SEC counsel cleared the way for the Facebook “pump and dump” scheme in 2008?

SEC counsel appears to have failed to disclose his conflicts of interest with Facebook Chairman James W. Breyer; hindsight says this oversight triggered the IPO feeding frenzy

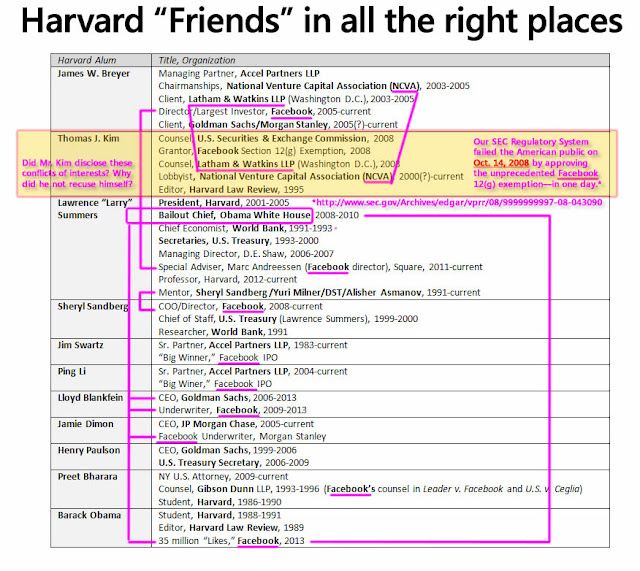

New: Apr. 17, 2013—On October 14, 2008, SEC Counsel Thomas J. Kim approved Facebook’s 500-shareholder exemption. The exemption request was submitted only one day earlier, on October 13, 2008 by Jeffrey R. Vetter, Fenwick & West LLP. (Click the Scribd logo under the document to expand the view)

This exemption is unprecedented. The Securities Act of 1933/34 was created to prevent private market making in unregulated stocks by unscrupulous underwriters. Such activities caused the Great Depression. However, this exemption cleared the way for Goldman Sachs and Morgan Stanley to make a $3+ billion private market in Facebook stock. They sold billions of dollars of private Facebook insiders’ stock to Russian oligarchs Yuri Milner, Alisher Amanov, DST, and Digital Sky Technologies. The dubious nature of these transactions was confirmed by Zuckerberg’s former speech writer, Katherine Loose, who wrote “no one asked if the Russians’ money was clean.” See Boy Kings.

This influx of foreign cash pumped Facebook’s pre-IPO valuation to $100 billion. One of the primary beneficiaries of this dramatic boost in valuation was James W. Breyer, chairman of Facebook and managing partner of Accel Partners LLP. Breyer is the second largest shareholder in Facebook. See SEC Insider Trading report on James W. Breyer.

SEC Counsel Thomas J. Kim approved the Facebook exemption in one day (Remember: we're describing the conduct of a former editor of the Harvard Law Review)

The SEC counsel who approved the exemption was Thomas J. Kim. The SEC is governed by Standards of Ethical Conduct which required him to disclose his conflicts of interest. Mr. Kim was Washington D.C. counsel for the law firm of Latham & Watkins LLP. Latham & Watkins was the chief lobbyist for the National Venture Capital Association (NCVA) whose chairmanships were held then by Facebook's director James W. Breyer. Therefore, Mr. Kim had a material conflict of interest which should have excluded him from any involvement with the SEC 12(g) exemption. Instead, he approved the exemption.

Is influence peddling wrong? Yes.

We also note that Fenwick & West LLP filed for the exemption for Facebook. Since Facebook was then in the process of stealing Leader Technologies’ invention at that time, and since Fenwick & West was Leader’s counsel at that time, the conflicts of interest are astounding.

"Influence peddling is the illegal practice of using one's influence in government or connections with persons in authority to obtain favors or preferential treatment for another, usually in return for payment."

Here are just a few of the regulations governing the conduct of employees of the U.S. Securities and Exchange Commission. These statements are contained in the Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.53 Preamble:

"(a) Members of the Securities and Exchange Commission are entrusted by various enactments of the Congress with powers and duties of great social and economic significance to the American people . . . Their success in this endeavor is a bulwark against possible abuses and injustice which, if left unchecked, might jeopardize the strength of our economic institutions."

(b) It is imperative that the members of this Commission continue to conduct themselves in their official and personal relationships in a manner which commands the respect and confidence of their fellow citizens." (emphasis added).

Or maybe this statement vis a vis Mr. Kim remarkable one-day turnaround of Facebook's variance request. Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.59 Relationship with persons subject to regulation:

"In the performance of his rule-making and administrative functions, a member has a duty to solicit the views of interested persons."

SEC: "We do Facebook exemptions-while-you-wait"—no public hearing on this unprecedented exemption

How could Mr. Kim have solicited the views of interested persons in accordance with Rule 200.59 in his unprecedented one-day SEC-exemption-while-you-wait? This reminds us of the equally remarkable same-day denial of Dr. Lakshmi Arunachalam's Amicus Curiae Brief at the Federal Circuit in Leader v. Facebook. There, the Clerk of Court Jan Horbaly's staffer Valerie White told a caller that there was no way the judges had time to even receive the brief, much less rule on it. This was before Ms. White's phone extension was disabled and she totally dropped off the radar. Apparently she had not been know the secret handshake. The common thread in all these disturbing actions is that these people were all associated with the Facebook cabal's law firms and Harvard before they were employed by the public.

"A member should not, by his conduct, permit the impression to prevail that any person can improperly influence him, that any person unduly enjoys his favor or that he is affected in any way by the rank, position, prestige, or affluence of any person."

Do ya think that Mr. Lee had ex parte conversations with his Latham & Watkins LLP buddies at Facebook to grease the secret exemption turnaround?

The SEC rules prohibit prejudicial ex parte communications with a party. Ex parte is a fancy word for side conversations that the other party does not know are occurring (literally: without a party present). Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.62 Ex parte communications:

"A member shall at all times comply with the Commission's Code of Behavior governing ex parte communications between persons outside the Commission and decisional employees."

SEC Opinion failed on the substance required by § 200.63

The Code requires the Commission's reasons for their actions to "contain a clear showing that no serious argument of counsel has been disregarded or overlooked." However, such statements are MISSING in the Facebook opinion. Code of Federal Regulations, Title 17: Commodity and Securities Exchanges, Part 200, Subpart C—Canons of Ethics, § 200.63 Commission opinions:

"The opinions of the Commission should state the reasons for the action taken and contain a clear showing that no serious argument of counsel has been disregarded or overlooked. In such manner, a member shows a full understanding of the matter before him, avoids the suspicion of arbitrary conclusion, promotes confidence in his intellectual integrity and may contribute some useful precedent to the growth of the law. A member should be guided in his decisions by a deep regard for the integrity of the system of law which he administers. He should recall that he is not a repository of arbitrary power, but is acting on behalf of the public under the sanction of the law."

To the contrary, Mr. Lee's opinion contains only CYA phrases like "based on the representations made to the Division in your letter" and "different facts or conditions might require the Division to reach a different conclusion" and "does not represent a legal conclusion." Such statements say nothing about any arguments of (opposing) counsel.

One remarkable aspect of the influence peddling that appears to be occurring in this Leader v. Facebook judicial and financial corruption scandal are the “Harvard connections.”

Undermining American Democracy

Between Oct. 2003 and Jun. 2004, while (1) Lawrence Summers was President of Harvard, (2) Mark Zuckerberg was a 19-year old sophomore, (3) SEC's Thomas J. Kim worked for James W. Breyer's lobbyist Latham & Watkins LLP, and (4) Fenwick & West LLP represented (stole FB's core technology from?) Leader Technologies, The Harvard Crimson carried FIFTY-ONE (51) articles about Zuckerberg and Facebook, and THREE (3) about Pope John Paul II.

It would appear that these individuals have been planning this undermining of U.S. and international financial and legal systems for the better part of two decades. They appear to have strategically placed "their people" to approve an exemption here, fix judges there, use prosecutor cronies to harass, bribe liberally, gum up the legal system with frivolity, exploit stock with cooperative underwriters, motivate politician$, etc.—all clothed in Crimson. Ironically, Harvard's motto is "Veritas" which is Latin for "Truth." And yet, to pull off their schemes, they decided to steal from a Harvard parent, Michael McKibben of Leader Technologies. Why didn't they just invite McKibben into their Club? They probably figured that given his friendship with Pope John Paul II that he marched to the tune of a different drummer. Perhaps our country would be in better shape if more did.

In any event, the SEC’s complicity in the Facebook "pump and dump" scheme is now evident. (And they have the audacity to prosecute others?) This exemption may go down as one of the biggest rip offs of all time. The reaction of our elected officials and regulatory bureaucrats to this new revelation will be quite revealing.

Spread the word.

Updated: Apr. 15, 2013

Why is the White House meddling in Leader v. Facebook—a patent case?

The Three Kings of U.S. Corruption (below) are closely associated with the President

(April 9, 2013)—Just when you think the Leader v. Facebook judicial corruption scandal could not get more twisted, new evidence reveals that President Obama has exerted "presidential communications privilege" to prevent a FOIA disclosure (Freedom of Information Act) at the U.S. Patent Office. Anyone regularly reading Facebook's duplicitous legal writings recognizes their fingerprints on this Patent Office response. It cites "Exemption 5" which allows agencies to withhold certain kinds of information, mostly regarding internal deliberations.

"The Protected Party is the President of the United States" —Loving v. Dept. of Defense

Out of all the legal precedents that the Patent Office could have cited, they chose Loving v. Department of Defense, 550 F. 3d 32 (DC Circuit 2008) whose subject is the "presidential communications privilege." It states "Here the party protected by the privilege, is . . . the President of the United States." It relies on the privilege because the communications "directly involve" the President.

Patent Office failed to provide a Vaughn index

What the Patent Office chose to ignore in the Loving case was the "Vaughn index" which is required "to fulfill the agency's obligation to show with 'reasonable specificity'" why the requested information is being withheld. Put simply, they are required to disclose the nature of the information being withheld (topic, sender, receiver, date, reason for concealing, etc.). The Patent Office did not provide a Vaughn index as the precondition to rely on Exemption 5 in the Loving case, and should therefore lose the privilege.

The Patent Office is hiding behind presidential privilege while violating the terms of the very law it relies on for the privilege. Does this tactic sound familiar? It's lawfare—mangle every argument with truth and error to fool the unsuspecting, and thus gum up the legal system.

We ask again: Why is President Obama involved in Leader v. Facebook? Could it be to protect his political interests in his 35 million Facebook "Likes" when he is supposed to be protecting Leader Technologies constitutional rights? Remember, the President's involvement would likely have occurred before the 2012 election. Pundits say he probably edged out Mitt Romey using his Facebook "Like" data to micro-target voter blocks.

The requester has forwarded the renewed request to the House Oversight Committee on Government Reform and to the Acting Commerce Secretary. The letter to Congressman Jim Jordan is embedded below.

ORIGINAL POST (Below)

Greed, envy and conspiracy against real American innovators

|

|

|

| Lawrence "Larry" Summers |

James W. Breyer Accel Partners LLP |

Gordon K. Davidson Fenwick & West LLP |

| Economist | Venture Capitalist | Attorney |

| Conflicts of Interest; Market Manipulation; Collusion (Allegations) |

Trade Secrets Theft; Market Manipulation Bribery & Collusion (Allegations) |

Intell. Property Theft; Abuse of Client Confidence Stock Manipulation Collusion (Allegations) |

Click the image below to enlarge.

Fig. 1—The Patent Office has just cited Executive Privilege to block release of Freedom of Information Act data in Leader v. Facebook. President Obama has also been discovered to have direct connections to Facebook's attorney Gibson Dunn LLP. Are the Facebook attorneys his version of President Nixon's White House "plumbers?"

Fig. 1—The Patent Office has just cited Executive Privilege to block release of Freedom of Information Act data in Leader v. Facebook. President Obama has also been discovered to have direct connections to Facebook's attorney Gibson Dunn LLP. Are the Facebook attorneys his version of President Nixon's White House "plumbers?"Click here to read the RENEWED APPEAL as well as the USPTO response.

"Experience has shown, that even under the best forms of government those entrusted with power have, in time, and by slow operations, perverted it into tyranny."

― Thomas Jefferson

“Among a people generally corrupt, liberty cannot long exist.”

― Edmund Burke

"So in everything, do to others what you would have them do to you, for this sums up the Law and the Prophets."

― The Gospel of St. Matthew 7:12

"You shall not steal. You shall not bear false witness against your neighbor."

― The Book of Exodus 20:16-17

(March 28, 2013)—A comprehensive overview of the Leader v. Facebook judicial and financial misconduct appeared yesterday. While most of the analysis is not new to AFI, it does tell the real story of Facebook's illicit beginnings. Compare this to the fantastical Zuckerberg super-hacker pabulum that the mainstream press has repeated uncritically since 2003. The essay identifies journalist David Kirkpatrick, author of The Facebook Effect, as a contributor to the Facebook fiction. Astoundingly, the mainstream media started citing Kirkpatrick for their primary research. More humorous, Facebook attorneys even QUOTED Kirkpatrick in various legal briefs to try and deceive federal judges.

Also remarkable is the alleged deep involvement of former Treasury Secretary and Obama Bailout Director Lawrence "Larry" Summers in all things Facebook. The trails of corruption just seem to fan out from Summers in all directions. Perhaps most damning is his failure to disclose (concealment of) his conflicts of interest during the 2008 bailout Summers failed to disclose conflicts of interest surrounding Goldman Sachs and Morgan Stanley in 2008—only a $32,000,000,000 oversight

Specifically, Summers failed to disclose his 20-year mentor relationship with Russian Yuri Milner. In the early 1990's, Milner collaborated with Summers and Summers' then research assistant, Sheryl Sandberg (now Facebook COO). In 1993, Milner even authored a World Bank paper for Summers that recommended what is now universally recognized as the reckless (and failed) Russian voucher system. That system has created the current oligarchies which have so corrupted the current Russian economy (PDF). It also created Alisher Asmanov, another Goldman Sachs partner. Since the Facebook IPO, Asmanov is now called the "Richest man in Russia." Summers' decisions have been very good to his protégés Asmanov, Milner and Sanberg.

Milner + Goldman Sachs = Summers Conflict of Interest

Purchase of Facebook Stock by a bailed-out-Goldman's Moscow Partners + Sandberg = Summers Conflict of Interest

At the time of the bailout, Milner was partnered with Goldman Sachs which received at least $16 billion in U.S. taxpayer funds. Milner reappeared six months later with bags full of money totaling; $3+billion in "overseas" funds to purchase Facebook insider stock. (See the Boy Kings briefing about those dubious transactions.)

Fenwick & West LLP paved the way for Russian funds from Summers' protégés

Fenwick & West LLP paved the way for these sales by getting Facebook a one-day SEC exemption turnaround allowing Facebook to ignore the chiseled-in-granite-500-shareholder rule (a private company with more than $10 million in assets cannot have over 500 shareholder without being considered a public company by default). That exemption enabled Milner to become the second largest investor in Facebook after Accel Partners/James W. Breyer. Many now believe this money to purchase Facebook stock came from Goldman Sachs and Morgan Stanley TARP funds laundered through Dubai and Cyprus. Click here to view the Larry Summers Conflicts Map.

Yahoo! Voice's Christofer French (PDF) boiled down modern day corruption into seven points. He drew his assessment from the downfall of the Roman Empire:

- Arrogant leadership

- Loss of a Middle Class

- Lust for power

- Greed

- Excessive Taxation

- A General Societal and Legal Winking

Christofer French. Sliding Down the Slippery Slope of Legal Corruption! Corruption Makes Us Numb and Also Unconscious. When We Are Consciously Corrupt, That's the Worst. Yahoo! Voices, Dec. 10, 2010.

Do these symptoms of system-wide corruption sound familiar? Will this corruption destroy America? Only if we are complacent and do nothing to stop it.

Several different sites have already re-posted the essay embedded below. (Note: Scribd, GoogleDrive and DocStoc allow you to download a PDF to your local computer. For example, with GoogleDrive, from the document, select File, then Download. Then a window on your computer pops up where you designate the folder to store it in. If you don't select a folder, the PDF will be stored in your browser's default download folder.)

Ask your elected representatives to investigate

Readers are encouraged to write their senators and congresspersons. Ask them to open inquiries and investigate these disturbing revelations. Attach this essay as your background. Meet with them to discuss your concerns. Get active. If not you, who? If not now, when?

CLICK HERE TO DOWNLOAD: The Real Facebook - A Portrait in Corruption, Mar. 28, 2013Fig. 3—The Real Facebook | A Portrait of Corruption.

Click Comment below to join the conversation ... or email your comment to amer4innov@gmail.com and we'll post it.

CLICK HERE TO DOWNLOAD: 2008 Banking Crisis Timeline - The Fleecing of America

Fig. 4—2008 Banking Crisis Timeline - The Fleecing of America

* * *