SEC counsel cleared the way for the Facebook “pump and dump” scheme in 2008?

SEC counsel appears to have failed to disclose his conflicts of interest with Facebook Chairman James W. Breyer; hindsight says this oversight triggered the IPO feeding frenzy

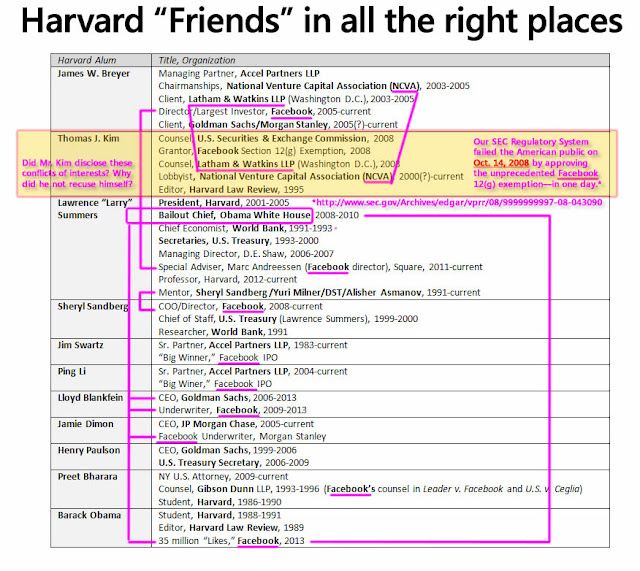

New: Apr. 17, 2013—On October 14, 2008, SEC Counsel Thomas J. Kim approved Facebook’s 500-shareholder exemption. The exemption request was submitted only one day earlier, on October 13, 2008 by Jeffrey R. Vetter, Fenwick & West LLP. (Click the Scribd logo under the document to expand the view)

This exemption is unprecedented. The Securities Act of 1933/34 was created to prevent private market making in unregulated stocks by unscrupulous underwriters. Such activities caused the Great Depression. However, this exemption cleared the way for Goldman Sachs and Morgan Stanley to make a $3+ billion private market in Facebook stock. They sold billions of dollars of private Facebook insiders’ stock to Russian oligarchs Yuri Milner, Alisher Amanov, DST, and Digital Sky Technologies. The dubious nature of these transactions was confirmed by Zuckerberg’s former speech writer, Katherine Loose, who wrote “no one asked if the Russians’ money was clean.” See Boy Kings.

This influx of foreign cash pumped Facebook’s pre-IPO valuation to $100 billion. One of the primary beneficiaries of this dramatic boost in valuation was James W. Breyer, chairman of Facebook and managing partner of Accel Partners LLP. Breyer is the second largest shareholder in Facebook. See SEC Insider Trading report on James W. Breyer.

SEC Counsel Thomas J. Kim approved the Facebook exemption in one day (Remember: we're describing the conduct of a former editor of the Harvard Law Review)

The SEC counsel who approved the exemption was Thomas J. Kim. The SEC is governed by Standards of Ethical Conduct which required him to disclose his conflicts of interest. Mr. Kim was Washington D.C. counsel for the law firm of Latham & Watkins LLP. Latham & Watkins was the chief lobbyist for the National Venture Capital Association (NCVA) whose chairmanships were held then by Facebook's director James W. Breyer. Therefore, Mr. Kim had a material conflict of interest which should have excluded him from any involvement with the SEC 12(g) exemption. Instead, he approved the exemption.

Is influence peddling wrong? Yes.

We also note that Fenwick & West LLP filed for the exemption for Facebook. Since Facebook was then in the process of stealing Leader Technologies’ invention at that time, and since Fenwick & West was Leader’s counsel at that time, the conflicts of interest are astounding.

"Influence peddling is the illegal practice of using one's influence in government or connections with persons in authority to obtain favors or preferential treatment for another, usually in return for payment."

Here are just a few of the regulations governing the conduct of employees of the U.S. Securities and Exchange Commission. These statements are contained in the Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.53 Preamble:

"(a) Members of the Securities and Exchange Commission are entrusted by various enactments of the Congress with powers and duties of great social and economic significance to the American people . . . Their success in this endeavor is a bulwark against possible abuses and injustice which, if left unchecked, might jeopardize the strength of our economic institutions."

(b) It is imperative that the members of this Commission continue to conduct themselves in their official and personal relationships in a manner which commands the respect and confidence of their fellow citizens." (emphasis added).

Or maybe this statement vis a vis Mr. Kim remarkable one-day turnaround of Facebook's variance request. Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.59 Relationship with persons subject to regulation:

"In the performance of his rule-making and administrative functions, a member has a duty to solicit the views of interested persons."

SEC: "We do Facebook exemptions-while-you-wait"—no public hearing on this unprecedented exemption

How could Mr. Kim have solicited the views of interested persons in accordance with Rule 200.59 in his unprecedented one-day SEC-exemption-while-you-wait? This reminds us of the equally remarkable same-day denial of Dr. Lakshmi Arunachalam's Amicus Curiae Brief at the Federal Circuit in Leader v. Facebook. There, the Clerk of Court Jan Horbaly's staffer Valerie White told a caller that there was no way the judges had time to even receive the brief, much less rule on it. This was before Ms. White's phone extension was disabled and she totally dropped off the radar. Apparently she had not been know the secret handshake. The common thread in all these disturbing actions is that these people were all associated with the Facebook cabal's law firms and Harvard before they were employed by the public.

"A member should not, by his conduct, permit the impression to prevail that any person can improperly influence him, that any person unduly enjoys his favor or that he is affected in any way by the rank, position, prestige, or affluence of any person."

Do ya think that Mr. Lee had ex parte conversations with his Latham & Watkins LLP buddies at Facebook to grease the secret exemption turnaround?

The SEC rules prohibit prejudicial ex parte communications with a party. Ex parte is a fancy word for side conversations that the other party does not know are occurring (literally: without a party present). Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.62 Ex parte communications:

"A member shall at all times comply with the Commission's Code of Behavior governing ex parte communications between persons outside the Commission and decisional employees."

SEC Opinion failed on the substance required by § 200.63

The Code requires the Commission's reasons for their actions to "contain a clear showing that no serious argument of counsel has been disregarded or overlooked." However, such statements are MISSING in the Facebook opinion. Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.63 Commission opinions:

"The opinions of the Commission should state the reasons for the action taken and contain a clear showing that no serious argument of counsel has been disregarded or overlooked. In such manner, a member shows a full understanding of the matter before him, avoids the suspicion of arbitrary conclusion, promotes confidence in his intellectual integrity and may contribute some useful precedent to the growth of the law. A member should be guided in his decisions by a deep regard for the integrity of the system of law which he administers. He should recall that he is not a repository of arbitrary power, but is acting on behalf of the public under the sanction of the law."

To the contrary, Mr. Lee's opinion contains only CYA phrases like "based on the representations made to the Division in your letter" and "different facts or conditions might require the Division to reach a different conclusion" and "does not represent a legal conclusion." Such statements say nothing about any arguments of (opposing) counsel.

One remarkable aspect of the influence peddling that appears to be occurring in this Leader v. Facebook judicial and financial corruption scandal are the “Harvard connections.”

Undermining American Democracy

Between Oct. 2003 and Jun. 2004, while (1) Lawrence Summers was President of Harvard, (2) Mark Zuckerberg was a 19-year old sophomore, (3) SEC's Thomas J. Kim worked for James W. Breyer's lobbyist Latham & Watkins LLP, and (4) Fenwick & West LLP represented (stole FB's core technology from?) Leader Technologies, The Harvard Crimson carried FIFTY-ONE (51) articles about Zuckerberg and Facebook, and THREE (3) about Pope John Paul II.

It would appear that these individuals have been planning this undermining of U.S. and international financial and legal systems for the better part of two decades. They appear to have strategically placed "their people" to approve an exemption here, fix judges there, use prosecutor cronies to harass, bribe liberally, gum up the legal system with frivolity, exploit stock with cooperative underwriters, motivate politician$, etc.—all clothed in Crimson. Ironically, Harvard's motto is "Veritas" which is Latin for "Truth." And yet, to pull off their schemes, they decided to steal from a Harvard parent, Michael McKibben of Leader Technologies. Why didn't they just invite McKibben into their Club? They probably figured that given his friendship with Pope John Paul II that he marched to the tune of a different drummer. Perhaps our country would be in better shape if more did.

In any event, the SEC’s complicity in the Facebook "pump and dump" scheme is now evident. (And they have the audacity to prosecute others?) This exemption may go down as one of the biggest rip offs of all time. The reaction of our elected officials and regulatory bureaucrats to this new revelation will be quite revealing.

Spread the word.

Updated: Apr. 15, 2013

Why is the White House meddling in Leader v. Facebook—a patent case?

The Three Kings of U.S. Corruption (below) are closely associated with the President

(April 9, 2013)—Just when you think the Leader v. Facebook judicial corruption scandal could not get more twisted, new evidence reveals that President Obama has exerted "presidential communications privilege" to prevent a FOIA disclosure (Freedom of Information Act) at the U.S. Patent Office. Anyone regularly reading Facebook's duplicitous legal writings recognizes their fingerprints on this Patent Office response. It cites "Exemption 5" which allows agencies to withhold certain kinds of information, mostly regarding internal deliberations.

"The Protected Party is the President of the United States" —Loving v. Dept. of Defense

Out of all the legal precedents that the Patent Office could have cited, they chose Loving v. Department of Defense, 550 F. 3d 32 (DC Circuit 2008) whose subject is the "presidential communications privilege." It states "Here the party protected by the privilege, is . . . the President of the United States." It relies on the privilege because the communications "directly involve" the President.

Patent Office failed to provide a Vaughn index

What the Patent Office chose to ignore in the Loving case was the "Vaughn index" which is required "to fulfill the agency's obligation to show with 'reasonable specificity'" why the requested information is being withheld. Put simply, they are required to disclose the nature of the information being withheld (topic, sender, receiver, date, reason for concealing, etc.). The Patent Office did not provide a Vaughn index as the precondition to rely on Exemption 5 in the Loving case, and should therefore lose the privilege.

The Patent Office is hiding behind presidential privilege while violating the terms of the very law it relies on for the privilege. Does this tactic sound familiar? It's lawfare—mangle every argument with truth and error to fool the unsuspecting, and thus gum up the legal system.

We ask again: Why is President Obama involved in Leader v. Facebook? Could it be to protect his political interests in his 35 million Facebook "Likes" when he is supposed to be protecting Leader Technologies constitutional rights? Remember, the President's involvement would likely have occurred before the 2012 election. Pundits say he probably edged out Mitt Romey using his Facebook "Like" data to micro-target voter blocks.

The requester has forwarded the renewed request to the House Oversight Committee on Government Reform and to the Acting Commerce Secretary. The letter to Congressman Jim Jordan is embedded below.

ORIGINAL POST (Below)

Greed, envy and conspiracy against real American innovators

|

|

|

| Lawrence "Larry" Summers |

James W. Breyer Accel Partners LLP |

Gordon K. Davidson Fenwick & West LLP |

| Economist | Venture Capitalist | Attorney |

| Conflicts of Interest; Market Manipulation; Collusion (Allegations) |

Trade Secrets Theft; Market Manipulation Bribery & Collusion (Allegations) |

Intell. Property Theft; Abuse of Client Confidence Stock Manipulation Collusion (Allegations) |

Click the image below to enlarge.

Fig. 1—The Patent Office has just cited Executive Privilege to block release of Freedom of Information Act data in Leader v. Facebook. President Obama has also been discovered to have direct connections to Facebook's attorney Gibson Dunn LLP. Are the Facebook attorneys his version of President Nixon's White House "plumbers?"

Fig. 1—The Patent Office has just cited Executive Privilege to block release of Freedom of Information Act data in Leader v. Facebook. President Obama has also been discovered to have direct connections to Facebook's attorney Gibson Dunn LLP. Are the Facebook attorneys his version of President Nixon's White House "plumbers?"Click here to read the RENEWED APPEAL as well as the USPTO response.

"Experience has shown, that even under the best forms of government those entrusted with power have, in time, and by slow operations, perverted it into tyranny."

― Thomas Jefferson

“Among a people generally corrupt, liberty cannot long exist.”

― Edmund Burke

"So in everything, do to others what you would have them do to you, for this sums up the Law and the Prophets."

― The Gospel of St. Matthew 7:12

"You shall not steal. You shall not bear false witness against your neighbor."

― The Book of Exodus 20:16-17

(March 28, 2013)—A comprehensive overview of the Leader v. Facebook judicial and financial misconduct appeared yesterday. While most of the analysis is not new to AFI, it does tell the real story of Facebook's illicit beginnings. Compare this to the fantastical Zuckerberg super-hacker pabulum that the mainstream press has repeated uncritically since 2003. The essay identifies journalist David Kirkpatrick, author of The Facebook Effect, as a contributor to the Facebook fiction. Astoundingly, the mainstream media started citing Kirkpatrick for their primary research. More humorous, Facebook attorneys even QUOTED Kirkpatrick in various legal briefs to try and deceive federal judges.

Also remarkable is the alleged deep involvement of former Treasury Secretary and Obama Bailout Director Lawrence "Larry" Summers in all things Facebook. The trails of corruption just seem to fan out from Summers in all directions. Perhaps most damning is his failure to disclose (concealment of) his conflicts of interest during the 2008 bailout Summers failed to disclose conflicts of interest surrounding Goldman Sachs and Morgan Stanley in 2008—only a $32,000,000,000 oversight

Specifically, Summers failed to disclose his 20-year mentor relationship with Russian Yuri Milner. In the early 1990's, Milner collaborated with Summers and Summers' then research assistant, Sheryl Sandberg (now Facebook COO). In 1993, Milner even authored a World Bank paper for Summers that recommended what is now universally recognized as the reckless (and failed) Russian voucher system. That system has created the current oligarchies which have so corrupted the current Russian economy (PDF). It also created Alisher Asmanov, another Goldman Sachs partner. Since the Facebook IPO, Asmanov is now called the "Richest man in Russia." Summers' decisions have been very good to his protégés Asmanov, Milner and Sanberg.

Milner + Goldman Sachs = Summers Conflict of Interest

Purchase of Facebook Stock by a bailed-out-Goldman's Moscow Partners + Sandberg = Summers Conflict of Interest

At the time of the bailout, Milner was partnered with Goldman Sachs which received at least $16 billion in U.S. taxpayer funds. Milner reappeared six months later with bags full of money totaling; $3+billion in "overseas" funds to purchase Facebook insider stock. (See the Boy Kings briefing about those dubious transactions.)

Fenwick & West LLP paved the way for Russian funds from Summers' protégés

Fenwick & West LLP paved the way for these sales by getting Facebook a one-day SEC exemption turnaround allowing Facebook to ignore the chiseled-in-granite-500-shareholder rule (a private company with more than $10 million in assets cannot have over 500 shareholder without being considered a public company by default). That exemption enabled Milner to become the second largest investor in Facebook after Accel Partners/James W. Breyer. Many now believe this money to purchase Facebook stock came from Goldman Sachs and Morgan Stanley TARP funds laundered through Dubai and Cyprus. Click here to view the Larry Summers Conflicts Map.

Yahoo! Voice's Christofer French (PDF) boiled down modern day corruption into seven points. He drew his assessment from the downfall of the Roman Empire:

- Arrogant leadership

- Loss of a Middle Class

- Lust for power

- Greed

- Excessive Taxation

- A General Societal and Legal Winking

Christofer French. Sliding Down the Slippery Slope of Legal Corruption! Corruption Makes Us Numb and Also Unconscious. When We Are Consciously Corrupt, That's the Worst. Yahoo! Voices, Dec. 10, 2010.

Do these symptoms of system-wide corruption sound familiar? Will this corruption destroy America? Only if we are complacent and do nothing to stop it.

Several different sites have already re-posted the essay embedded below. (Note: Scribd, GoogleDrive and DocStoc allow you to download a PDF to your local computer. For example, with GoogleDrive, from the document, select File, then Download. Then a window on your computer pops up where you designate the folder to store it in. If you don't select a folder, the PDF will be stored in your browser's default download folder.)

Ask your elected representatives to investigate

Readers are encouraged to write their senators and congresspersons. Ask them to open inquiries and investigate these disturbing revelations. Attach this essay as your background. Meet with them to discuss your concerns. Get active. If not you, who? If not now, when?

CLICK HERE TO DOWNLOAD: The Real Facebook - A Portrait in Corruption, Mar. 28, 2013Fig. 3—The Real Facebook | A Portrait of Corruption.

Click Comment below to join the conversation ... or email your comment to amer4innov@gmail.com and we'll post it.

CLICK HERE TO DOWNLOAD: 2008 Banking Crisis Timeline - The Fleecing of America

Fig. 4—2008 Banking Crisis Timeline - The Fleecing of America

* * *

What is bugging me is why U.S. Attorney PREET(inder) [no kidding] BHARARA, who filed the criminal case against Paul Ceglia did so (a) while the Ceglia v. Zuckerberg civil case was in process, and (b) suspiciously after Ceglia's attorney "dismantled" Facebook's forensic experts and revealed the existence of the 28 Zuckerberg hard drives and the Harvard email archives (evidence that was concealed from Leader Technologies in their case). I had to scratch that itch this morning, and look what I found!

ReplyDeleteBINGO!

BHARARA WAS AT HARVARD AT THE SAME TIME AS PRESIDENT BARACK OBAMA. Obama was there 1988-1991 and Bharara was there 1986-1990.

Then, Bharara worked for GIBSON DUNN LLP (Facebook's firm) from 1993-1996.

That curious connection got me to wondering if there was a connection between THOMAS G. HUNGAR (Facebook's Gibson Dunn LLP appeal counsel in Leader v. Facebook) and Bharara.

BINGO!!

Bharara handled a NY Second Circuit appeal case with Gibson Dunn's "W. James Hall" AT THE SAME that Hall was handling another case IN THE SAME COURT court with Thomas G. Hungar.

The Bharara-Hall case was MUHAMMAD V. NY DEPT. OF CORRECTIONS. The Hall-Hungar case was IN RE CHATEAUGAY CORP. This puts Bharara and Hungar in the SAME LAW FIRM rubbing shoulders in the same NY court AT THE SAME TIME, between October 1995 and July 1996. (Non-lawyers should know that these federal court houses are not that large, and the attorneys that work in them all know each other well, if not personally, at least professionally.)

CHA CHING!!!

Present and former GIBSON DUNN attorneys, PREET BHARARA and THOMAS HUNGAR are now engaged in defending Facebook? So who is leading the defenses of ALL THINGS FACEBOOK?

Reliable sources tell me that the U.S. Patent Office response to the recent Leader v. Facebook Freedom of Information Inquiry (into why the USPTO Director's office ordered Leader's patent into a third reexamination after passing on the first two, has invoked EXECUTIVE PRIVILEGE. What???!!!

Why is the President of the United States intervening on behalf of Facebook?

Don't believe me on this research? Here's my source material:

http://www.whitehouse.gov/the-press-office/president-obama-nominates-preet-bharara-tristram-coffin-jenny-durkan-paul-fishman-j

http://en.wikipedia.org/wiki/Early_life_and_career_of_Barack_Obama

http://www.mainjustice.com/files/2009/06/bharara.pdf

BHARARA-HALL: Muhammad v. City of New York Dept. of Corrections, 904 F. Supp. 161 - Dist. Court, SD New York 1995

http://scholar.google.com/scholar_case?case=17053064731312015818&q=Mohammed+v.+City+of/New+York+Dept+of/Corrections,+126+F.3d+119+(2d+Cir.+1997)&hl=en&as_sdt=2,36

HALL-HUNGAR: In re Chateaugay Corp., 89 F. 3d 942 - Court of Appeals, 2nd Circuit 1996

http://scholar.google.com/scholar_case?case=8415956821779936092&q=In+re+Chateaugay+Corp.,+89+F.+3d+942+-+Court+of+Appeals,+2nd+Circuit+1996&hl=en&as_sdt=2,36

I am told that the disclosure of the USPTO FOIA response will be published soon.

Does this corruption go to the top? I sincerely hope not.

ReplyDeleteVenture Capitalist To Join Harvard Corporation

Venture capitalist James W. Breyer was elected to the Harvard Corporation, the University’s highest governing body, Harvard announced Monday. He will become the organization’s thirteenth member on July 1.

Does this corruption go to the top YEP?

Help me understand something; why would the (President) of the United States have any interest in a Freedom of Information request at the USPTO concerning an inquiry as to the logic behind a third re-examination of a valid U.S. Patent –the same patent that had twice been reaffirmed at the same office? What connection does the White House have in this particular patent anyways? And what is so damning about this patent that the President invokes executive privilege to hide these facts from the American public?

ReplyDeleteWe now know that President Obama was at Harvard (as a foreign student, I might add) the same time Preet Bharara, the U.S. Attorney nominated by Obama, the same man who brought criminal charges against Paul Ceglia. So, after Ceglia’s attorneys proved that the previously non-existent 28 Zuckerberg hard drives and Harvard emails actually did exist, they were sealed from public scrutiny.

Mark Zuckerberg certainly does enjoy cozy relationships with certain Harvard alums. And if Harvard claims to be a higher school of learning, a school where honor and intellect are supposedly at the “forefront” of American, if not Global, superiority, then it would behoove Harvard to put up or shut up over their complicity in the greatest theft and cover up in American history.

I’ve also said this before, but I feel it deserves repeating; when will anyone in Congress grow some brass and subpoena these emails and/or hard drives for examination (or, at least, ensure their survival by making hard copies and other backups for future use)? Time is something that is not on our side here folks. These things do have shelf lives; once they are gone, they are gone –along with any proof that everyone at Harvard, from Zuckerberg and his pimple-faced geek squad, all the way up to, and including, the Big Cheese himself, Barry Sotero (aka President Barack Hussein Obama), that these people knowingly and willfully helped steal, reproduce, profit, extort, bribe, coerce, and cover up this theft of Leader’s U.S. Patent # 7,139,761.

I strongly encourage everyone to keep hounding their elected officials to move on this ASAP!!

Comment by: Sad and Sickened

ReplyDeleteWho can get this information to Bob Woodward at THE WASHINGTON POST? This is sickening and depressing that it is really this bad. These goon squad lawyers gotta go. Why haven't the "good" lawyers stepped up to fix this mess??? Surely they've noticed. We pay them to do their jobs MORALLY (RIGHT VS WRONG). I guess that idea is just a con. They have overrun Washington.

Well now, it seems that our Russian (not-so-friendlies) are once again meddling into Facebook affairs. A recent (today, 04/02/2013) posting by Lawless America on Facebook has suggested that, apparently, a bunch of foreigners are blatantly liking their page as to drive up their numbers. They then are using those numbers to try and discredit Lawless. Why?

ReplyDeleteA little background of Lawless America: They are a Community Page on Facebook. Their founder, Bill Winsdor, is dedicated to exposing corruption, wherever it may be. He has uncovered scores of horror stories, by ordinary Americans, of how our government has wrongly, accused, tried, and convicted innocent people. He has exposed how corrupt courts, officials, and legislators have manipulated the system into their personal gain and/or saving of embarrassment. Sound familiar yet?

Please see the post, below, as it appeared on my Lawless America (Bill Windsor) page:

Lawless America

5 hours ago

FACEBOOK FRAUD CONTINUES.

Last night, www.facebook.com/lawlessamerica was at 46,000 Likes. Today we are at 51,000. Looks like we have picked up 5,000 Russians. I believe someone is getting a bunch of foreigners to Like the page so they can claim our numbers are not legitimate. I have observed a lot of strange Facebook stuff. This page is most definitely being manipulated by someone other than me.

My first obvious question is, “Why would (Russians) want to delegitimize the number of LIKES for Lawless America”? Is there something that they (the Russians) don’t want Americans getting wind of? Could Lawless be on the verge, or have their sights set on, of exposing an even bigger cover up that only a privileged few either know or speak of? Is the media feeling the heat to the point where they almost certainly have to acquiesce?

What better way, and in grand Liberal fashion, to squelch the story by discrediting the source, rather than face the truth head on? I say it’s time to back this courageous outfit, and help them in helping us to expose Facebook’s cabal, and our corrupt judicial system.

Comment by: Don't look over your shoulder 8-|

DeleteI think it is highly probable that these are not 5,000 Russians at all. Remember, these FB goons are masters of misdirection. It would be very easy for a Facebook engineer to generate a spreadsheet with the right columns like NAME, LOCATION, EMAIL, FRIENDS, etc. and then simply import that list into the Facebook program if (s)he has the right authorizations. They're probably all fake accounts. For whatever reason, they want you/us to think they're Russian. Heck, they probably did it from Starbucks here on University Avenue in Palo Alto. Remember, these peoples are criminals who get their jollies by deceiving people for fun and profit.

"Pay no attention to that man behind the curtains."

--The Wizard of Oz... however, these Wizards only rape, pillage and plunder their fellow man.

... then again, maybe they are Russians who took a sudden interest in American judicial corruption. LOL.

http://www.huffingtonpost.com/2013/04/03/offshore-companies-politicians_n_3008426.html?utm_source=DailyBrief&utm_campaign=040413&utm_medium=email&utm_content=FeaturePhoto&utm_term=Daily%20Brief

ReplyDeleteDozens of journalists sifted through millions of leaked records

Tony Merchant, one of Canada’s top class-action lawyers, took extra steps to maintain the privacy of a Cook Islands trust that he’d stocked with more than $1 million in 1998, the documents show.

In a filing to Canadian tax authorities, Merchant checked “no” when asked if he had foreign assets of more than $100,000 in 1999, court records show.

Tony Merchant KNEW AND KNOWS HOW FACEBOOK WAS STOLEN

ICIJ's investigation into offshore secrecy

ReplyDeleteDozens of journalists sifted through millions of leaked records and thousands of names to see if there name was on the list like Tony Merchant

like to see if Preet Bharara is there: is this why its not on the front page news?? How can we stop it? the Republicans hate regulation the reason to protect their cronies from prosecution; and where is the "Liberal" Media on this

Comment by: law blogger

ReplyDeleteHere's more proof of Judge Kimberly A. Moore's judicial misconduct. Here is one of her coursework for Patent Law I. Look at the case she asked her George Mason University students to read for on-sale bar (102(b)) - PFAFF! That's the very case that she IGNORED in Leader v. Facebook. Naughty, naughty (top of Page 2):

http://ebookbrowse.com/moore-patent-i-pdf-d28019828

Comment by: bodacious

ReplyDeleteIsn't it a sad state of affairs in this country when our federal judges - who we are supposed to respect - have to be shamed with such expressions as "naughty, naughty"? I think I'll add SHAME, SHAME... but of course they don't care. They're only lining their pockets and have lost sight of democracy's ideals.

Why aren't the ethical attorneys speaking up? Or, is "ethical" and "attorney" in the same sentence a contradiction? 50% of Washington is attorneys. This IS the problem!!!!

Of course the White House is meddling. When are you people going to give up your silly notions about democracy? They needed the Facebook donations as well as the data. Why would the Constitution stand in the way of their right to maintain power at all costs? Geesh. How else do you think this administration decides how to target Executive Order give aways -- Facebook demographics. It's like crack. Once you're on it, you have to beg, borrow and steal to keep it coming, no matter who you hurt or what laws you break.

ReplyDeleteI just finished listening to Mike Mckibben’s radio interview…

ReplyDeletehttp://www.youtube.com/watch?feature=player_detailpage&v=YwefAh4PCbE.

I am not surprised that many people calling in to the show were either uninformed and/or dumfounded at the story that they just listened to. I am also not surprised that some people had had endured problems that were similar, perhaps not on as grand a scale.

The thing that I took away most from the whole interview is the same question, over and over, “What can we do?” What you can do is keep talking, keep writing, and keep calling. I have a life; so do elected officials. They no more want to be bothered as you or I with annoying telemarketers. The more they hear from us, the more they are likely to listen (if nothing else, to stop you from annoying them).

I just completed reading “Killing Lincoln”, by Bill O’Reilly, and there is a parallel here. As arrogant, flamboyant, and ignominious as John Wilkes Booth was, he was not going to go down alone. The assassination conspiracy was planned flawlessly, albeit executed haphazardly. He (Booth) knew that if he were ever to be captured, or killed, he was sure to implicate as many of his brethren as possible. He did this for two reasons:

1. He used these implications as a way to keep his “brethren” pressing forward and doing the dirty deed, and not back out at the last second.

2. Cowards, ultimately, never want to face the full brunt of repercussions alone.

These Facebook goons are forever and irrevocably tied to one another; if one domino falls, be assured the rest will collapse faster than the words, “I plead the fifth”, can be uttered!

Hey folks, look what I just dug up. Hope you add "Thomas J. Kim" to your FOIA inquiries to the U.S. Securities & Exchange Commission. THIS CORRUPTION IS ESPECIALLY SMELLY:

ReplyDeleteThat one-day turnaround SEC waiver that Facebook received on Oct. 14, 2007 is an itch I decided to scratch:

Here's the SEC wavier given to Facebook in ONE-DAY: http://www.sec.gov/Archives/edgar/vprr/08/9999999997-08-043090

I decided to look into the background of THOMAS J. KIM, Office of Chief Counsel, Division of Corporation Finance, USSEC on Oct. 14, 2007

Many more "koinky-dinks"

(1) He approved the Facebook waiver of the 500-shareholder rule in a one-day turnaround on October 14, 2007.

(2) He joined the SEC in 2006.

(3) He was a securities lawyer for GENERAL ELECTRIC before 2006.

(4) He was a partner in *** LATHAM & WATKINS LLP Washington DC *** office in 2003.

(5) LATHAM & WATKINS was chief Washington DC lobbyist for the National Venture Capital Association (NVCA) when ***JAMES W. BREYER, ACCEL PARTNERS LLP*** was NVCA Chairman. James W. Breyer served in various Chairman capacities for the NCVA in 2002-2004.

(6) This is exactly when Leader Technologies' invention were stolen. FENWICK & WEST LLP was both Leader's and James W. Breyer's / Accel Partners LLP counsel.

(7) He clerked for DC Distric Judge Oberdorfer 1995-1996

(8) He graduated from HARVARD LAW SCHOOL in 1995

(9) He edited the the HARVARD LAW REVIEW in 1995 (Barack Obama had edit the REVIEW in 1989)

CONCLUSION: Yet another "Harvard" connection to this corruption. Do they actually have a class in Corruption 101, or is there something in the Boston water? BIGGEST ETHICS QUESTION: Did Thomas J. Kim DISCLOSE his material conflicting associations with James W. Breyer, Fenwick & West LLP and Latham & Watkins LLP before approving the unpredendented waiver of the Facebook 500-shareholder rule that opened the floodgates of $$$ billions in dubious Russian funds to purchase private Facebook stock which pumped the Facebook pre-IPO valuation to $100B?

Taking best that Mr. Kim was a ringer for the Harvard cabal at the SEC.

Gotcha Mr. Kim. Shame. Shame. OK, corruption fighters. Jump on this.

SOURCES:

http://www.pli.edu/Content/Faculty/Thomas_J_Kim/_/N-4oZ1z139c7?t=WDQ2_8AD06&ID=PE562873

Barack Obama was HARVARD LAW REVIEW Editor Mar. 19, 1999.

http://latimesblogs.latimes.com/thedailymirror/2008/09/barack-obama-ha.html

http://www.lw.com/upload/pubContent/_pdf/pub945_1.pdf

http://www.prnewswire.com/news-releases-test/jim-breyer-of-accel-partners-elected-chairman-of-national-venture-capital-association-74019087.html

http://www.ali-cle.org/doc/frontmatter/TSSA09_fm.pdf

Comment by: Judicial Corruption

ReplyDeleteCongratulations to the super sleuths who uncovered this SEC connection to Breyer and the PUMP AND DUMP scheme that we have suspected. If there are any non-corrupt regulators left in Washington D.C. this should be like red meat to a dog. Then again, these are the same "regulators" who ignored Bernie Madoff for almost a decade. And, now we learn that Goldman Sachs was Madoff's banker. Why do all roads lead back to Goldman Sachs and a corrupt SEC? Hmmmmmmmmmmmm. Since we are relegated to quoting fairy tales to explain this audacious criminality, I'll quote the Red Queen from Alice in Wonderland: "Off with their heads."

Comment by: Betty

ReplyDeleteYou folks have introduced me to the concept of "koinky dinks". My definition is parallel events that are possibly linked rather than just mere coincidence. Here's another one:

The Clerk of the US Supreme Court, William Suter announced his retirement just five (5) weeks after Leader filed their Writ of Certiorari on Nov. 30, 2012. If you recall we kept waiting for a Facebook customary reply to such a normally grave challenge to a company. Instead we received more "crickets".

Here's a little timeline:

On August 11, 2012 Dr. Lakshmi Arunachalam filed a disciplinary complaint against the Federal Circuit at the US Supreme Court. It was sent to Clerk Sutter

http://donnaklinenow.com/disciplinary-complaint-filed-against-the-federal-circuit-at-the-u-s-supreme-court

According to Dr. A, Suter sent the complaint package back saying they don’t conduct lower court discipline at the U.S. Supreme Court, and instructing her to send them to Federal Circuit Clerk of Court Jan Horbaly === one of the subjects of the complaint along with Chief Judge Randall Rader.

On November 30, 2012, the U.S. Supreme Court is petitioned to hear Leader’s appeal

http://www.leader.com/docs/supremecourt.html

Facebook files no reply.

Then, five (5) weeks later . . .

January 7, 2013 = Suter announces retirement

http://www.supremecourt.gov/publicinfo/press/viewpressreleases.aspx?FileName=pr_01-07-13.html

Koinky dinks? Yeh, right!

Comment by: law blogger

ReplyDeleteHAS ANYONE SEEN ANY SEC REPORT ON THE RESULTS OF THIS FACEBOOK INVESTIGATION? Didn't think so.

Page 6, column 2, 1st paragrph: "The SEC had opened an inquiry into the structure of the offering and whether it violated the law because of widespread news coverage."

http://www.hunton.com/files/Publication/41fae5d0-e5f2-4874-8661-36ce0cfd66a6/Presentation/PublicationAttachment/82433900-f23d-4b78-bbd7-3dca3dc3ffdb/Facebook_McKinney_2.11.pdf

Also: Andrew Ross Sorkin, “Goldman Limits Facebook Investment to Foreign Clients,” The New York Times’ Dealbook (January 17, 2011) (Investment Limited to Foreign Clients Article)

http://dealbook.nytimes.com/2011/01/17/goldman-limits-facebook-investment-to-foreign-clients/

Check this out. On November 18, 2010 SEC Chief Counsel Thomas J. Kim, speaks at an SEC Small Business Forum. Notice how his bio edits out any prior association with Accel Partners and James W. Breyer via his former law firm Latham & Watkins. Well, how convenient.

ReplyDeletehttp://www.sec.gov/info/smallbus/2010gbforumprogram.pdf

Thomas J. Kim is the Chief Counsel and an Associate Director of the Division of Corporation Finance at the Securities and Exchange Commission. From 1995 to 1996, Mr. Kim served as a law clerk to the Hon. Louis F. Oberdorfer, U.S. District Court for the District of Columbia. Mr. Kim earned his J.D., magna cum laude, from Harvard Law School, where he was an editor of the Harvard Law Review. He graduated summa cum laude from Yale College with a B.A. in English.

He edits out the early 2000's years at Latham & Watkins. Coincidentally, these are the same years that Yuri Milner edits out of his bio when he worked for Bank Menatep that was caught laundering $10 billion in Russian mob money and diverting about $5 billion in IMF funds.

To John Craven, let me first say that Leader v Facebook, and how I might opine on it, has nothing to do with my immortal soul. Your fellow cronies at Facebook may have bought into the Zuckster deity, but as for me, I answer to someone up the food chain a bit. As a personal note, you may want to really get to know Him, for you shall see Him face to face one day; and everything that you have stolen shall be repaid to you in like fashion.

ReplyDeleteAlso, John, this matter is far from over; people with far more power and influence that you could only dream of are immobilizing behind the scenes. There is a reason Mr. Breyer is jumping ship now; he hears the soft, albeit growing, pitter-patter of questions upon questions from investigators to law makers. And the growing knowledge from the media (the ones not bought off…) that this story is morphing into a sicker, far-rooted deeper problem, a problem that Facebook helped create.

Jason Bellini…a.k.a. perhaps….do you really wish that this entire matter had unraveled differently? Had it done so, you would be begging Leader for a job. So, to say otherwise, is just an empty statement (but, I assume, that’s what Facebook pays you to state). Of course everyone wishes this had turned out differently; only history will show that there were two warring camps involved –one who did things correctly and were rewarding with nothing, and the other who started off incorrectly (stealing) and continued that wrong path (bribery) and used gained political muscle to garner favors to build up their amassed fortunes (coercion).

To correct a couple of points (Jason), Mike McKibben never set out to invent “social media”. His platform was designed for collaborative data flow, so that businesses could readily inter-communicate and share ideas. Boy Blunder turned it into something sophomoric (which is ironic, because he was one when he stole the source code). I would argue that Zuckster built his site because he was a horny, pimple-faced geek looking to score! Yes, Jason and JC, your Zuckster deity did steal that code and was subsequently found guilty of infringing on McKibben’s data flow patent. That is fact that is indisputable; those 11 counts of guilty verdict will never go away.

And might I close with a simple question to the both of you…I really don’t care who answers? Since team Zuckerberg created “social networking”. Since team Zuckerberg revolutionized the planet; an endeavor for which you are so grateful every day. Since Facebook is awesome dude!! Why can’t team Zuckerberg get these “social media” ideas patented? Why are there over 500 team Zuckerberg patents waiting on deck at the USPTO? Perhaps the answers lie in “prior art”? U.S. Patent # 7,139,761 is already on the books, preventing Facebook from getting their patents approved. How else can you explain un-needed re-examinations of said patent?

The truth is, boys, you need that patent out of the way; you know it, Facebook knows it, and (as of now) the courts know it.

There does come a time when you have to stare reality in the face…Perhaps team Leader inadvertently created “social media” first?