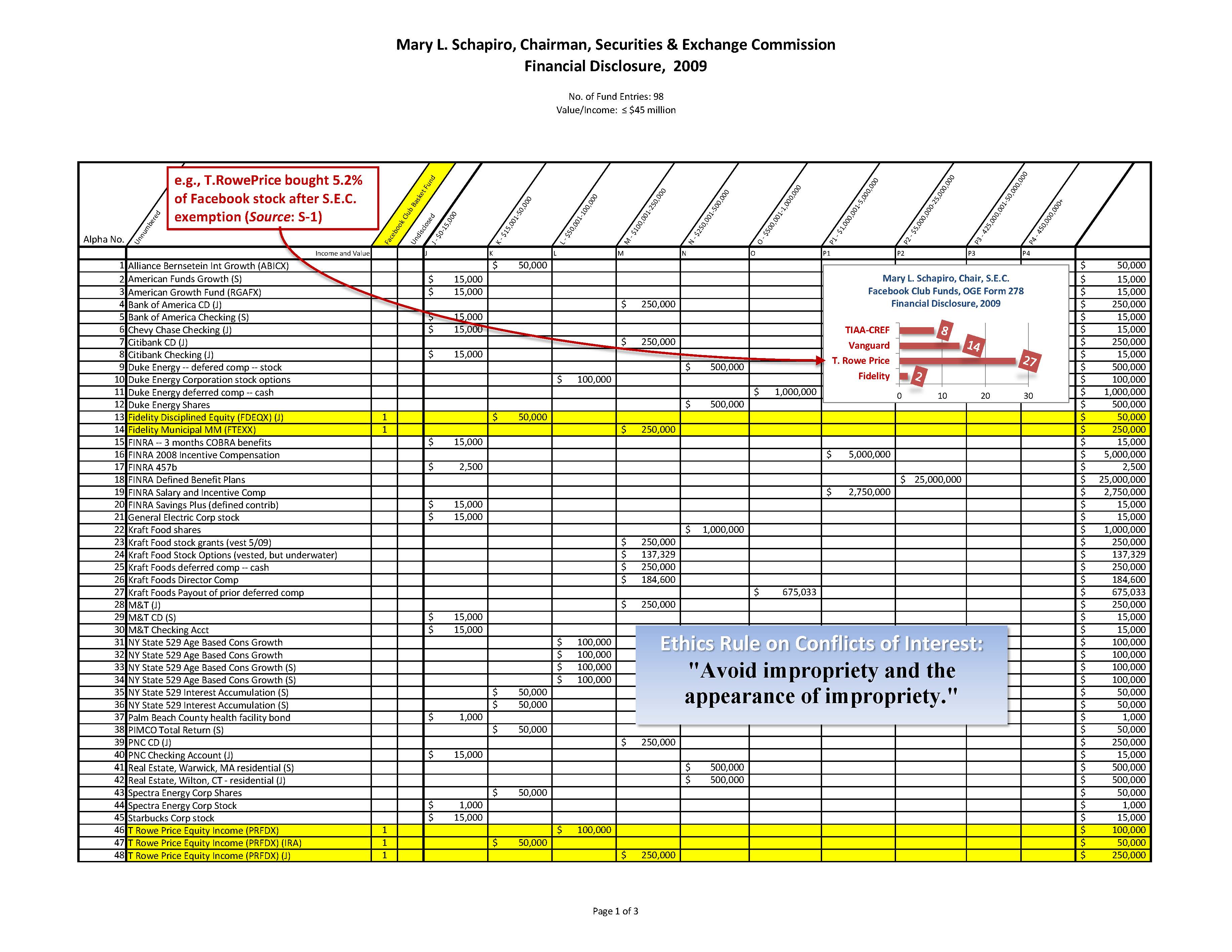

Schapiro sanctioned the 500-shareholder exemption so her 51 Facebook fund boats would all float in the IPO

Facebook IPO ''Dark Pools'' Uncovered

Facebook IPO ''Dark Pools'' UncoveredUpdate, Dec. 28, 2013—"Dark pools" discovered as the source of Washington's insider trading. Ever wondered how federal judges, politicians and senior bureaucrats get rich while they are in public service? This is the dirty little secret of Wall Street and S.E.C. insiders like Mary L. Schapiro.

Heads Up: The more regulators and Wall Street talk about "transparency," the more they appear to be ripping off the public behind closed doors.

Click here for a full list of Obama political appointees and Leader v. Facebook federal judges and their Facebook Basket Fund financial hodlings in 2008-2012.

Busy feathering her own nest

(Dec. 20, 2013)—New evidence shows that during the SEC’s so-called pre-IPO oversight of Facebook, Mary L. Schapiro, Chair of the SEC and her staff, were colluding with Facebook-friendly third party funds. They were using insider knowledge to position their personal holdings for big IPO paydays. Sadly, they collaborated in the theft of Facebook core technology from Ohio innovator Leader Technologies' investors to do it.

U.S. Law Optional

Readers should keep in mind that Schapiro is the same FINRA and SEC regulator who was never held accountable for missing Bernie Madoff’s $65 billion Ponzi scheme. She even admitted ethical shortcomings to Congress on Mar. 10, 2011 (New York Times) (PDF) promising to turn over a new leaf. However, conduct in the Facebook IPO disclosure is just more of the same nonsense, with sophistry like saying she must go "beyond what may be required in any given situation." She continued: “We will learn from this experience and will take all actions necessary to earn the trust that the public places in us.” Double take: She impled that following ethics laws was conditional, but that she was working to earn our trust nonetheless. Why didn't Congress impeach her on the spot? By this time, the Facebook Club boats were in full sail.

See Full Schapiro Senate Testimony, Mar. 10, 2011; see also Full Schapiro House Testimony, Sep. 22, 2011 following revelations that S.E.C. Chief Counsel David M. Becker had told Schapiro about Bernie Madoff's Ponzi scheme in 2009. Were Schapiro and Madoff Facebook "Friends" too?

Schapiro: Do as I say, not as I do – re. "Dark Pools"

• "Investor trust is the lifeblood of our financial markets." Mary L. Schapiro, CEO, FINRA, Dec. 18, 2008.

• "Good morning. Today we are tackling another item on our agenda to protect investors and bring greater transparency to our markets... Transparency is a cornerstone of the U.S. securities market... transparency plays a vital role in promoting public confidence in the honesty and integrity of financial markets" [speaking on "dark pool regulation;" pools in which she participated personally via Goldman Sachs and Morgan Stanley re. Facebook pre-IPO stock]." Mary L. Schapiro, Chairman, SEC, Oct. 21, 2009.

• Recusal is required when a regulator participates in recommendations from which he or she could benefit personally. Mary L. Schapiro did not recuse herself from Goldman Sachs' and Morgan Stanley's Facebook dark pool activities, yet she benefited personally. This renders the entire Facebook IPO a scam of the highest order. Schapiro told Congress on Sep. 22, 2011 (p. 31) that she agreed with this principle and regretted her failure to act. She admitted it was a mistake not to require the recusal of her Chief Counsel David M. Becker from policy making after the Madoff Scandal. Becker's late mother's estate (and therefore Becker) was a beneficiary in the Madoff settlement over which Becker was making policy.

• "We have proposed rules that would strengthen our regulation of dark pools of liquidity." Mary L. Schapiro, Chairman, SEC, Jan. 20, 2010.

• "the American people... need to believe and understand that there is a watchdog who is watching out for their interests." Mary L. Schapiro, Senate Hearing, p. 13, para. 1, Mar. 10, 2011.

• "Ms. Schapiro: Congressman, if I could just add, I think one of the important things we can do, and it goes back to the comment about setting the [ethics] tone at the top, is really heightening our employees' — all of our employees' — awareness to the impropriety or the appearance issues generally . . . I feel confident that we have in place the processes and the procedures that will help us prevent something like this [ignoring S.E.C. staff conflicts of interest] from happening again." House Hearing, pp. 17, 31, para. 3, Sep. 22, 2011.

Fig. 3—James "Jamie" Brigagliano resigned from the S.E.C three days before Mary L. Schapiro's Sep. 22, 2011 House testimony. He had been with the S.E.C. for 25 years. He was one of the lead rule makers for "dark pools." What did he know and when? Photo: Sidley Austin.

• Here is what one FINRA industry watchdog said about Schapiro's self-described "vigorous rulemaking agenda" (p. 7, para. 2) at the time of her Sep. 22, 2011 House testimony. Her chief lieutenant, James "Jamie" Brigagliano, had just resigned three days before her testimony, after 25 years at the SEC: "Is it a sad testimony that such a large cottage industry has been created, in which complex rules are crafted, which may or [may] not help the market and its structure, which then require navigating by the very insiders that helped craft those rules?" Themis Trading, para. 2, Sep. 20, 2011.

• Sidley Austin LLP appears to be the SEC public comment "straight man" for the Facebook Club—when they need to make their manipulation of the SEC appear transparent. For example, they sponsored "SEC Speaks" on Feb. 5, 2010 in Washington D.C. where many of the Facebook Club actors were present, including opening remarks by Mary L. Schapiro, and also including James A. Brigagliano (who later went to work for Sidley), David S. Shillman, and Thomas J. Kim (who just went to work for Sidley in August). On Oct. 14, 2008, Kim, as Chief Counsel, had approved the unprecedented Facebook's 500-shareholder exemption.

Fig. 4—David S. Shillman, Associate Director of the Division of Trading & Markets, Securities and Exchange Commission (SEC), provided policy recommendations to Mary L. Schapiro regarding regulation of "dark pools," working side by side with James A. Brigagliano and Thomas J. Kim of Facebook 500-shareholder exemption fame. Photo: WatersTechnology.

In this Sidley meeting, Kim was pressing the Facebook Club agenda by proposing that underwriters could pre-sell offerings before they were registered, which is exactly what Goldman Sachs, JPMorgan and Morgan Stanley did in the three-year run-up to the Facebook IPO. This proposal violates every common sense rule in the book regarding full disclosure. The fact that he even proposed it should have gotten him fired. (Reminder: like Barack Obama, Thomas J. Kim was an editor of the Harvard Law Review just after Obama.)

(On Aug. 8, 2013, Thomas J. Kim left the S.E.C. and joined Brigagliano at ... Sidley Austin LLP. [The duplicity of these actors is becoming predictable.] In 2008, Kim failed to disclose that he was formerly employed by Latham & Watkins LLP, attorney to James W. Breyer, Accel Partners LLP, Facebook's financier and second largest shareholder. Such a conflict dictated recusal. Instead, he issued the unprecedented exemption to Facebook that opened the pre-IPO "dark pool" trading by Goldman Sachs, Morgan Stanley and JPMorgan. This trading included $2-4 billion (or more, no one knows the full extent of the "dark pool" since disclosure was selective) in dubious Russian oligarch investing that pumped the Facebook valuation artificially. According to investors interviewed by AFI who received the Goldman dark pool prospectus, there was no mention of the Leader v. Facebook patent infringement case that was then pending at the Federal Circuit. Subsequently, it was learned that all three judges had holdings in the Facebook dark pool, sometimes called the Facebook Club Basket of Funds.)

• S.E.C. Public Comment Charade: On Mar. 4, 2010, a month later, the SEC's James A. Brigagliano and David S. Shillman, continued their "public comment" charade by hosting Morgan Stanley executives, who proposed enough "dark pool" gobbledygook to make a process engineer cough a hairball, and to certainly throw off even the most seasoned corruption watcher. Morgan's proposal was a total mess, but was largely adopted as policy. The evident strategy was to conceal the Facebook IPO agenda of their task masters at Goldman Sachs, JPMorgan, Morgan Stanley, Fenwick & West LLP, Accel Partners LLP, and Sidley Austin LLP.

[A common denominator here is that ALL of these individuals are attorneys with no moral backbone. The more they talk about "concern for the trust of the American investor," the deeper they are in the Facebook "dark pool."]

Too corrupt to fail?

Also keep in mind as you read Schapiro's testimony that she is personally holding shares, at that moment, in 51 Facebook basket fund boats that will all be floated by the coming Facebook IPO. She cries wolf in her attempts to be given more funds to catch more bad guys. But the bad guys are really her and her staff, most notably Chief Counsel Thomas J. Kim, who signed the Oct. 14, 2008 Facebook exemption.)

Schapiro's comments to Congress may have been Freudian, since she and her Facebook Club collaborators were, indeed, "looking around the next corner, looking beyond the horizon, and thinking above and beyond what may be appropriate advice from ethics counsel." [Wow. The smoke from this gun is noxious.]

Schapiro's ethical lapses are lucrative. When she left FINRA to head the SEC, having conpletely missed the $64 billion Madoff Ponzi scheme, she was paid a $9 million bonus nonetheless, although the number could have been as high as $25 million, according to her 2009 financial disclosure. Such industry duplicity is mindboggling.

The duplicity of Mary L. Schapiro

In what appears now to be a carefully timed scheme, Schapiro was appointed to her post by President Obama on Jan. 20, 2009. Just three months earlier, on Oct. 14, 2008, SEC Chief Counsel Thomas J. Kim, a former editor of the Harvard Law Review, same as Barack Obama, had issued to Facebook an unprecedented exemption from the sacrosanct 500-shareholder rule. See previous post. On May 26, 2009, Goldman Sachs' Russian oligarch partner, Yuri Milner, spearheaded the first $200 million of what would become billions of dollars of private investing in pre-IPO Facebook stock.

This unprecedented pre-IPO activity pumped the valuation. Mary L. Schaprio only closed her eyes, covered her mouth and plugged her ears. Even the normally Facebook-friendly Techcrunch took note that Milner's association with the Russian Bank Menatep was conspicuously missing from his bio. The bank was caught diverting $4.8 billion in IMF funds. Strangely, Techcrunch didn't mention another Bank Menatep charge: laundering $10 billion in Russian Mafia funds. Did Schaprio investigate to protect Americans from this evident fraud? Apparently she was too busy "looking around the next corner" ... to her Facebook IPO winnings.

Fenwick & West LLP, who were also the former attorneys for Columbus inventor Leader Technologies—the true inventors of social networking—filed for the exemption on Facebook’s behalf.

Fenwick & West did not disclose this astounding lawyer conflict of interest, in violation of the Rules of Professional Conduct.

Thomas J. Kim failed to disclose that he was formerly employed by Latham & Watkins LLP, attorney to Facebook’s then chairman and second largest shareholder, James W. Breyer.

Thomas J. Kim’s silence violated his signed ethics commitment under the Standards of Ethical Conduct for Employees of the Executive Branch, 5 C.F.R. Part 2635.

Schapiro allowed Goldman Sachs to make an unregulated market in private Facebook stock to James W. Breyer’s friends, incl. T.Rowe PRice, FidelitY, Vanguard & TIAA-CREF

This unprecedented Thomas J. Kim S.E.C. exemption for Facebook was used by Goldman Sachs, JPMorgan and Morgan Stanley to make a private, unregulated market in billions of dollars in Facebook insider stock. Then, when questions were asked about whether or not these transactions violated U.S. securities laws (see May 2, 2012 whistle blower complaint, p. 9), Goldman slammed the door on their U.S. clients (PDF). They brokered the sale of Facebook insider stock to third parties, including their Russian oligarch partner, Alisher Usmanov. At the same time, James W. Breyer’s secret club of funds invested, including Fidelity, T.RowePrice, Vanguard, TIAA-CREF and Blackrock (the “Facebook Club”). Of course, Schapiro in her duplicity, declined to investigate these transactions that make Bernie Madoff look like a school yard prankster.

Mark Zuckerberg’s former speech writer, Katherine Losse, said in her book The Boy Kings that Facebook employees were essentially ordered to sell their shares and ask no questions.

T.Rowe Price bought 5.2% of Facebook’s pre-IPO shares

On Feb. 1, 2012, Facebook S-1 Registration disclosed on page 127 (on the May 16, 2012 Facebook S-1 Amendment No. 8 the disclosure is on page 145):

“T. Rowe Price Associates, Inc., 6,033,630 Class A shares, 5.2% and 12,158,743 Class B shares”The footnote on p. 128 states that the Class A shares are held by 81 T.RowePrice funds, and the Class B shares by 77 T.RowePrice funds.

On Apr. 16, 2011, according to The Wall Street Journal, "T. Rowe declined to comment on how the Facebook shares were purchased (PDF). A Facebook spokesman declined to comment." Zuckerberg's former speech writer, Katherine Losse, said in her book The Boy Kings that Facebook employees were essentially ordered to sell their shares, and ask no questions. Evidently the Facebook 20-somethings had not developed a moral backbone, or had no concept of their ethical duty to blow the whistle on this corruption. Thank you James W. Breyer and Co. for corrupting an otherwise promising generation of young people.

Schapiro ignored whistle blower warnings—she was too busy feathering her OWN nest

AFI has obtained whistle blower reports warning the SEC of the Facebook pre-IPO fraud in its failure to disclose Leader v. Facebook. This fraud is in addition to the fraud complaint in the class action suit over Facebook’s concealment of mobile advertising assessments. See latest ORDER: In Re Facebook Inc., IPO Securities and Derivative Litigation, Case 1:13-cv-04016-RWS (S.D.N.Y.), Dec. 12, 2013.

On Apr. 17, 2012 (SEC Whistle-blower Complaint, Ref. No. TCR1334705074400), Schapiro was warned about the likely collusion and insider trading activity among Facebook principals, lawyers and underwriters, including their failure to disclose in the S-1 the results of the Leader Technologies, Inc. v. Facebook, Inc. split verdict where Facebook was found guilty of literal infringement on 11 of 11 claims of U.S. Patent No. 7,139,761 (the highest form of infringement). This occurred despite the fact that Facebook concealed 28 hard drives of Zuckerberg evidence that they said was lost, which is now known to be a lie.

On May 2, 2012, (SEC Whistle-blower Complaint, Ref. No. TCR1335967891507, p. 104), Schapiro was provided a copy of this complaint previously sent to the Goldman Sachs’ compliance officer by a licensed broker dealer on the lack of disclosure of the intellectual property risks.

On May 3, 2012, (SEC Whistle-blower Complaint, Ref. No. TCR1336081478379), p. 119), Schapiro was provided an overview of the Business Judgment Rules that were likely being broken by the Facebook insiders.

On May 7, 2012, (SEC Whistle-blower Complaint, Ref. No. TCR1336411301942,, p. 133), Schapiro was provided proof of longstanding conflicts of interest among Facebook, a Russian oligarch, Lawrence “Larry” Summers, Goldman Sachs, Morgan Stanley and JPMorgan.

Despite these substantial warnings, neither Schapiro nor her staff responded to any of these complaints.

Now we know why, Schapiro was feathering her own investment nest by promoting the Facebook IPO, and protecting it from all assaults on its illegitimacy.

Schapiro failed to disclose her substantial Facebook Club stock holdings

Schapiro failed to disqualify herself, or divest herself, of her 51 holdings in T.RowePrice, Fidelity, Vanguard and TIAA-CREF funds that she valued at up to $4.4 million in 2008. Twenty-seven (27) of Schapiro’s holdings were in T.RowePrice, a 5.2% pre-IPO owner of Facebook.

Not so coincidentally, the Federal Circuit Chief Judge in Leader v. Facebook, Alan D. Lourie, holds 22 Facebook Club funds. District Court Judge Leonard P. Stark holds 9 Facebook Club funds. Chief Justice John G. Roberts holds 21 Facebook Club funds.

Sound ethical practices are a prerequisite for fixing a broken government

When will American law and business enforce conflict of interest laws? We have no hope of fixing our problems in Washington until we enforce sound ethical principles. One cannot build a solid house on a crumbling foundation.

Let's start with long time SEC Chair, Mary L. Schapiro. Her misconduct opened these floodgates of corruption.

The Facebook handlers have been buying off America's best and brightest for more than a decade in their quest to construct an empire founded on murder (U.S. Border Agent Brian Terry by Fast and Furious weapons), greed and corruption. Clearly, Mary L. Schapiro does not think anyone will hold her accountable. So far, she's right.

Let's change that.

* * *

Comment

Click "N comments:" on the line just below this instruction to comment on this post. Alternatively, send an email with your comment to afi@leader.com and we'll post it for you. We welcome and encourage anonymous comments, especially from whisteblowers.

MARK PATTERSON

ReplyDeleteChief of staff, treasury department

A former lobbyist for Goldman

LEWIS SACHS

Senior Treasury Advisor

Who oversaw Tricadia a company heavily involved in betting against the mortgage securities it was selling

OBAMA

picked Gary Gensler a former Goldman sachs executive who helped ban the regulation of derivatives

OBAMA

picked Mary Schapiro the former CEO of FINRA to run the securities and exchange commission

OBAMA

Chief of staff Rahm Emanuel made $320,000 serving on the board of freddie mac.

OBAMA

picked Timothy Geithner as Treasury secretary Geithner to pay Goldman Sachs 100 cents on the dollar??

OBAMA

chief economic advisor was Larry Summers who tolled the Winklevoss to piss of and help zuckerberg to steal the idea facebook Chris Hughes Larry Summers and Obama new that facebook was stolen Obama had Larry Summers had mark zuckerberg and Chris Hughes who stole Leader's source code stolen from Michael McKibben Cameron and Taylor Winklevoss instead of of telling the truth put your extortion hands out

OBAMA

The 2008 finance crisis was not an accident it was caused by an out of control industry and at the wheel was chief economic advisor Larry Summers and step by step captured the political system. They didn't care about the quality of the mortgage it was pure greed and getting a fee out of it and new it was dangerous, Larry Summers and the banks preferred subprime loans they carried higher interest rates $$$$ borrowers were needlessly placed in expensive subprime loans,(predatory loans) more greed for Larry Summers and the banks$$$$ And the SEC office of risk Management was reduced to a staff of one

OBAMA

administration resisted regulation of bank compensation The administration had no response Their view its a temporary blip but new it was not? and not a single senior financial executive had been prosecuted or arrested for fraud The Obama administration has made no attempt to recover any compensation pay out

OBAMA

Facebook IPO, using underwriters including Goldman Sachs, forced through the Securities and Exchange Commission to create money out of nothing

OBAMA

The finance minister of Sweden the Netherlands, Luxemboug, Italy, Spain, and Germany called for the G20 nations including the United States to impose strict regulations on bank compensation

OBAMA

Henry Paulson CEO of Goldman Sachs helped lobby the SEC to relax limits on leverage that was nuts but they did it?? Bank leveraging up to the level of 33-to -1. and it was all about greed. and at the time this was done their was only five people working at the SEC office.

OBAMA

Obama care web site has a clear priority--gathering confidential information about Americans.

PRESIDENTIAL LIES:

ReplyDeleteLBJ: We were attacked (in the Gulf of Tonkin)

Nixon: I am not a crook.

I will end the war in Vietnam.

GHW Bush: Read my lips - No new taxes.

Clinton: I did not have sex with that woman... Miss Lewinski

Obama: I will have the most transparent administration in history.

The stimulus will fund shovel-ready jobs.

I am focused like a laser on creating jobs.

The IRS is not targeting anyone.

It was a spontaneous riot about a movie.

If I had a son.

I will put an end to the type of politics that "breeds division, conflict and cynicism".

You didn't build that!

I will restore trust in Government.

The Cambridge cops acted stupidly.

The public will have 5 days to look at every bill that lands on my desk

It's not my red line - it is the world's red line.

Whistle blowers will be protected in my administration.

We got back every dime we used to rescue the banks and auto companies, with interest.

I am not spying on American citizens.

ObamaCare will be good for America

You can keep your family doctor.

Premiums will be lowered by $2500.

If you like it, you can keep your current healthcare plan

It's just like shopping at Amazon.

I knew nothing about "Fast and Furious" gunrunning to Mexican drug cartels.

I knew nothing about IRS targeting conservative groups.

I knew nothing about what happened in Benghazi.

I have never met my uncle from Kenya who is in the country illegally and that was arrested and told to leave the country over 20 years ago.

And, I have never lived with that uncle. (He finally admitted 12-05-2013 that he DID know his uncle and that he DID live with him.

And the biggest one of all:

"I, Barrack Hussein Obama, pledge to preserve, protect and defend the Constitution of the United States of America."

Larry Summers was very vocal he thought regulation was bad Goldman sachs sold at least $3.1 billion worth of toxic CDOs in the first half of 2006 . Henry Paulson secretary of the treasury to get the job Paulson had to sell his $485 million of Goldman Sachs stock when he went to work for the government but he didn't have to pay any taxes on it it saved him $$$ 50 million $$$

ReplyDeleteGoldman sachs in late 2006 started to sell toxic CDOs and started to bet against them telling it's customers that they were high quality investment and Goldman was betting on the U.S housing crash. Goldman sachs started selling CDOs specifically designed to crash Henry Paulson Goldman Sachs and Morgan Stanley weren't alone Merrill Lynch, J.P Morgan, and Lehman Brothers were all in on it.

Goldman sachs Larry Summers new that mark zuckerberg stole the idea facebook and stole Leader's source code stolen from Michael McKibben and so did Chris Hughes, Obama + Chris Hughes ended up in the same bed x0x0xo and Larry Summers got his leveraging power to run facebook his way to rip off facebook IPO

THE DAVID KIRKPATRICK BS STORY

LIBOR The strategy wasn’t a secret. Each morning at a meeting of UBS’s interest-rate-derivatives desk in Tokyo, Mr. Hayes would change his status on his Facebook page to reflect his daily desires for Libor to move up or down Originally, the purpose of the feature was to allow users to inform their friends This feature first became available in September 2006 updates were followed by the "What are you doing right now in March 2009, the question was changed to "What's on your mind? (move it up or no move it down ) Facebook than added the feature to tag certain friends (or groups, bankers lawyer Shady traders etc.) The ponzi scheme had everything it needed. Facebook that was stolen (Sean Parker Facebook extortionist James W. Breyer david kirkpatick IN the early days of FACEBOOK they all new that facebook was stolen and new of THEFT OF Leader Technologies' , david Kirkpatick set up libor manipulation in England and on facebook under the disguise of doing an investigation with the help of Mark Zuckerberg The PayPal boys teamed with Larry Summers to prop Zuck up in front of this new global transaction system scam and the IPO WAS A JACK UP Mark Zuckerberg’s former speechwriter, Katherine Losse, said in her book The Boy Kings that Facebook employees were essentially ordered to sell their shares and ask no questions. Facebook's secret profiles, master passwords... and a 'hot or not' app: Insider's book reveals Zuckerberg's 'twisted' quest for total domination

The Winklevoss twins have both been very vocal in their support of bitcoin, but Cameron and Taylor Winklevoss instead of of telling the truth put your extortion hands out you know that facebook was stolen you know the idea facebook was not yours nor was it zuckerberg idea??, BITCOIN the new global transaction system scam, China has told every one they are going to dump the bitcoin but their is still INDIA for the new global BITCOIN transaction system scam. But how are they going to do this Michael McKibben, SO WHO is sucking up to india IT'S OBAMA giving out awards and to give by official decision PAYMENT PRIZES AND AWARDS????? obama using back door keys from the NSA to spy and steal ideas

A federal judge in California ruled yesterday that Hulu will stand trial in a lawsuit that claims the streaming video site illegally shared viewing data ...

HAVE A FUCKING NICE DAY EVERY ONE