(Dec. 12, 2013) —The obvious judicial misconduct in the Leader v. Facebook patent infringement case has triggered a string of questions. Why would these federal judges risk their reputations and careers to side with Facebook? How much are they being paid? Are there other hidden agendas?

Ethics and separation of powers scoffed at

The answers are both sad and shocking. Sad because American democracy is much closer to a breaking point than suspected. Shocking in the depth and breadth of the collusion.

Investigators studied four courts, first the U.S. Supreme Court and the Federal Circuit. Both of these first two courts turned a blind eye to justice in Leader v. Facebook. Then, the investigators randomly picked two appeals courts, the 1st and 8th Circuits. They wanted to see if the investing patterns of the judges in Leader v. Facebook repeated themselves in other courts. This would give an indication of how widespread the corruption is.

The investing pattern repeats itself

In each court, certain judges enriched themselves on investments in one or more of the following funds: Fidelity, T.RowePrice, Vanguard, Goldman Sachs, Morgan Stanley, JPMorganChase, Microsoft, IBM, and Blackrock (the “Facebook Basket”).

The National Venture Capital Assoc. breeding ground

The common denominator among these funds is a group of directors from the National Venture Capital Association (NCVA).

Facebook’s largest investor and former chairman, James W. Breyer, Accel Partners LLP, was the chairman of NCVA in 2004, when the theft of Leader Technologies’ patent took full sail.

Other NCVA directors who served with Breyer are Fidelity’s Robert C. Ketterson and Vanguard’s Anne Rockhold (now CFO of Accel Partners).

The NCVA’s chief lobbyist is the law firm Latham & Watkins LLP, who employed the SEC’s Chief Counsel Thomas J. Kim. Kim granted Facebook an unprecedented exemption from the 500-shareholder rule in 2008. This exemption triggered a flood of dubious foreign investing in Facebook led by Goldman Sachs and Morgan Stanley. This activity pumped Facebook’s pre-IPO valuation to $100 billion, before it crashed after the insiders cashed out over $13 billion shares. See previous post.

Latham & Watkins LLP represents James W. Breyer, and currently employs the husband of Leader v. Facebook Federal Circuit judge Kimberly A. Moore.

The HealthCare.gov corruption starts here

Ann Huntress Lamont also served as a NCVA director during the formative days of this Facebook IPO investing scheme. Lamont has co-invested in deals with Breyer and currently serves as director and investor in Castlight Health, founded by Todd Y. Park, President Obama's chief technology officer and HealthCare.gov architect. Lamont's husband, Ned Lamont, funding his own campaign, tried unsuccessfully to defeat Senator Joe Lieberman in Connecticut in 2006. Lamont holds over 60 investments in Goldman Sachs funds and 19 JPMorganChase funds alone—more Facebook Club members.

Fig. 2—57% of the Supreme Court Justices with Facebook Basket interests attended Harvard.

Fig. 2—57% of the Supreme Court Justices with Facebook Basket interests attended Harvard.Click here to browse a PDF collection of the Leader v. Facebook judge financial disclosures.

Click here for a binder ZIP file of all Leader v. Facebook judge financial disclosures (28.8 MB).

In the 1st Circuit, 44% of the judges held six or more Facebook Basket investments (TIAA-CREF, Fidelity, T.RowePrice, Vanguard, JPMorgan, Morgan Stanley, Microsoft, IBM, Blackrock, Goldman Sachs, State Street) with a whopping 71 holdings by Chief Judge Sandra L. Lynch.

In the 8th Circuit, 54% of the judges held six or more, with a maximum of 17 holdings by Judge James B. Loken.

Click this icon to download the Excel spreadsheet containing the data analyzed. Includes links to the financial disclosures and Judgopedia links.

Click this icon to download the Excel spreadsheet containing the data analyzed. Includes links to the financial disclosures and Judgopedia links.Of the 47 judge financial disclosures analyzed in this study, 60% attended Harvard, Yale, Princeton and Columbia. 55.6% attended Harvard and Yale. 35.6% attended Harvard.

In the Supreme Court, 100% are from three Ivy League schools (Harvard, Yale and Columbia). 56% attended Harvard.

Here's the file on GoogleDrive also.

In the Federal Circuit, 40% of the judges held six or more, with a maximum of 22 holding by Chief Judge Alan D. Lourie.

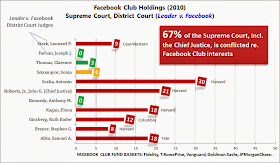

In the Supreme Court, 67% of the justices held six or more, with Chief Justice John G. Roberts, Jr. holding 21 and Associate Justice Antonin Scalia holding 30.

35.6% attended Harvard; 60% are Ivy League

Among these "red zone" judges collectively (more than five Facebook Basket holdings), 35.6% attended Harvard, and 60% are Ivy League.

In Leader v. Facebook, the "red zone" holdings are higher: 46% Harvard and 69% Ivy League.

* * *

Harvard Law: Screw the Public 101Such duplicity begs the question: What is Harvard teaching these lawyers about ethics and conflicts of interest? Are they nurturing statesmen, or criminals? Most of these lawyers have lectured at one time or another at Harvard. And why does one higher education institution dominate such a powerful and important branch of government?

From the Harvard University Financial Conflict of Interest Policy:

Harvard requires that its faculty members disclose relationships with outside entities, directly or through third party funds, when the relationships and/or common sense dictate. When there is a doubt, disclose.

Harvard requires disclosure when “products, services, or activities are related to the areas” engaged in by the faculty member, like investments in Facebook.

“Examples of Financial Interests that Should be Disclosed . . . (d.) An equity interest in a publicly-traded entity . . . (e.) income from investment vehicles . . . (f.) Stocks in large publicly traded companies.”

From the Code of Conduct for U.S. Judges:

“CANON 2: A judge should avoid impropriety and the appearance of impropriety.”

“CANON 3: A judge should perform the duties of the office fairly, impartially and diligently.”

CANON 3(C)(1)(d): “A judge shall disqualify himself or herself in a proceeding in which the judge’s impartiality might reasonably be questioned, including but not limited to instances in which: . . . the judge [has an] interest that could be substantially affected by the outcome of the proceeding.”

Despite their substantial Facebook Basket holdings, not a single judge in Leader v. Facebook withdrew or even disclosed his or her conflicts.

By 2008, the Facebook Basket train had left the station

By the time Leader Technologies filed their patent infringement lawsuit against Facebook in November 2008, the Facebook Basket train had already left the station. They had promises of a massive Facebook IPO to keep. They had an election to win, and massive amounts of American data to possess (HHS: Health “Datapalooza” – yee ha). With Barack Obama in the White House they could pad the bureaucracy with high-level accomplices at the SEC, Commerce, Justice, HHS, FEC, National Economic Council, etc. All the while, their hackers would be burying their data-siphoning code so deep in America's digital infrastructure, that it would take decades to find. Providing leverage for future influence and control.

Collusion is expensive

This agenda needed cash, and lots of it.

1. Bailout. First was the fabricated crisis called the bank bailout in 2008. This carefully planned “crisis” was led by more Harvard people—by Jamie Dimon at JPMorganChase—by Lloyd Blankfein and Henry Paulson at Goldman Sachs—by Lawrence “Larry Summers” at the National Economic Council.

2. Stimulus. Next came the “green” energy stimulus. 20 of 22 investments failed, but the bulk of the funds went to cronies, so no harm, no foul.

3. Facebook IPO. Then, the long-promised Facebook IPO emerged with more Harvard-led collusion. The SEC’s Harvard alum Thomas J. Kim granted Facebook an unprecedented exemption from the sacrosanct 500-shareholder rule. His boss, Mary L. Shapiro, SEC chair, gave secret blessing since she held 49 funds in the Facebook Basket.

Facebook’s schemers-in-chief were Harvard alums James W. Breyer, Accel Partners, along with his partners, James Swartz and Ping Li.

Fellow Harvard schemers were Sheryl K. Sandberg and Lawrence “Larry” Summers. Sandberg had been mentored by Summers for the last 20 years. She was his research assistant at the World Bank in 1993, and later his chief of staff at the U.S. Treasury Department.

4. HealthCare.gov. Next came almost a billion dollars to build HealthCare.gov. Todd Y. Park, another Harvard man, was put in charge. Michelle Obama chimed in with her own Ivy connections. She used her influence to ensure that her Princeton friend, Toni Townes-Whitley, received the no-bid contract that has cost the American people over $634 million dollars to build the HealthCare.gov site.

5. U.S. Data Siphons. Once the HealthCare.gov data siphon backdoors are fully functioning, the Facebook Club will have unfettered access to all of America’s healthcare and IRS data. The opportunities for criminal blackmail by misuse of the data will be locked in.

(Oh, you want that job now, do you? What if we tell your prospective employer about your medical problem? Don’t worry, we’ll make sure they don’t find out, but you must promise to do what we ask when we come calling down the road.)

6. Digital Blackmail

The Soviet KGB secret police were especially good at this sort of blackmail. Is it any mistake that Facebook’s second largest shareholder is a Russian oligarch with close ties to Vladimir Putin? Blackmail is generally an income generator too.

Was Chief Justice John G. Roberts, Jr. blackmailed into supporting Obamacare? He has 21 holdings in the Facebook Basket.

A hiccup in the Facebook Club strategy appears to have come when Harvard man Lawrence “Larry” Summers was rebuffed as Barack Obama’s choice to be Chairman of the Federal Reserve. Even 300 of his fellow economists opposed his nomination.

However, with Facebook massive data center in Lulea, Sweden in full operation, the giant sucking sound of American private data leaving U.S. shores is deafening. It’ll be outside the reach of U.S. law and unaccountable. Will the Facebook Club succeed?

Data snapshots are enough

The snapshots of healthcare data they’re getting now, while the HealthCare.gov site is insecure, will be enough to blackmail you and your children for decades to come, even if the spigot is turned off later. It’ll be too late.

America’s health insurance coverage relies on confiscated property

The HealthCare.gov site claims the social technology being used is “open source” when they know it is not. According to Leader Technologies, no Health and Human Services official has contacted them about licensing their invention. As a result, HealthCare.gov is operating on confiscated private property.

Leader Technologies’ investors risked $10 million and invested 145,000 man-hours to invent social networking. Facebook stole it. The U.S. government is now relying on Leader’s invention, without licensing it, for an important element of our civic way of life; our health. Doesn’t that bother anyone?

Harvard people in all the right places.

What’s wrong with this picture?

* * *

Harvard's motto is "Veritas," or truth, personified by the Roman god Veritas.

ReplyDeleteIn light the level of corruption evidenced by the alumni of this institution, perhaps the new motto should be "Mantus," the ancient Roman god of the underworld and death. His consort was "Mania," whose influence might have been seen in the mania surrounding the Facebook IPO. Clearly, the influence of the underworld of the Facebook Club has brought about major threats to truth and justice. I cannot fathom how the leadership of Harvard can tolerate these behaviors. The Founders must be churning in their graves.

There certainly are some Harvard professors who are ethical, and they must stand up and be heard now.

Roman gods aside, the injustice done to Leader Technologies has not yet been resolved. I'm hopeful that it will be and that the perpetrators will be brought to justice sooner rather than later before any more damage is created.

Wait, this post is not accurate. The only conflicts of interest that are claimed are mutual fund holdings. But it is already well established that the holding of mutual funds does not establish a conflict of interest. See Canon 3 for Federal Judges. There is no conflict here so I don't understand how this blog could claim there was corruption.

ReplyDeleteJason, you are misinformed. See the post for a fuller analysis of this subject. Judges cannot play the games you are trying to play with that rule. If they will benefit from their decisions, they must recuse. http://americans4innovation.blogspot.com/2013/12/fast-and-furious-judge-tied-to-assualt.html

Delete