoted the lie that Leader Technologies’ invention was Open Source and free for anyone to use. It was not. It was privately owned, proprietary software. Yet IBM induced most tech companies to participate in the theft.

- Conspiracy and racketeering: Secret plans were executed to privately control intelligence, judiciary and securities regulation. Key players were IBM’s chief counsel, David J. Kappos with Chandler, Eric H. Holder, Jr., NSA, Barack H. Obama, Eurotech, The White Oak Group, JPMorgan, Goldman Sachs, Larry H. Summers, Sheryl K. Sandberg, Juri Milner, Morgan Stanley, T. Rowe Price, James W. Breyer, National Venture Capital Association, Fidelity, Vanguard, Latham & Watkins, Fenwick & West, Orrick Herrington, Cooley Godward, Weil Gotshal, Federal Circuit and Gibson Dunn.

- Other stolen contracts & technology: IBM willfully induced the misappropriation of multiple other intellectual properties and contractual claims important to social platforms (e.g., Dr. Lakshmi Arunachalam, Johannes Van der Meer, Paul Ceglia).

- Misappropriation of funds: JPMorgan’s $10 billion line of credit was used to promote The Eclipse Foundation scam. JPMorgan is also a Facebook underwriter.

- Ponzi-like scheming with Lenovo’s banker: Goldman Sachs, another Facebook underwriter, arranged Lenovo’s debt financing of the IBM PC Group—no arm's length relationships.

- NSA backdoors breach reps and warranties: IBM provided intelligence snooping backdoors for the NSA and CIA, irrespective of laws broken.

- Embedded systems snooping: IBM’s embedded systems strategy was aimed at building permanent NSA backdoors through companies like Eurotech SpA and Ltd., even though U.S. laws prohibit such intrusion.

- Contempt of Congress: IBM, JPMorgan and Goldman Sachs participated in a plan to privately fund American intelligence without Congressional oversight.

- Anti-trust Conspiracy: IBM used its monopolistic market position to steal innovations from Leader Technologies, Inc., a small Ohio business, and others.

- Judicial collusion: IBM, via its inside and outside counsel, induced members of the federal judiciary to violate their ethical Code of Conduct by holding stocks in IBM and cronies without proper conflict of interests disclosure, and by manipulating the impartiality of courts.

- Privately-funded intelligence agencies: IBM’s secret collusion with Tsinghua University, Beijing, China, James W. Breyer, Accel Partners LLP, In-Q-Tel (C.I.A.'s "private" venture capital company), Facebook and the NSA to construct privately-funded, offshore “dark profiles” on American citizens—out of reach of oversight by Congress.

Bookmark: #ibm-sellout-timeline

2004 Timeline of IBM Mark Loughridge’s sellout of America |

| Month |

Day |

Action |

| Jan |

All month |

Former PayPal executives, Harvard president and unscrupulous law firms coached the 19-year Mark Zuckerberg as the Manchurian candidate for Facebook.*

*Lawrence H. Summers, James W. Breyer, John P. Breyer, IDG Capital Partners (China)/Accel Partners LLP, Reid Hoffman, Matt Cohler, Ping Li, Jim Swartz, Latham & Watkins LLP, James P. Chandler, Fenwick & West LLP. |

| Zuckerberg implausibly claimed “one to two weeks” to build Facebook singlehandedly; was ambiguous about his idea, but crystal clear about doing it himself |

| Unprecedented Harvard Crimson coverage arranged for a 19-year old Zuckerberg between Aug. ’03 and Jun. ’04 |

| Feb |

2-5 |

EclipseCON (inaugural meeting of Eclipse Foundation); Who’s Who tech cast of characters; eagerly awaited Version 3.0 of Leader Technologies’ invention of social networking stolen by Eclipse and IBM’s lawyers |

| 4 |

Facebook launched; began NSA feed on Jun. 6, 2009 |

| Mar |

3 |

Eclipse Foundation board appointed: IBM, Genuitec, Univ. of Washington, Ericcson, HP, Intel, MontaVista, QNX, SAP AG, Serena |

| May |

13 |

James W. Breyer, Accel Partners, became chairman of National Venture Capital Association (NVCA) along with directors Gilman Louie (In-Q-Tel a.k.a. CIA), Robert Ketterson (Fidelity); Breyer now "super bullish on China" |

| 27 |

JPMorgan issued $10 billion line of credit to IBM; Goldman Sachs provided the debt financing to Lenovo; (JPMorgan and Goldman are both Facebook underwriters; they were on both sides of the IBM-Lenovo deal) |

| Jun |

6 |

Leader Technologies’ patent first published by Patent Office |

| 29 |

James P. Chandler’s CRYPTO/Markland Technologies acquired by E-OIR (The White Oak Group); homeland security applications; no conflicts of interest disclosed to client Leader Technologies; E-OIR rated Top 100 defense contractors by 5/16/2006 |

| Jul |

27 |

Barack Obama introduced as Manchurian candidate to Democratic national convention; unseated Hillary Clinton; supported and funded presidential candidacy on Facebook using the software stolen from Leader |

| Aug |

|

Peter Thiel invested $500K in Facebook |

| 18 |

Google went public (an Eclipse member) using Facebook’s underwriters JPMorgan and Goldman Sachs, among others; began NSA feed on Jan. 14, 2009 |

| 30 |

IBM proposed embedded systems Eclipse project (end result will be spying toasters and TVs) |

| Oct |

27 |

Tsinghua University (Beijing, China) joined Eclipse |

| Dec |

8 |

IBM PC Group, Mark Loughridge, CFO, sold to Lenovo (China) financed by Goldman Sachs’ Bob Yang, now executive to international money launderer, HSBC; IBM sold 750 patents to Facebook on Mar. 22, 2012; IBM just sold its server division to Lenovo on Oct. 1, 2014,

underwritten by Facebook underwriters Goldman Sachs and Credit Suisse. |

| Eclipse Foundation claims to have "not unexpectedly" lost original “single company” platform contributor; “re-implements” foundational code (stolen from Leader Technologies, Inc., Columbus, Ohio by Eclipse principals' lawyers); certainly a dubious intellectual property foundation upon which to build America's and the world's digital future |

Table 1: IBM's sellout of America to the Chinese—2004.

Backstory

Now that we have summarized the 2004 smoking gun, we will back up and provide evidence sufficient to convince any reasonable person that America was sold out by people we trusted.

In the late 1990’s, Columbus, Ohio software innovator Leader Technologies, Inc. was referred to James P. Chandler,III, George Washington Law professor emeritus.

Chandler had a private intellectual property law practice in Washington, D.C. His clients were a Who’s Who, including the White House, IBM, NSA, FBI, CIA, Congress, the Judiciary and the U.S. Department of Justice. Chandler had authored the Economic Espionage Act of 1996 and the Federal Trade Secrets Act.

Chandler advised David J. Kappos, then IBM’s chief intellectual property counsel, Mark Loughridge, IBM’s chief financial officer, and Eric H. Holder, Jr., then Assistant Attorney General.

No conflicts disclosed

According to Leader, Chandler agreed to represent Leader and did not disclose any conflicts of interest. Disclosure of conflicts of interest is an integral part of the Rules of Professional Conduct for lawyers and Code of Conduct for judges and judicial employees: “a lawyer should further the public's understanding of and confidence in the rule of law and the justice system because legal institutions in a constitutional democracy depend on popular participation and support to maintain their authority” and “a judge should avoid impropriety and the appearance of impropriety in all activities.”

Confirmed by Leader prior to publication, not a single person identified in this article has ever disclosed even a single conflict identified here. The silence is deafening.

IBM-biased legal advice

Hindsight is 20-20. After studying Leader’s Internet software invention in 2000, Chandler gave Leader a piece of horrible legal advice. This patent law professor advised that Leader should take another two years and “reduce the invention to practice” before he would file the patents. He also told Leader they had “at least 60 patentable inventions.”

(It turns out that Chandler's patent estimate was a low-ball. Fenwick & West LLP, another Leader attorney recommended by Chandler, has now filed hundreds of social networking patents for Facebook without seeking a waiver of conflicts from Leader either. This doesn't count the thousands of patents that IBM has filed off the same Leader invention.)

Hindsight shows that Chandler fed Leader’s ground-breaking software invention to IBM and IBM’s cronies. These Chandler cronies supported Chandler’s vision for national security and a stealth way to quietly reward judges with insider financial tips in exchange for crooked decisions. However, Chandler’s vision required the theft of Leader’s intellectual property to accomplish these intertwined goals.

By mid-2002, Chandler had extracted over $500,000 in legal fees from Leader. As mentioned above, he also encouraged Leader to hire Silicon Valley law firm, Fenwick & West LLP. The two firms then waited for Leader to do the hard work to engineer its invention.

That opportunity came on Jun. 6, 2002.

When unscrupulous attorneys want their hands in your knickers, they disguise their schemes with high-sounding legal sophistry

Chandler wrote himself into the source code custody clause of a “Smart Camera” research contract with Lawrence Livermore National Laboratory (LLNL) that he brought to Leader. Leader thought the opportunity was a big break, but it was a Chandler double-cross. As a part of that contract, Chandler received a copy of Leader’s full source code. Fenwick received a copy as well. Fenwick’s clients included Facebook’s first venture capitalists, James W. Breyer and Accel Partners LLP.

Leader “University Initiative” planned in early 2001

Leader’s inventor, Michael McKibben, had a son attending Harvard as an undergraduate. In early 2001, McKibben developed a “University Initiative” to involve IBM and Harvard—both Chandler relationships—in implementing Leader’s social networking invention.

IBM launched Eclipse in late 2001

Unknown to Leader, on Nov. 29, 2001, IBM “donated” $40 million (from CFO Mark Loughridge) to start The Eclipse Foundation to offer “open source” software (free of licenses, fees and royalties). See also IBM Annual Report, p. 21.

Chandler’s IBM cronies, David J. Kappos and Mark Loughridge, provided the perfect cover for Chandler to feed Leader’s invention to IBM out his back door without detection. Tellingly, Eclipse board minutes in Dec. 4, 2002 stated that the original source code platform for Eclipse came from “a single company” (never identified by name). But then by Dec. 8, 2004, just two years later, these lawyers stated disingenuously that they were “not unexpectedly” “unable to locate” the original contributor. All signs point to Leader Technologies as the contributor, via its ne'er-do-well attorneys Chandler and Fenwick.

Feb. 4, 2004 —Leader’s University Initiative renamed “Facebook”

Like a phoenix, Facebook came out of nowhere and launched on Feb. 4, 2004 at Harvard with a plan that mimicked Leader’ University Initiative written 18 months earlier. Hindsight shows that Harvard alums, James W. Breyer, and Accel Partners LLP funded the launch, supported by Harvard’s president, Larry Summers.

Mark Zuckerberg claims to have done it all by himself as a sophomore in “one to two weeks” while drinking, chasing girls and studying for mid-terms. No self-respecting engineer would claim such a Herculean fete. But a pathological liar supported by Hollywood “narratives” did.

Numerous Facebook projects were in play at Harvard in 2003. Paul Ceglia, the Winklevoss Twins (ConnectU), Aaron Greenspan (HOUSEsystem) and even Harvard's computer group was planning one. Zuckerberg was evidently tasked with stalling all of them until Leader's invention (via IBM / Eclipse) was ready and Facebook could launch. Zuckerberg was never more than a face on the Facebook cereal box. The public and media bought well-acted The Social Network film fiction uncritically.

Tellingly, Facebook’s phalanx of lawyers, with complicit judges (see IBM's Benedict Arnold Minions below), have stonewalled all legal efforts to study Zuckerberg's 28 computers and email from his Harvard days in 2003-2004.

Unscrupulous double down

It is illogical to expect these people to see the error of their ways voluntary, repent, and change their wicked ways. They are going to have to be confronted and battled. We hope our untainted elected representatives use the powers delegated to them by the People to stop this criminality before these bullies do much more damage to our Republic.

Fenwick & West LLP, after representing Leader Technologies during the critical research and development phase, including learning the "secret sauce," has gone on to become Facebook’s securities and patent attorney without seeking conflicts of interest waivers from Leader Technologies. Fenwick also took Obamacare architect Todd Y. Park's company, Castlight Health, Inc. public, while Park was the White House chief technology officer without a single word from Obama about this impropriety.

JPMorgan and Goldman Sachs have gone on to underwrite Facebook’s initial public offering and fund many other infringers of Leader Technologies' patents—earning them billions of dollars in fees and stock.

James W. Breyer and Accel Partners LLP became Facebook’s second largest shareholder. Breyer declared in 2012 that his is “super bullish on China.” No wonderHe is ceding America’s sovereignty to China where intellectual property is not respected and likeminded oligarchs rule.

James P. Chandler visited Russia and China to cement the theft of his client Leader Technologies’ invention and his private national security NSA agenda.

David J. Kappos was appointed Patent Office director and ordered Leader Technologies’ patent invalidated as one of his final acts; appointing IBM cronies, like chief administrative judge Stephen C. Siu, inside the Patent Office to do his dirty work.

Eric H. Holder, Jr. was appointed Attorney General and has turned a blind eye to all federal judges’ conflicts of interest in Leader v. Facebook, right up to Chief Justice John G. Roberts, Jr. who holds substantial stock in JPMorgan and Facebook cartel interests. Holder himself is loaded up with Fidelity and T. Rowe Price holdings.

Vanguard, T. Rowe Price and Fidelity became large Facebook investors.

Yada, yada, yada.

Collusion among IBM & Harvard principals

Following the adage “follow the money,” all roads lead to IBM’s chief financial officer, Mark Loughridge. He paid Chandler’s consulting fees, donated $40 million to start Eclipse, and led to the Chinese Lenovo sale, which he explained to nervous IBMers.

Mark Loughbridge failed to disclose is numerous hidden-agenda associations to IBM shareholders:

- IBM chief financial officer

- David J. Kappos, IBM colleague

- Eclipse Consortium funder

- James P. Chandler client

- JPMorgan client

- Fenwick & West LLP client

- James W. Breyer, Accel Partners LLP colleague

- Robert C. Ketterson, Fidelity Investments colleague

- Chinese Lenovo deal selling out the IBM PC Group

- Vanguard Group director (major Facebook shareholder)

- William R. Brody, IBM director, T. Rowe Price director (5.2% Facebook shareholder, 6.9% Baidu (China) shareholder)

As a fiduciary in IBM and Vanguard, Loughbridge has an affirmative duty to disclose conflicts of interest that can taint his judgment and impartiality. This is a firm requirement of the Business Judgment Rule.

Mark Loughridge’s fiduciary duty sins

To what extent are IBM's earnings since 2004 fraudulent as a result of Mark Loughridge's nondisclosure? IBM's use of its monopoly to oppress small American inventors is exactly the sorts of despotic powers America's founders decried as deadly to the Republic.

When in doubt, the corrupt double down

David J. Kappos left the Patent Office, after assigning IBM crony judges to invalidate Leader Technologies’ patent, and then went to work for Cravath Swaine LLP. On Jan. 23, 2014, Kappos’ Cravath Swaine facilitated the sale of IBM’s server unit to Lenovo.

IBM's Benedict Arnolds

Leader v. Facebook patent & related officials with Fidelity, Vanguard and Other Facebook “Dark Pool” Holdings / Conflicts of Interest |

| Gov't Official |

Agency |

Title |

Fidelity |

Vanguard |

T. Rowe Price / Other |

| Holder, Jr., Eric H. |

Justice Department |

Attorney General |

9 (incl. Contrafund) |

|

5 |

| Kappos, David J. |

Patent Office |

Director |

|

13 |

Former IBM employee; current Cravath Swaine LLP partner that handled latest IBM sale of server unit to Lenovo |

| Blank, Rebecca M. |

Commerce |

Secretary |

10 |

9 |

TIAA CREF, 20 |

| Grove, Robert M. |

Commerce |

Director |

19 |

|

TIAA CREF, 6;

Goldman Sachs, 1;

Morgan Stanley, 1;

JPMorgan, 1 |

| Kerry, Cameron F. |

Commerce |

General Counsel |

16 |

7 |

|

| Shapiro, Mary L. |

Securities & Exchange |

Chair |

|

|

|

| Roberts, John G., Jr. |

Supreme Court |

Chief Justice |

10 (incl. Contrafund) |

2 |

|

| Lourie, Alan D. |

Federal Circuit |

Chief Judge |

|

16 |

|

| Moore, Kimberly A. |

Federal Circuit |

Circuit Judge |

8 (incl. Contrafund) |

3 |

|

| Wallach, Evan J. |

Federal Circuit |

Circuit Judge |

6 (incl. Contrafund) |

|

|

| Stark, Leonard P. |

Dist. Court, Del. |

2nd Trial Judge |

7 |

1 |

|

| Summers, Lawrence H. |

White House |

Director |

|

4 |

Bank of America, 34;

TIAA-CREF, 17;

Fees: JPMorgan; Goldman Sachs

|

| Farnan, Joseph J. |

District Court, Del. |

1st Trial Judge |

0 |

0 |

|

| Petravick, Meredith |

PTAB Patent Judge |

3rd Reexam |

X |

X |

Failed to disclose holdings in multiple FOIA requests |

| Stoffel, William J. |

PTAB Counsel |

3rd Reexam |

X |

X |

Failed to disclose holdings in multiple FOIA requests |

| Siu, Stephen C. |

PTAB Patent Judge |

3rd Reexam |

Former IBM, Mircosoft employee; failed to disclose financial holdings in multiple FOIA requests; his Leader v. Facebook patent reexamination court staff have issued 189 patents to IBM |

| Todd Y. Park |

White House, HHS |

CTO |

The Obama Administation has stonewalled all FOIA requests to review Park's financial disclosures. Park is Obama's chief architect of Obamacare. Park's company, Castlight Health, Inc. went public on Mar. 14, 2014 led by Facebook's attorneys, Fenwick & West LLP and Cooley Godward LLP, with Facebook's underwriters Goldman Sachs and Morgan Stanley. It is unprecedented to allow a sitting White House officer take a private company public without his recusal from his public job. The ties to this IBM cartel are evident, begging serious questions about the true intentions of Obamacare. See Chinese Involvement in Obamacare hidden by missing SEC certifications. |

Table 2: X = conflicting associations with Facebook interests.

The only honest broker in this list appears to be

Judge Joseph J. Farnan. He oversaw

Leader v. Facebook up to one month before trial, after which he “retired” to make way for Obama nominee Leonard P. Stark. Judge Stark was formally appointed to his judgeship by President Obama just a week after the trial—evident reward for giving the administration the verdict they wanted. On Jan. 20, 2010, Judge Farnan had conducted the pivotal

Markman Hearing which was a disaster for Facebook. Just a week later, on Jan. 26, 2010, Judge Farnan suddenly announced his “retirement” having previously told the litigants he was looking forward to the trial. He still practices law in Delaware.

Judge Joseph J. Farnan appears to have been the only honest broker in this cast of characters. Tellingly, he was pressed into retirement just a month before trial. Actually, Judge Farnan did not retire. He went into private practice and continues to practice law in Delaware. Strange conduct from someone who said he was looking forward to the

Leader v. Facebook trial just months earlier. It appears that the Facebook cartel did not like Judge Farnan’s

Markman opinion.

[Editorial Note: These investing geniuses should run the Federal Reserve since their returns beat the market so dramatically. All of them have become multi-millionaires in a few short years. Simply astounding!]

The financial holdings by judges and others involved in this criminal cartel involved in the Leader v. Facebook matter are evident. When in doubt about how to behave, the corrupt double down. This cartel must be broken up and imprisoned. The health and future of the American Republic may hinge on it.

* * *

Notice: This post may contain opinion. As with all opinion, it should not be relied upon without independent verification. Think for yourself.

Comment

Click "N comments:" on the line just below this instruction to comment on this post. Alternatively, send an email with your comment to amer4innov@gmail.com and we'll post it for you. We welcome and encourage anonymous comments, especially from whisteblowers.

e.g. "IBM Eclipse Foundation" or "racketeering"

e.g. "IBM Eclipse Foundation" or "racketeering"